SAVING

Skip to content

Welcome to the BlackRock site for individuals

Before you proceed, please take a moment to review and accept the following Terms and Conditions.

By accessing this website, you, as a client or potential client, accept to receive information on this website in more than one language. Should you require help understanding the content on this website, please reach out to your financial or other professional advisor.

Individual Investors

An individual investor, also known as a retail client and a private client, is a client organisation or individual who cannot meet both (i) one or more of the professional client criteria laid down in Annex II to the Markets in Financial Instruments Directive II (Directive 2014/65/EU), and (ii) one or more of the qualified investor criteria set out in Article 2 of the Prospectus Regulation ((EU) 2017/1129).

Terms and Conditions

Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the countries in which our funds are authorised for sale. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction.

Please note that you are required to read and accept the terms of our Privacy Policy before you are able to access our websites.

Once you have confirmed that you agree to the legal information in this document, and the Privacy Policy – by indicating your consent above – we will place a cookie on your computer to recognise you and prevent this page reappearing should you access this site, or other BlackRock sites, on future occasions. The cookie will expire after six months, or sooner should there be a material change to this important information.

By confirming that you have read this important information, you also:

(i) Agree that such information will apply to any subsequent access to the Individual investors (or Institutions / Intermediaries) section of this website by you, and that all such subsequent access will be subject to the disclaimers, risk warnings and other information set out herein; and

(ii) Warrant that no other person will access the Individual investors section of this website from the same computer and logon as you are currently using.

The offshore funds described in the following pages are administered and managed by companies within the BlackRock Group and can be marketed in certain jurisdictions only. It is your responsibility to be aware of the applicable laws and regulations of your country of residence. Further information is available in the Prospectus or other constitutional document for each fund.

This does not constitute an offer or solicitation to sell shares in any of the funds referred to on this site, by anyone in any jurisdiction in which such offer, solicitation or distribution would be unlawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

Specifically, the funds described are not available for distribution to or investment by US investors. The units/shares will not be registered under the US Securities Act of 1933, as amended (the "Securities Act") and, except in a transaction which does not violate the Securities Act or any other applicable US securities laws (including without limitation any applicable law of any of the States of the USA) may not be directly or indirectly offered or sold in the USA or any of its territories or possessions or areas subject to its jurisdiction or to or for the benefit of a US Person.

The funds described have not been, nor will they be, qualified for distribution to the public in Canada as no prospectus for these funds has been filed with any securities commission or regulatory authority in Canada or any province or territory thereof. This website is not, and under no circumstances is to be construed, as an advertisement or any other step in furtherance of a public offering of shares in Canada. No person resident in Canada for the purposes of the Income Tax Act (Canada) may purchase or accept a transfer of shares in the funds described unless he or she is eligible to do so under applicable Canadian or provincial laws.

Applications to invest in any fund referred to on this site, must only be made on the basis of the offer document relating to the specific investment (e.g. prospectus, simplified prospectus, key investor information document or other applicable terms and conditions).

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant Prospectus or other constitutional document.

If you are unsure about the meaning of any information provided please consult your financial or other professional adviser.

The information contained on this site is subject to copyright with all rights reserved. It must not be reproduced, copied or redistributed in whole or in part.

The information contained on this site is published in good faith but no representation or warranty, express or implied, is made by BlackRock (Netherlands) B.V. (“BNBV”) or by any person as to its accuracy or completeness and it should not be relied on as such. BNBV shall have no liability for any loss or damage arising out of the use or reliance on the information provided including without limitation, any loss of profit or any other damage, direct or consequential. No information on this site constitutes investment, tax, legal or any other advice.

Where a claim is brought against BlackRock by a third party in relation to your use of this website, you hereby agree to fully reimburse BlackRock for all losses, costs, actions, proceedings, claims, damages, expenses (including reasonable legal costs and expenses), or liabilities, whatsoever suffered or incurred directly by BlackRock as a consequence of improper use of this website. Neither party should be liable to the other for any loss or damage which may be suffered by the other party due to any cause beyond the first party's reasonable control including without limitation any power failure.

