Capital at risk

Marketing material

iBonds: Discover fixed maturity ETFs

Vasiliki Pachatouridi, Head of iShares Fixed Income Product Strategy EMEA

What are iBonds ETFs?

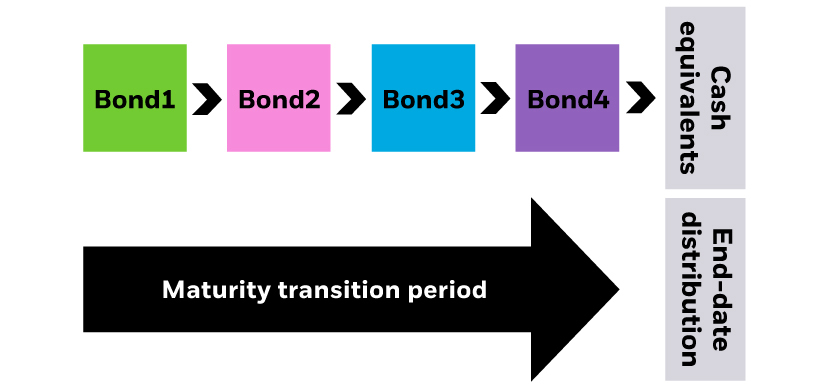

iBonds ETFs are an innovative suite of bond ETFs that have a fixed maturity date. An iBond ETF holds a diversified basket of bonds with similar maturity dates, and distributes a final pay out at maturity.

Risk: Diversification and asset allocation may not fully protect you from market risk.

Why iBonds ETFs?

Traditional bond ETFs do not have a maturity date, as bonds within the ETF mature, and new bonds are being added. This gives a continuous, rolling exposure to bond markets.

In contrast, like individual bonds, iBonds ETFs have a fixed maturity date. So, there is less exposure to interest rate risk as maturity approaches. This means investors can expect a final repayment at maturity, in addition to regular income.

What are the benefits of iBonds ETFs?

There are a number of benefits of iBonds ETFs.

Firstly, iBonds ETFs give easy access to the bond market. Generally, bonds are difficult to trade, as they are not listed on an exchange. With iBonds ETFs, you gain exposure to a basket of bonds with the click of a button – traded on an exchange, just like a stock.

Second, iBonds ETFs offer diversification. iBonds track an underlying index and provide exposure to hundreds of bonds, across various sectors and countries.

Finally, iBonds ETFs have a fixed maturity date. You can choose your time horizon and invest for a period which works for your needs. iBonds ETFs are available in a range of maturities, meaning you can choose how long you want to invest your money for.

In summary, iBonds ETFs allow you to access bond markets in an efficient way, giving exposure to a diversified set of bonds, while incorporating a fixed maturity date.

Thanks for watching!

Risk: When interest rates rise, there is usually a decline in the market value of bonds, and the issuer of the bond may not be able to repay and make interest payments.

This document is marketing material: Before investing, please read the Prospectus and the PRIIPs KID available on www.ishares.com/it, which contain a summary of investors’ rights.

Risk Warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

In the UK and Non-European Economic Area (EEA) countries: this is issued by BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL, Tel: +44 (0)20 7743 3000. Registered in England and Wales No. 00796793. For your protection, calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For investors in Italy: For your protection telephone calls are usually recorded. For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian. For investors in South Africa: Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the South African Financial Services Conduct Authority, FSP No. 43288. For Investors in Switzerland: This document is marketing material.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy. This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2023 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, and iSHARES are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.