Transition Centers of Expertise: Mobility - Land

Key takeaways

- The passenger EV industry has entered its growth stage, with rapid increases in adoption and usage, as well as improving technology and falling costs.

- Different regions are at different stages in the EV-adoption curve. China and Europe have taken the lead, followed by the U.S.

- Investment opportunities extend beyond the vehicles themselves to charging infrastructure, battery technology and other emerging fields.

- Given the cost of capital, and the high capital expenditure requirements in many areas of EV manufacturing and infrastructure, we expect further consolidation.

- Risks include lower-than-expected adoption rates, thinner profit margins on energy resale, technology obsolescence, and grid-capacity or supply-chain bottlenecks.

- Opportunities in this space are diverse across public and private markets, and in maturity from venture-stage companies to large-scale infrastructure plays.

About BlackRock’s Transition Centers of Expertise

The transition to a low-carbon economy is among a handful of major structural shifts that we see rewiring economies, sectors and businesses.

BlackRock’s new Transition Centers of Expertise (CoEs), of which our Battery CoE is one, bring together the knowledge of our more than 600 sustainable and transition specialists across the firm, as well as external experts and industry associations. These virtual communities, organized by sector technology, encompass expert views throughout the capital stack and across industry value chains, contribute to the assumptions used in the BlackRock Investment Institute Transition Scenario (BIITS), and help source new opportunities for our clients.

Introduction

The BlackRock Investment Institute Transition Scenario projects that demand for electric vehicles will increase roughly seven times by 2030 from today’s levels, led by growth in the U.S. The reasons include lower costs, the growing availability of public charging infrastructure, and a wave of policies banning the sale or manufacture of internal combustion engine vehicles in the 2030s. As a result, we expect nearly every new car in the world to be electric by 2050.

-

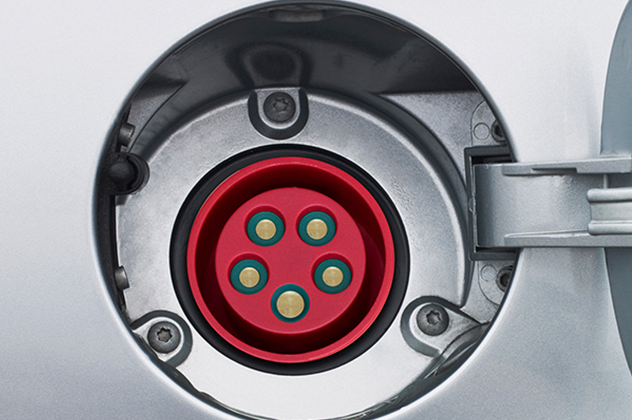

The degree to which consumers choose to charge their EVs at home or use public chargers will depend, in part, on the availability of power delivery and resultant charging speeds, which can vary from minutes to hours2.

Those speeds will likely increase as technology improves and high-power charging (150kW and higher) becomes more widely available.

These factors look different for medium and heavy-duty road vehicles including buses and trucks, however. Such vehicles drive longer distances, carry heavier loads and are on the road for a substantially larger portion of the day, which means they require bigger batteries, higher capacity charging, and often charging depots with schedules that optimize logistic.

That could mean fleet operators with effective time- and demand-based charging strategies or dedicated heavy-duty charging networks will best be able to minimize their fleet downtimes as public infrastructure networks continue to be built out.

-

The added load of EV charging on regional electric grids is projected to elevate global power consumption by approximately 15% by 20504. While this could prove to be a headwind, the anticipated increase in demand spans decades, providing system operators with ample time to refurbish and expand their existing networks.

One outstanding challenge remains, however, in the form of grid connection delays. It's possible that system operators may struggle to keep pace with escalating connection requests.

On the more positive side are vehicle-to-grid technologies, by which electric vehicle owners can offer energy storage to grid operators using their vehicle batteries. This would contribute to grid stability while allowing users to benefit from the evolving energy landscape.

-

Changes in technology, policy and the shifting preferences of consumers and investors can move technologies or sectors from being on a gradual, linear path of decarbonization to an exponential acceleration after they reach a tipping point.

Markets will sometimes anticipate future earnings growth and price it in before the tipping point is reached, however, changing the potential investment opportunity. In some cases, valuations can get ahead of themselves.

For example, we have seen the valuations of many EV companies surged before pulling back last year, even as their overall market share kept growing5. For this reason, we believe finding transition-related opportunities that are not priced in yet requires granular analysis.

