Growth investing can be an exciting strategy to pursue and there is usually some form of theme that is capturing the market’s attention. Whether it’s the rapid growth of the “Asian Tigers” of Hong Kong, Singapore, South Korea and Taiwan in the early 1990s, the emergence of the internet at the end of the 20th century or the commodity super-cycle in the 2000s, there is typically something going on in the world to lure investors in. And the returns on offer can look very enticing, particularly through the rear view mirror.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Over the last decade, the US technology sector has been synonymous with growth investing. So much so that numerous acronyms and nicknames have been conceived to capture their importance to the prevailing market narrative. We’ve had the FAANGs, the MAMAAs and, this year, we’ve heard a lot about “The Magnificent Seven” of Apple, Microsoft, Alphabet (formerly Google), Amazon, Nvidia, Meta and Tesla, who have between them contributed the majority of the returns delivered by the US stock market.

Clearly, there have been plenty of interesting growth opportunities on offer elsewhere, but the sheer size and ubiquity of these US technology businesses has meant their recent share price strength has obscured almost everything else. There is, perhaps, a FOMO (fear of missing out) effect here, with more and more investors being lured in by the emphatic returns delivered in the past, even though the prospect of them being repeated could be slim. We know from history that what starts as a growth boom can ultimately become an asset price bubble. We also know that these do not end well, with those investors that come in just before the bubble bursts bearing the worst of the losses, and with the broader economic scars being felt many years into the future.

Only time will tell if US technology stocks are currently in a bubble, but it is certainly the case that the sector’s popularity has increased valuation risk. Indeed, the extent of US technology sector outperformance has recently exceeded that of the peak of the dotcom bubble in March 2000.1 With this valuation risk in mind, it may make sense for growth investors to look elsewhere, towards parts of the market where valuations are more modest, but where growth prospects are still appealing.

Continental Europe

Europe offers a surprisingly diverse and dynamic opportunity set. The continent has its own technology success stories, such as semiconductor businesses ASML and STMicroelectronics, but these don’t attract anywhere near as much attention or hype as those in the US. As a result, valuations can be much more modest, which means the potential upside for investors is greater.

Meanwhile, Europe also offers attractive exposure to other growth industries such as healthcare and luxury goods. In these sectors, Europe is home to market-leading businesses such as Novo Nordisk, LVMH and Hermès.

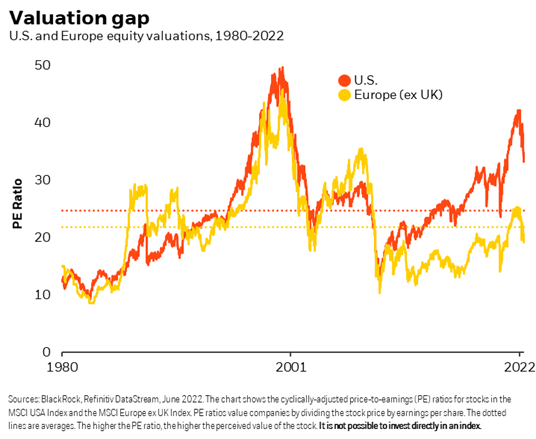

From the perspective of valuations, these opportunities tend to be available at a more attractive price than their US counterparts. The chart below demonstrates that European equity valuations are currently much lower than those in the US and are trading below their long-term average.

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results.

BlackRock Greater Europe Investment Trust plc offers exposure to a range of high-quality European growth businesses, such as those mentioned above. It also has the ability to invest in companies in emerging Europe, which represents another often overlooked source of growth.

Frontier markets

Indeed, emerging Europe is one of several regions that represent “frontier markets”, the next generation of economic success stories. The frontier markets of Asia, Africa, Latin America and Eastern Europe offer an abundance of rapid growth opportunities. Risks may be higher in these regions, which can manifest itself in price volatility, but the long-term opportunity is undeniable.

For portfolio managers like Sam Vecht, Emily Fletcher and Sudaif Niaz, who manage BlackRock Frontiers Investment Trust plc, these risks are mitigated through careful stock selection and a diversified portfolio of more than 50 companies across many different frontier markets.

Meanwhile, from a sector perspective, financials, energy and consumer staples account for more than half of the portfolio’s assets. Information technology, which dominates growth exposure across much the developed world, accounts for just 6.6% of the portfolio,2 which may make the frontier markets opportunity appealing for any investor looking to diversify away from technology.

Smaller companies

Another source of enhanced growth historically has been achieved through investing in smaller companies. Over the long term, smaller companies have been shown to outperform larger companies,3 thanks to the longer runway of growth that lies ahead of them and their ability to quickly take advantage of opportunities that present themselves.

It is ironic, therefore, that growth investors have been seduced by the attractions of the US technology behemoths in recent years. Logic suggests that it should be easier – and probably faster – for a business to double in size from £100m to £200m than for a larger business to growth from £100bn to £200bn.

Hence, investors may wish to consider looking further down the market cap spectrum for overlooked growth opportunities. BlackRock runs two growth investment trusts focused on the opportunity in UK smaller companies. BlackRock Smaller Companies Trust plc seeks out the fastest growing, most innovative and exciting companies from the available universe of UK growth stocks. BlackRock Throgmorton Trust plc, meanwhile, looks for growth across UK small and mid-cap stocks, and has the ability to enhance growth potential through the use of derivatives.

Conclusion

Given the extent of media coverage of US technology outperformance, one could be forgiven for thinking that growth investing begins and ends with The Magnificent Seven. This would be a mistake, however, and potentially a costly one. History shows that growth fads come and go in equity markets.

It pays to take a broader perspective when looking for growth and BlackRock has a range of growth investment trusts that do exactly that. With talented portfolio managers searching for undervalued opportunities in less popular parts of the market, we’re confident that finding growth in overlooked places can be a successful long-term strategy for growth investors that are prepared to move away from the herd.

For further details about BlackRock’s full range of growth investment trusts, please visit our Growth Opportunities content hub.