The New Infrastructure Blueprint

A global opportunity

Taken together, these forces require an enormous amount of new infrastructure, from super batteries and hyperscale data centers to modern logistics hubs and upgraded airports.

We explore the major structural forces driving what’s poised to be a transformational moment in infrastructure investing. And we dive into the various ways capital can invest in the opportunities that we’re seeing today as well as the ones we’re expecting, and how investors can incorporate the asset class into their portfolios.

A changing world

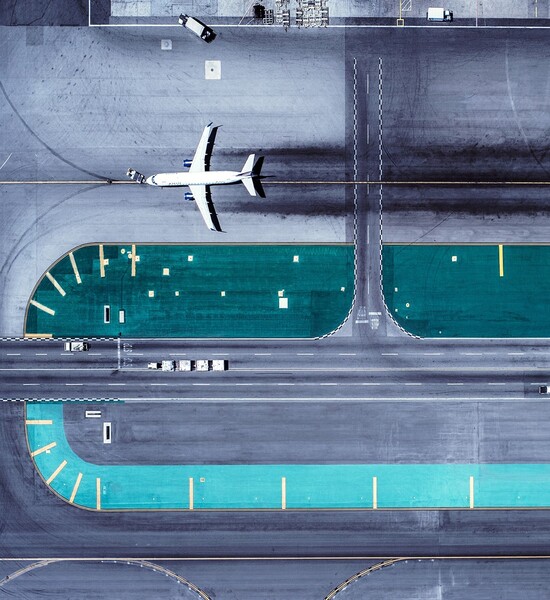

Infrastructure sits at the intersection of the trends transforming the world we live in. It’s the cell towers and fiber internet that power the digitization of business and everyday life. It’s the new land, air and sea transportation facilities that support global supply chains as they reconfigure.

More broadly, it’s the new and upgraded infrastructure across transportation, energy, communication and other services required by a growing and urbanizing world population.

Many companies are seeking to reduce their dependencies on distant producers, shortening supply chains to bring them closer to their end consumers. Mexico is one of the nations that has benefited from this nearshoring trend.

Rapidly advancing technology will require more infrastructure, including new sources of energy.

Urban expansion means enhanced infrastructure across multiple sectors. Among other things, cities require more electricity, expanded telecommunications networks and essential water and sanitation systems.

Source: Ministry of Economy, Mexico, August 9, 2023.

Source: McKinsey analysis, January 2023, citing Synergy Research Group.

Source: World Bank, “Urban Development Overview,” April 3, 2023.

A new era for energy

An increasingly digital and urban population requires more electricity, while nations work to lower carbon emissions and strengthen their energy security.

The financing gap

Governments have traditionally built and maintained infrastructure, but with national debt tripling since the 1970s, it’s unlikely they can fund it alone. The situation requires a strategic pivot. And private investors are meeting this need, led by large pensions and sovereign wealth funds who are attracted by the stability, long duration and inflation-protected potential returns of infrastructure assets.

At the same time, for companies around the world infrastructure is just one of many demands on their resources – and is often not their core business consideration. A private investor can work with corporates, allowing firms to focus on their strategic priorities.

What it means for investors

The infrastructure moment is a growing opportunity for investors. It encompasses a wide range of investment options and sectors, and it can play a variety of roles within a portfolio.

A wide array of opportunities

Private investors have the chance to be at the center of a transformative period for essential infrastructure. The opportunities range from partnering with governments to build physical assets to joint ventures with infrastructure operators, as well as bespoke debt structures.

Diversification in a portfolio

Infrastructure has historically had a relatively low correlation to traditional asset classes due to its idiosyncratic characteristics – it typically doesn’t move in step with economic cycles and its service contracts are often inflation-linked.

Stable investment

As an asset class, infrastructure has traditionally been known for its stability. Many projects involve essential services that remain in demand regardless of economic conditions, and which generate steady, regular and predictable cash flows.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Authors

The Bid – Investing In The Future: The New Era of Infrastructure

Episode Description

Infrastructure is experiencing a transformative moment, owing to the rise of remote work, the digital revolution, urbanization and a changing energy landscape driven by AI’s increasing demand for data centers. David Giordano, Global Head of BlackRock Climate Infrastructure, helps us explore the major structural forces driving this change, and examine the role of private capital in bridging the financing gap for new energy investments and how changes in supply chain strategies are influencing the infrastructure investment landscape.

