The new inflation regime

What to expect

Long-term trends, such as aging workforces and geopolitical fragmentation, will keep inflation persistently above pre-pandemic levels. Meanwhile, central banks continue to hike rates to reign in prices, despite their inability to resolve production constraints. We think that U.S. interests rates will reach around 2.5% in the U.S. by the middle of the year, creating more financial pains.

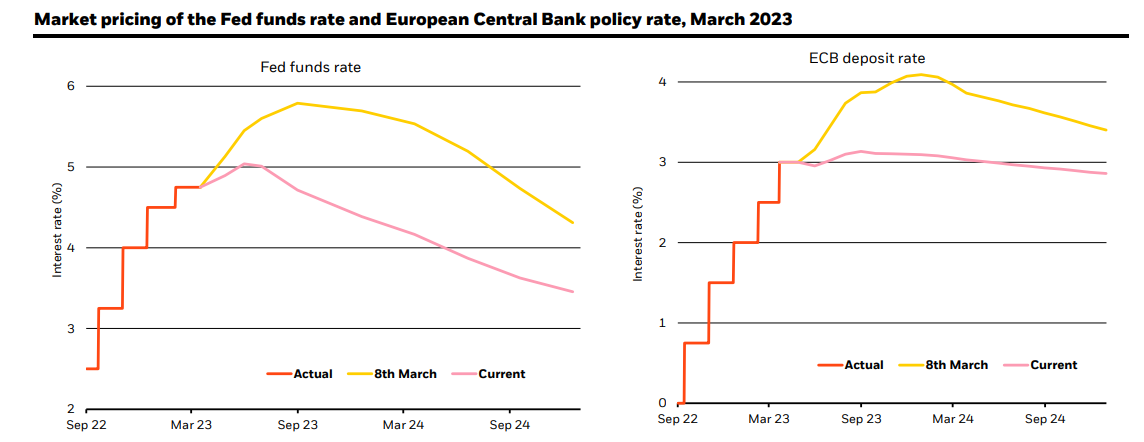

Persistent inflation

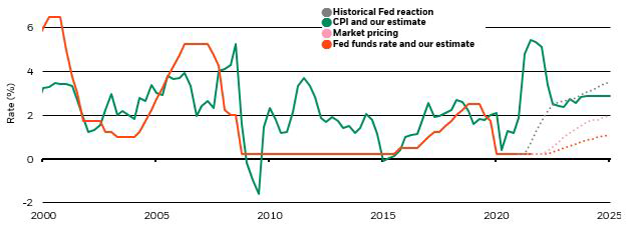

Source: Forward looking estimates may not come to pass. Source: BlackRock Investment Institute, with data from Refinitiv Datastream, March 2023. Notes: The charts show the forward fed funds rate and the European Central Bank deposit rate through December 2024 as implied by futures prices

U.S. and Euro area inflation and our expectations, 2006-2026

U.S. inflation data at the beginning of 2023 showed that core inflation – which excludes food and energy – is still very high, and core services inflation excluding shelter is running close to 6% on an annual basis. Inflation is nowhere near on track to settle back at the Fed 2% target. Unless the worker shortage can be solved, we think getting inflation down means reducing economic activity to a level that can be more comfortably sustained.

Supply chain constraints

Supply chain disruptions are at historical highs

The surge in inflation over the past year has been driven by economy-wide and sector-specific supply constraints, a profound change from the decades-long dominance of demand drivers. The pandemic resulted in a huge switch in consumer spending in the U.S., away from services and towards goods. This pushed up goods prices, resulting in higher overall inflation, despite activity not being back to its pre-COVID path. We were in a world shaped by supply and expected the supply side to adjust over time – but the nature of the activity restart meant we were far from 1970s stagflation. We are now seeing a textbook energy supply shock, more like the 1970s, layered on top of the restart.

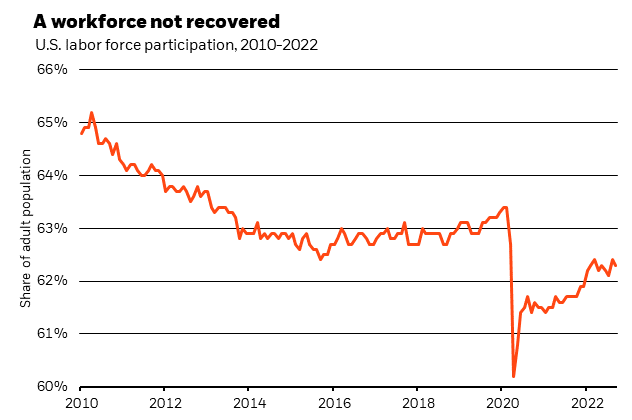

Sources: BlackRock Investment Institute, U.S. Bureau of Labor Statistics, October 2022. Notes: The chart shows the U.S. labor force participation rate, defined as the share of the adult population (aged 16 and over) that is working or actively looking for work.