-

We see attractive investment opportunities across the clean transport value chain and in adjacent businesses.

Competitive advantages are emerging for companies with existing assets or partners in areas such as retail fueling locations, where customer convenience reigns.

For public chargers, adjacent business models that deliver retail and services to customers while they wait may see strong growth, exemplified by BP’s recent acquisition6 of Travel Centers of America to expand its convenience retail and EV charging business.

In the transition to a low-carbon economy, electrification is an immediate and vital phase, making it front-and-center in terms of investible opportunities.

Government incentives, changing consumer preferences and technological developments, especially in batteries, are rapidly altering the landscape for EVs and related infrastructure, and making it an opportunity worth exploring.

Mega forces: Low-carbon transition

Investor Q&A

Our Mobility CoE includes Patrick Bydume, an investor in energy-related infrastructure, SuetChee Chiong, who invests in early-stage private companies, Giovanni D’Andria, who specializes in energy infrastructure across Europe, Hannah Johnson, an active manager in public markets and Paddy O’Kane, Chair of the BlackRock Mobility Center of Expertise.

Where do you see the most compelling opportunities in electrifying ground transport?

Giovanni D’Andria: Even as we focus on individual opportunities, it’s important to remember just how wide the range of opportunities really is. From an infrastructure standpoint, there’s a clear gap – and we believe there’s a clear investment opportunity – between the vehicles on the road and the public charging stations.

This gap takes a few forms, and the priority is making sure that there’s charging infrastructure available. And there are other related gaps in spaces like high-powered charging infrastructure. There’s also a new focus on charging-station networks for long-distance travel, whereas at the beginning people were just focusing on EVs for local use.

Now we’re seeing opportunities to invest in chargers that are more future-proofed, so that the investment can last longer. And as the sector becomes more technologically sophisticated it increases the barriers to entry for many potential competitors. We think it's really going to be a few players that will dominate the sector.

Hannah Johnson: Yes, there’s a winner-takes-all situation emerging for the most competitive offerings. There are more situations where consolidation may occur among the listed infrastructure players, especially as valuations fall. Consolidation, by bringing greater standardization, should help to derisk the technology aspect.

In components like the electric motor, the battery, the raw materials and software, there could be volume plays. In technology, for instance, a software system can see its profit margins grow rapidly as you increase its adoption.

SuetChee Chiong: As EV technology matures, the deal opportunities have moved toward private equity and infrastructure rather than venture capital, especially in the equipment manufacturing and charging space.

But that maturity isn’t uniform. The passenger EV space is reasonably mature, while the commercial vehicle sector is only just starting to electrify. Currently, the users are primarily logistics players who are actively lowering their carbon footprint and attracted to the lower total-cost-of-ownership economics of electric fleets. This is because commercial buyers are more driven by economics and a clear business case and not driven by emotions.

We’re starting to see innovative commercial EV business-services models, which will further accelerate the electrification of commercial vehicles. The majority of traditional logistics fleet owners have a competency gap in this area, which opens up space for these EV-services businesses.

New normal

Recent and projected EV share of new passenger vehicle sales by market

Source: BloombergNEF, June 2023. Note: Europe includes the EU, the UK and European Free Trade Association (EFTA) countries. EV includes battery electric vehicles and plug-in hybrid electric vehicles. Forward looking estimates may not come to pass.

Read the full report

Market insights contributors

Centers of Expertise: Mobility - land

Investment case studies

1. World Resources Institute, 2020;

2. Transportation.gov, 2023

3., 4, 5. Bloomberg NEF Global EV Outlook 2023;

6. BP: February 2023.

FOR PROFESSIONAL, INSTITUTIONAL, WHOLESALE AND QUALIFIED INVESTORS/PROFESSIONAL, QUALIFIED AND PERMITTED CLIENT USE ONLY

RISKS

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

IMPORTANT INFORMATION

This material is provided for educational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Reliance upon information in this material is at the sole risk and discretion of the reader. The material was prepared without regard to specific objectives, financial situation or needs of any investor.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, and estimates of yields or returns.

No representation is made that any performance presented will be achieved by any BlackRock Funds, or that every assumption made in achieving, calculating or presenting either the forward-looking information or any historical performance information herein has been considered or stated in preparing this material. Any changes to assumptions that may have been made in preparing this material could have a material impact on the investment returns that are presented herein. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy.

In the U.S., this material is for Institutional use only – not for public distribution.