Sources: The Infrastructure Blueprint, BlackRock June 2024; UN Revision of World Population Prospects 2022

Written Disclosures

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

In the UK and non-European Economic Area countries this is issued by BlackRock Investment Management (UK) Limited who is authorized and regulated by the Financial Conduct Authority and in the European Economic Area this is issued by BlackRock (Netherlands) BV who is authorized and regulated by the Netherlands Authority. For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

TRANSCRIPT

<<THEME MUSIC>>

Oscar Pulido: Infrastructure is experiencing a transformative moment, owing to the rise of remote work, the digital revolution, urbanization and a changing energy landscape driven by AI’s increasing demand for data centers. So, what opportunities exist for investors and how can infrastructure investment not only build wealth but contribute to a more efficient future?

Welcome to The Bid, where we break down what's happening in the markets and explore the forces changing the economy and finance. I'm Oscar Pulido.

David Giordano is Global Head of Climate Infrastructure, at BlackRock. David will help us explore the major structural forces driving this change, and we’ll also examine the role of private capital in bridging the financing gap for new energy investments and how changes in supply chain strategies are influencing the infrastructure investment landscape.

<<THEME MUSIC>>

Well, David, welcome back to The Bid. It's been a while, but it's great to have you back on the podcast.

David Giordano: Thank you very much. It's great to be here.

Oscar Pulido: So David, infrastructure is very topical right now. In fact, Larry Fink, talks about it in his annual chairman's letter, it's one of the main themes. So tell us a bit about how we got to this point, why is infrastructure so topical?

David Giordano: Thank you, Oscar. It's really an exciting time to look at the landscape and see the opportunity set that exists around infrastructure investing right now, and particularly around the transition to the decarbonization of our economy. We like to call it the golden age of infrastructure, I really like to think about this right now as the age of implementation. Having spent 25 plus years investing in renewable energy and being around the industry. We've never been at a place where we've had such fantastic alignment around public policy, around consumer demand, and around the technological innovation and maturity that we see in the industry right now.

Just last year we invested $2.2 trillion around the energy transition. That number is going to grow to $3.5tn by 2030. As we get into the 2040s, it's going to be $4.5tn. That creates a massive investment opportunity for private markets to really fill the gap to fuel this broad transition to a decarbonized economy, and particularly around creating carbon free sources of electricity generation.

So, a really exciting time, but it's also going to require a real, all of the above approach to this because it's not just about the generation, it's also about the transmission and the distribution and the decarbonization of energy intensive businesses like steel, like cement, hydrogen will play a role, it's really going to be an entire ecosystem around the macroeconomic trends to really drive the transition that's going to require this massive investment.

Oscar Pulido: Sounds like there's a lot of moving parts there, and you mentioned a couple of numbers, one of which was four and a half trillion dollars, which is the annual amount of investment that is going to be required in the 2040s to assist with this energy transition. There's another big number that comes to mind, which is the global population. Today, it's 8 billion. It's forecasted to go to 10 billion by 2050. I think a big reason for that is emerging markets and just the demographics in those countries. So I wonder if you can talk about how emerging markets will address the need for more infrastructure, and what opportunities does this present for investors?

David Giordano: Yes. This is a great opportunity to bring private capital into emerging markets and really create an opportunity to facilitate not just clean energy, but more importantly probably energy access as you think about those markets, and I really think in emerging markets, we have an interesting opportunity from an energy perspective to leapfrog some of the technologies as well. If you think about phones, emerging markets largely skipped landlines and went right to the mobile network. I think we're going to see some really great advancements on the technology side, whether it be microgrid, or other technologies that will facilitate this energy access as we go to a broader electrification of our use of energy. You know, electricity is set to grow to become the primary source of energy, broadly and emerging markets are really going to be leading the way in this space.

I think the key to investing into these markets is really, thinking about where public capital and private capital can really work together.

And we've taken advantage of some opportunities to create blended finance and I think that blended finance, if you think about that term, the goal of it is to really catalyze private capital to come in and invest into projects just like they would invest to them in those projects in the developed world. And as we look to the growth across these areas, I think it creates an enormous opportunity to participate in what will be, one of the most important things from just an overall, global stability perspective because that access to energy and, low carbon energy in the developing world is going to be the biggest driver to meeting our decarbonization goals across the economy.

Oscar Pulido: David, you mentioned global stability and what comes to mind is geopolitics. The geopolitical landscape is something that we spend a lot of time talking about, and when we talk about those topics, things like energy security and nearshoring come up. So, what do those things mean for infrastructure?

David Giordano: It's a great point, Oscar. And as you think about this and you break it into those two components, you've got, the nearshoring, the onshoring of manufacturing. And this is really, if you think post pandemic, a desire for the economy to have a much more diversified supply chain.