A workforce not recovered

Even though U.S. unemployment is at a 50-year low, workforce participation rates still significantly lag pre-2020 levels. Aging demographics were already going to add pressures to labor markets, but then the forced break from work during the pandemic likely pushed many older workers into early retirements.

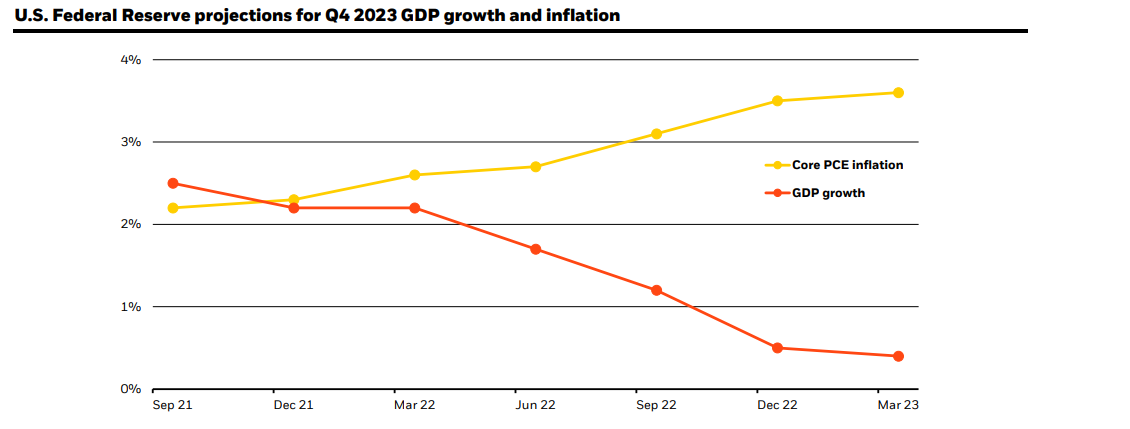

Source: BlackRock Investment Institute, U.S. Federal Reserve, March 2023. Notes: The chart shows the progression of the median Federal Open Market Committee projection for Q4 2023 U.S. real GDP growth and core Personal Consumption Expenditures (PCE) inflation year-over-year, from September 2021 to March 2023.

U.S. GDP and potential supply capacity, February 2023

A world shaped by supply constraints will bring more macroeconomic volatility. Central banks have to either accept higher inflation or destroy demand to squeeze wages and prices to rein in inflation. Bringing inflation down to central bank targets would likely crush demand to meet constrained supply – meaning significant economic damage.

Central bank frameworks

Forward-looking estimates may not come to pass. Source: BlackRock Investment Institute, Federal Reserve Board, U.S. Bureau of Labor Statistics, Bloomberg, with data from Haver Analytics, December 2021. Notes: The chart shows the U.S. nominal Federal Funds Rate (orange line), year on year headline Core Price Inflation (CPI) inflation (green) and some projected paths of the nominal federal funds rate. The U.S. CPI shown from 2022-2025 are our estimates embedded in our Capital Market Assumptions. The dotted red line shows our own projection. The gray line shows the path that would have been implied by a simple monetary policy rule linking the choice of policy rate to the rate of inflation and the level of the output gap. The pink line shows the current market-implied path.

U.S. CPI inflation, Fed Funds Rate and expectations, 2000-2025

Major central banks’ much more muted policy reaction shows that they will likely live with supply-driven inflation rather than destroy demand and economic activity – provided that inflation expectations remain anchored. We see a steeper yield curve than the market currently expects as inflation rises due to accommodative central bank policy, continued fiscal spending in developed economies, and a revival of the term premia.

Portfolio positioning

The Great Moderation, the multi-decade long period of low inflation and low volatility, is over. Focused on taming inflation, central banks are poised to overtighten and are unlikely to come to the rescue if a recession takes hold. This fundamentally different regime requires a new investment playbook.