You acknowledge and agree that it is your responsibility to keep secure and confidential any passwords that we issue to you and your authorised employees and not to let such password(s) become public knowledge. If any password(s) become known by someone other than you and your authorised employees, you must change those particular password(s) immediately using the function available for this purpose on the Website.

You may leave the BNBV website when you access certain links on this website. In so doing, you may be proceeding to the site of an organisation that is not regulated. BNBV has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

BNBV shall have no liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to, any direct, indirect or consequential damage, arising out of the use of the services provided herein.

Risk Warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The data displayed provides summary information. Investment should be made on the basis of the relevant Prospectus which is available from the manager.

For your protection, telephone calls and/or other electronic communications which result in, or are intended to result in, transactions will be recorded or saved.

Investors should read the offering documents for further details including the risk factors before making an investment.

For investors in Sweden:

The prospectus and KID are available at BNBV, Stockholm branch, Malmskillnadsgatan 38, 111 51 Stockholm, Sweden. Investors should read the KID before making an investment decision.

Please note that while some of the BlackRock funds are "ring-fenced", others form part of a single company and are not. For BlackRock funds that do not have segregated liability status, in the event of a single BlackRock fund being unable to meet liabilities attributable to that BlackRock fund out of the assets attributable to it, the excess may be met out of the assets attributable to the other BlackRock funds within the same company. We refer you to the prospectus or other relevant terms and conditions of each BlackRock fund for further information in this regard.

The views expressed herein do not necessarily reflect the views of BlackRock as a whole or any part thereof, nor do they constitute investment or any other advice.

Any research found on these pages has been procured and may have been acted on by BlackRock for its own purposes.

This site is operated and issued by BNBV which is authorised and regulated by the Autoriteit Financiële Markten («AFM»). You can gain access to the AFM website from the following link: www.afm.nl. BlackRock (Netherlands) B.V. is a company registered in the Netherlands, No. 17068311. Registered Office: Amstelplein 1, 1096 HA, Amsterdam. BlackRock is a trading name of BlackRock (Netherlands) B.V. VAT No 007883250. General enquiries about this website should be sent to EMEAwebmaster@blackrock.com. This email address should not be used for any enquiries relating to investments.

©2024 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Key points

-

01

Healthy earnings, but selectivity key

We expect earnings to expand globally and support equities – but see some areas of the market lagging behind.

-

02

Mega forces drive sector dispersion

Vast spending is driving economic growth and transforming the corporate landscape, leading to wide dispersion within sectors.

-

03

Global bargains?

Many companies outside the U.S. have world-leading businesses with global operations – yet trade at a discount to U.S. peers.1

Will 2025 be another positive year for equities?

At BlackRock Fundamental Equities, we see a supportive environment for equity markets as we head into 2025. Inflation is likely to remain under control in most major economies, in our view, allowing central banks to cut interest rates further. At the same time, global economic growth is forecast to be around 3% a year over the next couple of years, according to the IMF. This environment could allow a broad set of companies to boost earnings and maintain elevated profit margins.

Dispersion between and within sectors

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Source: Fundamental Equities, with data from Bloomberg, Oct. 31, 2024.

Cyclical signs of life

The auto sector may remain weak due to the tricky EV transition, but we expect housing and construction to pick up in 2025.

Next wave of winners

Valuations for the most obvious beneficiaries of structural change are high, and so we look for the next wave of winners within AI, the energy transition and other mega forces.