And really as you think about the energy transition, that has diversification built into it as well. And when we think about that transition, it is an all of the above solution. And so there will be fantastic opportunities to actually support that nearshoring and onshoring of manufacturing with clean energy, reliable energy, and low-cost energy.

It's also going to create opportunities more broadly across the infrastructure landscape. It's going to be ports, it's going to be airports, it will be roads and highways as well to support the reconfiguration, if you will, of the supply chain.

That also then plays into the second point you made, which is around energy security, and you think about, Europe post Russia's invasion of Ukraine and it really highlighted the need to have a diversification of supply for your energy. And so again, that solar, that's wind, that's natural gas too.

As we go through this transition, nuclear will continue to play a role and in some countries, play a more prominent role. And all of this again, fits into that broader theme, that broader opportunity set for infrastructure investing.

The other thing I'd highlight too, as you think about the policies, a big part of the policies has been about encouraging investment in domestic supply to support the transition. And if you think about, something like solar modules and then you look at a wind turbine, which has a much more diversified supply chain, I think all of these things start to fit together into, a much more secure and certain energy future and a decarbonized one.

Oscar Pulido: And David, just to clarify for my own edification, when you say diversified supply chain, do you mean the way that we're powering supply chains or do you just mean that there are different component parts coming from a lot of different sources in the supply chain?

David Giordano: Both. The way that we're powering supply chains on the one hand, but on the other hand is where are the component parts coming from to build out these power plants, and if you look at what is at the core of something like the Inflation Reduction Act here in the United States, at the core of it, it's really inspiring manufacturing. There are additional tax benefits associated with domestic content that creates an economic benefit for a project that can utilize that domestic content. So, it all fits in together into one broader ecosystem.

Oscar Pulido:

And so, David, maybe just switching gears for a second, you alluded to this a little bit just a second ago, the term private capital came up. In fact, one of the reasons Larry Fink touched on infrastructure in his annual letter was not only the need for it, but also how to finance these projects. And he touches on how governments are going to be challenged to finance these projects on their own and that private capital will be needed in order for this infrastructure build out to come to fruition. So can you talk a little bit more about the role that private capital is going to play as we transition to a low carbon economy?

David Giordano: Private capital is going to be essential Oscar in really facilitating that transition. And so again, as you think about, a deglobalization effort, if you will, around the geopolitical landscape, that plays into what we were just talking about as it relates to diversifying the supply chain nearshoring and reshoring of manufacturing. And so again, all of those pieces fit together.

We also have incredible stress on governments right now, just in terms of the debt service that they will have to be paying. And it's forecasted over the next couple of years, many of the largest economies in the world would be paying more in debt service than they are in defense spending. That means that they're not going to be able to finance the infrastructure needs on their own, they're going to need private capital to play a role in this.

And private capital is really well positioned to invest in the development and then the long-term ownership of these projects and really be, that facilitator of investment into these long-term infrastructure opportunities.

Oscar Pulido: So, you're saying that this infrastructure investment that is needed is almost too expensive for governments to handle by themselves, so this is why the role of private capital is going to step in to assist?

David Giordano: Yes. that's exactly right. There is just no scenario that you can paint and say that governments can absorb all of the capital needs on their own.

And private capital is in a great position and there's a huge demand from institutional capital providers to have access to those types of investments.

I think the other piece to this, as you think about it, is, government has some role in the financing side of it, but really, it's more important that government sets up the right policies, has the right regulations in place to really facilitate the transition at scale.

We were just talking to some of our partners in the industry and it's estimated that there's about 40 gigawatts of projects in the United States that have signed interconnection agreements but are unable to go forward with construction because they don't have their local permitting in place.

And so, government’s role, yes, there's a financing component to it, but more importantly, it's about setting up the right institutions, having the right processes and regulations in place to really create then the efficient flow of capital into these assets where there's quite a bit of institutional money that is looking for access to those uncorrelated to public markets, cash flows.

Oscar Pulido: So David, we're talking about megaforces. We touched on geopolitical fragmentation, there's another one that comes to mind, which is demographic divergence. In fact, we recently had a conversation with Peter Fisher and Nicholas Fawcett about this exact topic, demographic divergence. Essentially talking about the fact that populations are aging very differently in different parts of the world. And so this has an impact on demographic shifts, on urbanization, and it makes me wonder how does infrastructure then play into this?

David Giordano: So, look, as you think about the demographic shifts and you think about the differences between, the developed world and the developing world. We were recently at an event with the president of Kenya where the average age in Kenya is 19 years old, that’s vastly different than looking at a country like Japan or even the United States.