A new investment playbook

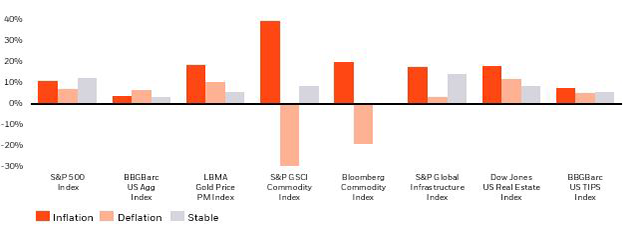

Source: Bloomberg; Data as of May 2021. Inflationary periods defined by QoQ Seasonally-adjusted CPI changes of more or less than 17bps, or 40%, from the median QoQ CPI change of 43bps. Inflationary periods measured between July 2001 and May 2021 Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Higher levels of dispersion can create opportunities that can be captured with granular asset allocation decisions and active insights.

Re-examine asset class assumptions and consider more frequent portfolio adjustments to navigate an uncertain road ahead.

Ways to address inflation within your portfolio

-

Inflation-linked bonds and unconstrained strategies may outperform traditional government bonds. With nominal government bond yields less sensitive to higher inflation expectations and actual inflation than in the past, inflation-linked bonds can provide resilience and help protect against further inflation surprises.

Traditional fixed income assets are expected to generate a negative real yield over the medium term. Consider flexible/unconstrained strategies to manage duration risk in the current environment and to capture opportunities across different sectors to achieve a positive real yield. Floating-rate investments, such as a direct lending, provide incremental risk diversification away from traditional fixed income with limited (or no) interest rate sensitivity.

Learn more about BlackRock’s fixed income offerings.

-

Central banks*’* efforts to tame inflation have caused financial cracks felt across equities. As we continue to live with inflation and higher rates, we think investors pursuing strong relative performance may want to consider companies with quality earnings. Compared to 2022, we expect 2023 to be a year in which stock performance is more likely to be driven by earnings, versus last year when returns were driven by multiple contraction. Pricing for healthcare stocks is compelling, with valuations below the market average. Other defensive sectors such as consumer staples and utilities were bid up in price last year as investors sought stability and their valuations still sit at or above the broad market.

Additionally, profitable blue-chips with stable earnings and low debt can serve as a natural ballast to value stocks because of their ability to absorb higher input costs while utilizing their pricing power to increase market share.

Learn more about BlackRock’s equities platform.

-

Commodity-related equities enhance portfolio resiliency and strengthen commodities exposure. Commodities historically outperform during periods of high inflation. As demand for goods and services increases, so does the price of the commodities used to produce them. Commodity-related equities provide access to both the entire value chain and to commodities not available via the futures market (e.g., platinum, diamonds, lithium, and iron ore).

Explore BlackRock’s latest insights into commodities markets.

-

Infrastructure investments can serve as a diversified source of return. Many infrastructure assets have an explicit link to inflation through regulations, concession agreements or contracts. Moreover, infrastructure’s operating and maintenance costs are typically fixed - an implicit hedge against inflation on the cost side.

Assets with front-loaded dividend payments outperform amid rising inflation, having less downside risk in such an environment. As with real estate, the cost of new infrastructure construction increases with higher inflation, reducing competition to existing assets.

Core real estate values rise with inflation due to higher replacement costs increasing the value of existing assets, as it becomes more expensive to build new supply. Holders of real estate debt benefit, as paying down debt with inflated dollars is beneficial for levered real estate.

Learn more about BlackRock’s real assets offerings.

-

Challenged by elevated inflation and heightened volatility, investors may benefit from strategies that can source idiosyncratic return streams uncorrelated to traditional risk assets and remain nimble amidst evolving market conditions.

Global tactical asset allocation strategies provide exposure across a wide range of public asset classes, sectors, and geographies – looking to take advantage of timely relative value opportunities. Multi-strategy hedge funds take an integrated approach, often involving long/short investing, and blending top-down and bottom-up methods to capture consistent returns and provide diversification1 against directional moves in traditional asset classes.

1Diversification does not guarantee a profit or eliminate the potential for loss

The inflation challenge

Key points

Inflation stabilizes higher

We believe inflation will likely settle above the Fed’s 2% target due to evolving supply shocks, the Ukraine war, deglobalization and COVID lockdowns in China. It is likely that the Fed will not raise rates beyond neutral - a level that neither stimulates nor decreases economic activity.

A new frontier for yield

The current environment is creating opportunities for fixed income investors, especially in short-term and high-quality assets. Investors have been overweight cash allocations, which has helped preserve capital for future buying opportunities at better prices.

Diversification is key

In our view, diversified portfolios with exposures to commodities, real assets and equity companies with high purchasing power are better positioned for periods of elevated and stickier inflation.

I don’t think we’re going into a recession, but I think it's becoming more prominent in the thought process of a lot of people out there. So, what do you do with that?

Rick Rieder

Chief Investment Officer of Global Fixed Income at BlackRock

Rick Rieder

Chief Investment Officer of Global Fixed Income at BlackRock