In Canada, this material is intended for permitted clients as defined under Canadian securities law, is for educational purposes only, does not constitute investment advice and should not be construed as a solicitation or offering of units of any fund or other security in any jurisdiction.

For investors in the Caribbean, any funds mentioned or inferred in this material have not been registered under the provisions of the Investment Funds Act of 2003 of the Bahamas, nor have they been registered with the securities regulators of Bermuda, Dominica, the Cayman Islands, the British Virgin Islands, Grenada, Trinidad & Tobago or any jurisdiction in the Organisation of Eastern Caribbean States, and thus, may not be publicly offered in any such jurisdiction. The shares of any fund mentioned herein may only be marketed in Bermuda by or on behalf of the fund or fund manager only in compliance with the provision of the Investment Business Act 2003 of Bermuda and the Companies Act of 1981. Engaging in marketing, offering or selling any fund from within the Cayman Islands to persons or entities in the Cayman Islands may be deemed carrying on business in the Cayman Islands. As a non-Cayman Islands person, BlackRock may not carry on or engage in any trade or business unless it properly registers and obtains a license for such activities in accordance with the applicable Cayman Islands law.

In Latin America, for institutional investors and financial intermediaries only (not for public distribution). This material is for educational purposes only and does not constitute investment advice or an offer or solicitation to sell or a solicitation of an offer to buy any shares of any fund or security and it is your responsibility to inform yourself of, and to observe, all applicable laws and regulations of your relevant jurisdiction. If any funds are mentioned or inferred in this material, such funds may not been registered with the securities regulators of Argentina, Chile, Colombia, Mexico, Panama, Peru, Uruguay or any other securities regulator in any Latin American country and thus, may not be publicly offered in any such countries. The securities regulators of any country within Latin America have not confirmed the accuracy of any information contained herein. No information discussed herein can be provided to the general public in Latin America. The contents of this material are strictly confidential and must not be passed to any third party.

IN MEXICO, for institutional and qualified investors use only. Investing involves risk, including possible loss of principal. This material is provided for educational and informational purposes only and does now constitute an offer or solicitation of an offer to buy an shares of any fund or security.

This information does not consider the investment objectives, risk tolerance or the financial circumstances of any specific investor. This information does not replace the obligation of financial advisor to apply his/her best judgment in making investment decisions or investment recommendations. It is your responsibility to inform yourself of, and to observe, all applicable laws and regulations of Mexico. If any funds, securities or investment strategies are mentioned or inferred in this material, such funds, securities or strategies have not been registered with the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, the “CNBV”) and thus, may not be publicly offered in Mexico. The CNBV has not confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services (“Investment Services”) is a regulated activity in Mexico, subject to strict rules, and performed under the supervision of the CNBV.

The materials that may be shared in this forum are for information purposes only, do not constitute investment advice, and are being shared in the understanding that the addressee is an Institutional or Qualified investor as defined under Mexican Law. BlackRock México Operadora, S.A. de C.V., Sociedad Operadora de Fondos de Inversión (“BlackRock México Operadora”) is a Mexican subsidiary of BlackRock, Inc., authorized by the CNBV as a Mutual Fund Manager (Operadora de Fondos), and as such, authorized to manage Mexican mutual funds, ETFs and provide Investment Advisory Services.

For more information on the Investment Services offered by BlackRock Mexico, please review our Investment Services Guide available in www.blackrock.com/mx. This material represents an assessment at a specific time and its information should not be relied upon by the you as research or investment advice regarding the funds, any security or investment strategy in particular. Reliance upon information in this material is at your sole discretion. BlackRock México is not authorized to receive deposits, carry out intermediation activities, or act as a broker dealer, or bank in Mexico.

For more information on BlackRock México, please visit: www.BlackRock.com/mx. BlackRock receives revenue in the form of advisory fees for our advisory services and management fees for our mutual funds, exchange traded funds and collective investment trusts. Any modification, change, distribution or inadequate use of information of this document is not responsibility of BlackRock or any of its affiliates. Pursuant to the Mexican Data Privacy Law (Ley Federal de Protección de Datos Personales en Posesión de Particulares), to register your personal data you must confirm that you have read and understood the Privacy Notice of BlackRock México Operadora.

For the full disclosure, please visit www.BlackRock.com/mx and accept that your personal information will be managed according with the terms and conditions set forth therein.

