Continue the portfolio construction course with module 2, which outlines the first two steps of the portfolio construction process: 1) Benchmarking 2) Budgeting 3) Investing and 4) Monitoring.

What is benchmarking?

Benchmarking should be the first step in creating a stable portfolio

It serves as a tool for financial professionals to monitor the progress of investments, including projecting what returns their clients can expect to receive at the start of any time period and evaluating returns at the end of a set time period.

All investors should use a benchmark to manage portfolios often and early in the process

However, financial professionals tend to leave out the benchmark when constructing or making changes to a portfolio, and use it only at the end of their asset allocation process to evaluate a portfolio’s performance.* By using the benchmark at the end of the process, opportunities to pivot and optimize the portfolio throughout the process are forfeited.

Pick a benchmark that is the best fit

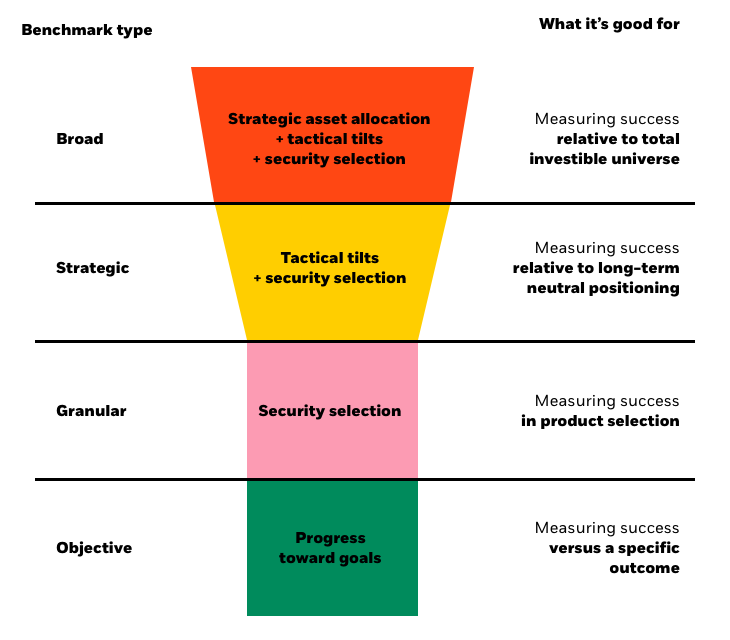

There are different types of benchmarks that help measure success and can be selected based on the investment approach.

What does budgeting entail?

Reduce costs by combining index, factor and alpha-seeking strategies

Blending complementary sources of return and pairing factor strategies alongside index and alpha-seeking (or active) strategies is one way of reducing costs while helping to improve investment outcomes. Explore the differences between the strategies.

For illustrative purposes only

-

This is David.

As a nurse, David makes an impact by ensuring the ongoing health of all of his patients.

Investment portfolios need personalized care from dedicated professionals, too.

When building a portfolio, financial professionals should start by defining their clients’ goals. With those in mind, there are a number of strategies financial professionals can employ to ensure the portfolio is healthy and on track to meet their clients’ goals.

Indexing, for instance, is a strategic method that provides diversified market exposure at a low cost. Consider this strategy to serve as the core of a portfolio.

For higher returns, look to factor and alpha-seeking strategies. Factors, on one hand, offer the potential for excess return at a generally lower cost than alpha-seeking.

But while alpha-seeking typically has higher fees, it offers greater potential for excess and differentiated returns.

At the end of the day, it is all about finding a balance between the strategies.

Investors seeking higher excess returns, for instance, might lean more into factor and alpha-seeking strategies, while those who are seeking lower-cost investments and are comfortable with lower excess returns might use a higher proportion of index vehicles.

When pursuing a well-balanced portfolio, it is crucial to ensure that these strategies are properly blended. The overlap of alpha-seeking strategies, for example, could lead to a less diversified portfolio that may earn lower-than-expected returns.

David knows that sometimes, it takes a combination of strategies to get the right results.

Similarly, BlackRock helps financial professionals find a healthy balance between index, factor, and alpha-seeking strategies.

Think differently

Financial professionals who establish a benchmark and reference it regularly provide their clients with transparency into how successfully they are meeting objectives or identify where they may need to pivot. Further, creating a budget and exploring how to best combine different investment strategies to minimize cost can optimize the value of the portfolio.

This concludes the second module of the portfolio construction course. Read the next module, which discusses the last two steps of the portfolio construction process, to continue the course.