Global opportunities

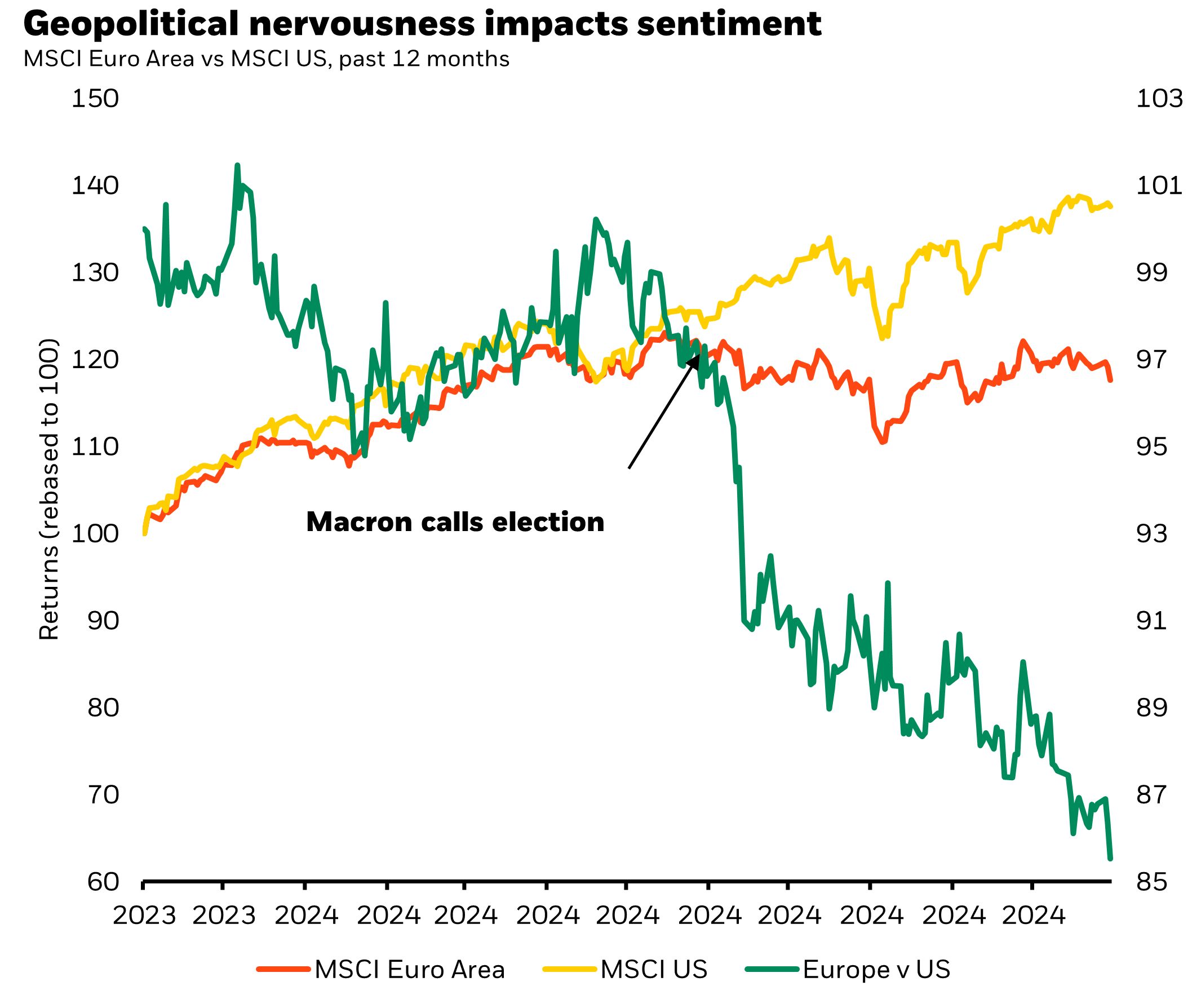

Geopolitical concerns can lead to regional discounts for companies with solid fundamentals. See the chart for one example of how sentiment can impact a region.

Emerging markets and Japan

We see opportunities in parts of emerging markets that may benefit from the relocation of supply chains after the pandemic, and Japanese stocks that are set to receive a boost from corporate reform.

Source:

1Bloomberg data, December 2025

Disclaimer

For Italy: This document is marketing material: Before investing please read the Prospectus and the PRIIPs KID available on www.blackrock.com/it, which contain a summary of investors’ rights.

Risk warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time and depend on personal individual circumstances.

Important information

This document is marketing material.

In the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 –549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

In Italy: For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

In South Africa: Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the South African Financial Services Board, FSP No. 43288.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

FOR MORE INFORMATION: blackrock.com