For investors in Central America, these securities have not been registered before the Securities Superintendence of the Republic of Panama, nor did the offer, sale or their trading procedures. The registration exemption has made according to numeral 3 of Article 129 of the Consolidated Text containing of the Decree-Law No. 1 of July 8, 1999 (institutional investors). Consequently, the tax treatment set forth in Articles 334 to 336 of the Unified Text containing Decree-Law No. 1 of July 8, 1999, does not apply to them.

These securities are not under the supervision of the Securities Superintendence of the Republic of Panama. The information contained herein does not describe any product that is supervised or regulated by the National Banking and Insurance Commission (CNBS) in Honduras. Therefore any investment described herein is done at the investor’s own risk.

This is an individual and private offer which is made in Costa Rica upon reliance on an exemption from registration before the General Superintendence of Securities (“SUGEVAL”), pursuant to articles 7 and 8 of the Regulations on the Public Offering of Securities (“Reglamento sobre Oferta Pública de Valores”). This information is confidential, and is not to be reproduced or distributed to third parties as this is NOT a public offering of securities in Costa Rica. The product being offered is not intended for the Costa Rican public or market and neither is registered or will be registered before the SUGEVAL, nor can be traded in the secondary market.

If any recipient of this documentation receives this document in El Salvador, such recipient acknowledges that the same has been delivered upon his request and instructions, and on a private placement basis.

In Argentina, only for use with Qualified Investors under the definition as set by the Comisión Nacional de Valores (CNV).

In Chile, the sale of each fund not registered with the CMF began on the date as indicated for such fund as described herein and the sale of such securities is subject to General Rule No. 336 issued by the SVS (now the CMF). The subject matter of this sale may include securities not registered with the CMF; therefore, such securities are not subject to the supervision of the CMF. Since the securities are not registered in Chile, there is no obligation of the issuer to make publicly available information about the securities in Chile. The securities shall not be subject to public offering in Chile unless registered with the relevant registry of the CMF.

In Peru, this private offer does not constitute a public offer, and is not registered with the Securities Market Public Registry of the Peruvian Securities Market Commission, for use only with institutional investors as such term is defined by the Superintendencia de Banca, Seguros y AFP.

In Uruguay, the Securities are not and will not be registered with the Central Bank of Uruguay. The Securities are not and will not be offered publicly in or from Uruguay and are not and will not be traded on any Uruguayan stock exchange. This offer has not been and will not be announced to the public and offering materials will not be made available to the general public except in circumstances which do not constitute a public offering of securities in Uruguay, in compliance with the requirements of the Uruguayan Securities Market Law (Law Nº 18.627 and Decree 322/011).

In the EEA and UK, this material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

This document is marketing material.

In the UK and Non-European Economic Area (EEA) countries, this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA), this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

For Qualified Investors in Switzerland:

For Qualified Investors only. This document is marketing material.

This document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA").

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.

In Saudi Arabia, Bahrain, Dubai (DIFC), Kuwait, Oman, Qatar and UAE, the information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are “forward-looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

Saudi Arabia: The information contained in this document is intended strictly for sophisticated institutions.

Bahrain: The information contained in this document is intended strictly for sophisticated institutions.

Dubai (DIFC): Blackrock Advisors (UK) Limited -Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit L15 - 01A, ICD Brookfield Place, Dubai International Financial Centre, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738).

The information contained in this document is intended strictly for Professional Clients as defined under the Dubai Financial Services Authority (“DFSA”) Conduct of Business (COB) Rules.

Kuwait: The information contained in this document is intended strictly for sophisticated institutions that are ‘Professional Clients’ as defined under the Kuwait Capital Markets Law and its Executive Bylaws.

Oman: The information contained in this document is intended strictly for sophisticated institutions.

Qatar: The information contained in this document is intended strictly for sophisticated institutions.

UAE: The information contained in this document is intended strictly for non-natural Qualified Investors as defined in the UAE Securities and Commodities Authority’s Board Decision No. 3/R.M of 2017 concerning Promoting and Introducing Regulations.

For investors in Israel: BlackRock Investment Management (UK) Limited is not licenced under Israel's Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder.

In South Africa, please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the South African Financial Services Conduct Authority, FSP No. 43288.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

In Singapore, this document is provided by BlackRock (Singapore) Limited (company registration number:200010143N) for use only with institutional and accredited investors as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. This material is for distribution to "Professional Investors" (as defined in the Securities and Futures Ordinance (Cap.571 of the laws of Hong Kong) and any rules made under that ordinance.) and should not be relied upon by any other persons or redistributed to retail clients in Hong Kong.