And as we think about that, that also implies, further urbanization, which means it's not just going to be, centrally generated power that's going to be able to facilitate that growth in urbanization. We're going to need to have the structure in place to facilitate, behind the meter, which, by that I mean rooftop solar and battery energy storage that's localized. Generating power at the distribution level, being much more responsive, having a smarter grid, smarter metering to inspire behavior to use power more efficiently. Energy efficiency, which is not something we've talked about, but that plays into, this broader infrastructure need to support the energy needs of that population growth.

All of these need to work together to really make this feasible and ensure that there is reliable, inexpensive, and clean energy available to support that growth.

Oscar Pulido: Well, I have to say I know there are countries that have a younger population than the developed world, countries like the US and Japan, but I had not heard a statistic like the one around Kenya that you just mentioned. And it really brings to life that divergence in demographics that we talk about. Uh, I also start to think about how the world has evolved over the last few years post the pandemic, rise of hybrid work, the rise of video streaming, of course, the rise of artificial intelligence. How does this reshape the demand for infrastructure projects

David Giordano: Yes, Oscar. it's a really great point and as you think about the investment opportunity, right? There was 35 billion, spent on data centers last year. That number is going to approach 50 billion by 2030. we're just going to continue to see massive investment as we see the growth of artificial intelligence, but also the broader use as you point out streaming, increased remote work, it's just going to continue to put more pressure and create more demand around data, going back to the our earlier part of our conversation, the increase in manufacturing capacity, more broadly dispersed through throughout geographies is going to increase electricity demand.

And as we think about that, it creates opportunities to invest then in the generation technologies that can meet that demand and can meet it at low cost and with low carbon intensity.

I think the other thing to think about with this too is, it's getting a lot of press lately, if you think about the average search you do, on your computer and then you think about, putting in an artificial intelligence prompt. AI actually requires about 10 times the energy as the regular Google search, if you will. And so, if you extrapolate that out, by 2026, we estimate that demand just for data centers will equal the demand of Japan. Just to put it in context, it's going to be a massive shift, it's going to create investment opportunities in data centers, but it's also going to create a massive shift in the way we generate and use electricity.

Oscar Pulido: And so, David, you've given us a lot to think about here in particular, when people hear infrastructure or maybe they think about roads and bridges and, and maybe they stop there. That's sort of the more traditional way of thinking about infrastructure, but, uh, you've made the point that it's much more than that. It's really thinking about how are we going to power this digital revolution that we're experiencing. So if we bring it back to the end investor who's thinking about infrastructure, what should they be considering when they're looking at the investment opportunity set?

David Giordano: Oscar, I think as you think about infrastructure investment opportunities. you want to think about a couple of key components, and it's really based on the fundamentals.

First and foremost, you want to, be focused on infrastructure where you know that is in the fast movement of demand, right?

And we've talked a lot about power demand, and as you think about how are we going to meet those demands, it's an all of the above solution. So just sticking to the energy side, you really want to think about all of the areas that are going to provide that reliable, low cost, low carbon energy. And that really is technologies ranging from classic wind and solar investments, natural gas is going to play a key role in facilitating the transition, especially as we have more and more coal retirements.

I think as an infrastructure investor, you want to keep your eye on what's happening in the nuclear world. You know, SMRs and other technologies are going to continue to progress and reach commercialization. But you really want to see the trends. I think you want to focus on cost, and I think you want to focus on reliability and really pay attention to the demand fundamentals, and then look for attractive investment opportunities with that sort of foundation.

Oscar Pulido: Well, I have to say, David, you have put a lot of structure around infrastructure, meaning that I think you've helped us understand all the different components of it, the broader definition that exists, and I'm kind of left thinking back to some of the numbers that you shared, the fact that over 2 trillion a year is invested, uh, in this space right now, it'll be in the three trillions a year by 2030, and in the four trillions by 2040. So, this promises to be an important topic for many years to come. Thank you for sharing all these insights, and thank you for doing it on The Bid

David Giordano: Thank you very much, Oscar. it was a real pleasure and an honor to be here.

Oscar Pulido: Thanks for listening to this episode of The Bid. Next week I’ll be talking with Axel Christensen about Latin America’s Strategic Economic Shift in the Global Market.

<<SPOKEN DISCLOSURES>>

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

In the UK and Non-European Economic Area countries, this is authorized and regulated by the Financial Conduct Authority. In the European Economic Area, this is authorized and regulated by the Netherlands Authority for the Financial Markets.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

MKTGSH0624U/M-3645533

Investing In The Future: The New Era of Infrastructure

Infrastructure is experiencing a transformative moment, so what opportunities exist for investors and how can infrastructure investment not only build wealth but contribute to a more efficient future?