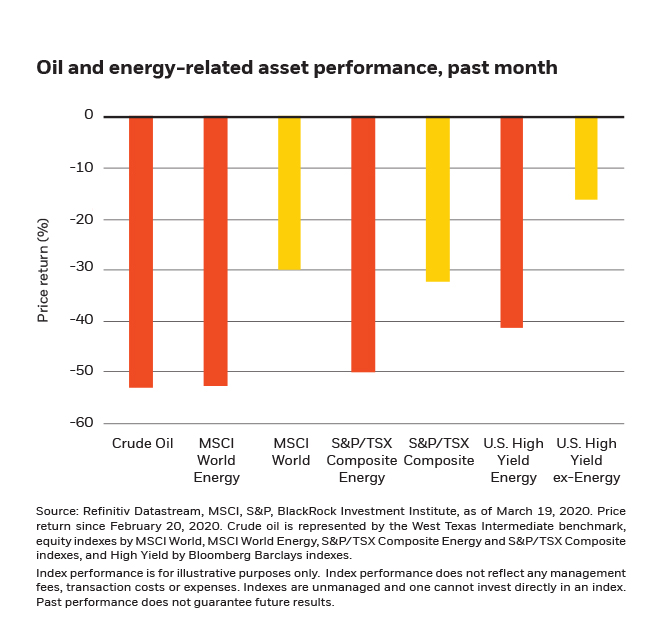

Canadian equities extended their losses last week, though fell slightly less than the U.S. market, bringing the one-month decline in the S&P/TSX Composite Index from its peak on February 20 to nearly 34%. Kurt and Daniel break down recent developments in stocks and take an inventory of policy developments after an eventful week.

Energy was the worst performing sector in the S&P/TSX Composite Index (TSX) and slid another 19% during this past week alone as crude prices remained heavily depressed. At one point during the week, Western Canadian Select traded below $8/barrel, a record low since the data series began in 2006, according to data from Bloomberg. Canadian producers have shifted into cost-cutting mode, pulling back capex and production as oil prices likely sit well below profitable levels. Any assumption of energy being a large weight in the Canadian market cap needs a sanity check now that the sector has dwindled to 12% of the TSX from 30% in 2009.

Though often perceived as a lower-beta, defensive sector, REITs were among the hardest hit segments and underperformed the broader market last week. The impact of social distancing measures on the retail sector, a potential rise in unemployment and slowing wage growth are factors likely weighing on real estate fundamentals, despite ultra-low borrowing rates.

Canadian policy roundup

Coordinated monetary and fiscal policy, as well as steps to avoid seizures in the financial system, are critical to improved visibility in financial markets. Fortunately, a wide range of Canadian governmental institutions have taken decisive steps to bridge a steep economic contraction and sustain the functioning of the financial system at a time of financial market stress. Although financial markets are unlikely to gain better visibility as the number of coronavirus cases climbs and the economic damage from containment spreads, additional coordinated and decisive policy moves are critical to limiting further fallout from here.

Monetary policy

The Bank of Canada (BoC) lowered its overnight policy rate in two separate 50 basis point instalments on March 4 and March 16, leaving the policy rate standing at 75 basis points – now one of the highest rates in the developed world. The bank has room to further lower interest rates, and market participants are anticipating another 25-50 basis point reduction at or before its next meeting on April 15. Is it possible the BoC could cut the policy rate to zero and introduce asset purchases? Yes – nothing is off the table for consideration given the likely deep contraction.

To support the plumbing of the Canadian financial system, the Bank of Canada announced the following additional programs:

- a new Banker’s Acceptance Purchase Facility will provide support for small- and medium-sized businesses through weekly operations to guide rates lower,

- purchases of $500 million of Canada mortgage bonds per week,

- the Standing Term Liquidity Facility, an overnight credit facility for financial institutions in need of temporary liquidity, and

- the increased frequency and expanded list of eligible collateral for term repo operations to ensure cash needs of business and financial institutions are met.

Like financial markets around the globe, Canadian fixed income markets are facing liquidity challenges with historically wide bid/ask spreads and reduced market depth. These strains increase at lower credit ratings but have also been present in government bond markets. As a result, we wouldn’t rule out further moves from the BoC to help ease the strain. On the bright side, fixed-income ETFs have continued to trade and have acted as a price-discovery mechanism during turbulent markets.

Fiscal policy

The federal government stepped in with a massive C$82 billion (~3.5% of GDP) aid package split between C$27 billion of direct income support and C$55 billion in tax deferrals. The stimulus is targeted towards Canadians with low-to-modest incomes, those without access to sick leave, and small businesses. The government also announced a C$10 billion Business Credit Availability Program to provide working capital loans, postponement of payments, and lower lending rates for qualified businesses financed through the Business Developed Bank of Canada and Export Development Canada. Ottawa is expected to announce more fiscal support, specifically to address the ongoing challenges in the energy sector.

Public-private initiatives

Several steps have been taken to provide credit relief and support capital markets among regulators, banks and institutions, including but not limited to:

- Canada’s banking regulator, the Office of the Superintendent of Financial Institutions lowered bank collateral requirements to unlock an additional C$300 billion of lending capacity.

- Canada’s largest banks and the Canadian Mortgage and Housing Corporation (CMHC) committed to provide mortgage deferrals for up to six months on a case-by-case basis to individuals and small businesses.

- The Insured Mortgage Purchase program (last used during 2008-2009) allows CMHC to purchase of up to C$50 billion of insured mortgage pools.