In South Korea, this information is issued by BlackRock Investment (Korea) Limited. This material is for distribution to the Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations) and for information or educational purposes only and does not constitute investment advice or an offer or solicitation to purchase or sells in any securities or any investment strategies.

In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600.

In Australia and New Zealand, [MM3] issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL) for the exclusive use of the recipient, who warrants by receipt of this material that they are a wholesale client as defined under the Australian Corporations Act 2001 (Cth) and the New Zealand Financial Advisers Act 2008 respectively.

This material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. Before making any investment decision, you should therefore assess whether the material is appropriate for you and obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide on its website for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction.

This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. BIMAL is a part of the global BlackRock Group which comprises of financial product issuers and investment managers around the world. BIMAL is the issuer of financial products and acts as an investment manager in Australia. BIMAL does not offer financial products to persons in New Zealand who are retail investors (as that term is defined in the Financial Markets Conduct Act 2013 (FMCA)). This material does not constitute or relate to such an offer. To the extent that this material does constitute or relate to such an offer of financial products, the offer is only made to, and capable of acceptance by, persons in New Zealand who are wholesale investors (as that term is defined in the FMCA).

BIMAL, its officers, employees and agents believe that the information in this material and the sources on which it is based (which may be sourced from third parties) are correct as at the date of publication. While every care has been taken in the preparation of this material, no warranty of accuracy or reliability is given and no responsibility for the information is accepted by BIMAL, its officers, employees or agents. Except where contrary to law, BIMAL excludes all liability for this information.

In China, this material may not be distributed to individuals resident in the People's Republic of China ("PRC", for such purposes, not applicable to Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services.

For Southeast Asia: This document is issued by BlackRock and is intended for the exclusive use of any recipient who warrants, by receipt of this material, that such recipient is an institutional investors or professional/sophisticated/qualified/ accredited/expert investor as such term may apply under the relevant legislations in Southeast Asia (for such purposes, includes only Malaysia, the Philippines, Thailand, Indonesia and Brunei). BlackRock does not hold any regulatory licenses or registrations in Southeast Asia countries listed above, and is therefore not licensed to conduct any regulated business activity under the relevant laws and regulations as they apply to any entity intending to carry on business in Southeast Asia, nor does BlackRock purport to carry on, any regulated activity in any country in Southeast Asia. BlackRock funds, and/or services shall not be offered or sold to any person in any jurisdiction in which such an offer, solicitation, purchase, or sale would be deemed unlawful under the securities laws or any other relevant laws of such jurisdiction(s).

This material is provided to the recipient on a strictly confidential basis and is intended for informational or educational purposes only. Nothing in this document, directly or indirectly, represents to you that BlackRock will provide, or is providing BlackRock products or services to the recipient, or is making available, inviting, or offering for subscription or purchase, or invitation to subscribe for or purchase, or sale, of any BlackRock fund, or interests therein. This material neither constitutes an offer to enter into an investment agreement with the recipient of this document, nor is it an invitation to respond to it by making an offer to enter into an investment agreement.

The distribution of the information contained herein may be restricted by law and any person who accesses it is required to comply with any such restrictions. By reading this information you confirm that you are aware of the laws in your own jurisdiction regarding the provision and sale of funds and related financial services or products, and you warrant and represent that you will not pass on or utilize the information contained herein in a manner that could constitute a breach of such laws by BlackRock, its affiliates or any other person.

In Japan, this is issued by BlackRock Japan. Co., Ltd. (Financial Instruments Business Operator: The Kanto Regional Financial Bureau. License No375, Association Memberships: Japan Investment Advisers Association, The Investment Trusts Association, Japan, Japan Securities Dealers Association, Type II Financial Instruments Firms Association.) for Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act).

For Other Countries in APAC: This material is provided for your informational purposes only and must not be distributed to any other persons or redistributed. This material is issued for Institutional Investors only (or professional/sophisticated/qualified investors as such term may apply in local jurisdictions) and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, BlackRock funds or any investment strategy nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

FOR PROFESSIONAL, INSTITUTIONAL, WHOLESALE AND QUALIFIED INVESTORS/PROFESSIONAL, QUALIFIED AND PERMITTED CLIENT USE ONLY

©2024 BlackRock, Inc. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. All other trademarks are those of their respective owners.