Understanding the impact of subscription lines on private equity funds

Overview

Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for irregular capital calls from the fund’s investors. BlackRock in collaboration with Technical University of Munich (TUM) studied how subscription lines impact private equity fund performance. The study analyzed the effect of different borrowing conditions on IRRs and multiples under different performance scenarios and across a broad range of vintage years. The research suggests that subscription lines are more useful as a portfolio management tool that simplifies the operations of both the fund manager and its investors, rather than as an instrument to boost performance and obscure performance evaluation.

The rise of subscription lines

A subscription line, also called a credit facility, is a loan taken out mostly by closed-end private market funds, in particular by private equity funds. The loan is secured against a fund’s investors’ commitments, generally without recourse to the actual underlying investments in the fund. Initially, these subscription lines were pure short-term bridge financing, which was repaid in 30 to 90 days. Among other factors, low interest rates and less restrictive borrowing provisions have dramatically increased the use of subscription lines of credit by closed-end private market funds.

Sign up to receive BlackRock's alternatives insights

Portfolio management tool

Subscription lines reduce the administrative burden on managers and investors alike. In effect, a subscription line delays capital calls, thereby shortening the investor’s holding period and, assuming a sufficiently positive performance, moderately increases the IRR.

Impact on investor cash flows

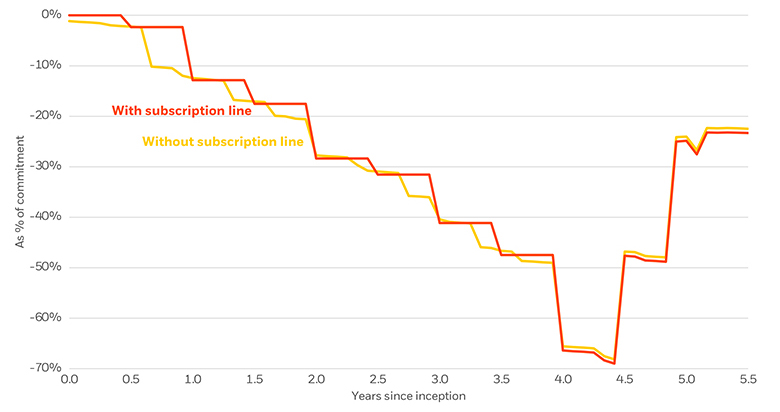

Cumulative net cash flows

For illustrative purposes only. Source: BlackRock, Burgiss Private iQ. The chart above contrasts the cumulative net Limited Partner (LP) cash flows for a simulated fund with (orange) and without (yellow) the use of a subscription line during the investment period of five years. Data set includes over six thousand buyout deals with initial investment dates ranging from 1994 to 2013. More than 95% of the deals are fully realized and each deal has a capital investment of at least five million, denominated in either USD (55%), EUR (39%) or GBP (6%). All included deals were held for at least nine months and the most recent cash flow was registered at July 31 2017.The results discussed here are at the end of the fund and that the impact on performance during the life of the fund, especially during the investment period and while raising the next fund, might be substantially higher. Maturity and size of the loan were six months and 25%, respectively.

Impact on private equity

In this paper, we try to provide a more complete picture of the effect of subscription lines on the performance of private equity funds. Our analysis quantifies the impact of subscription lines on final net performance and concludes that this impact is relatively moderate on average, with the median and mean IRR changing by +0.2 percentage points and +0.5 percentage points, respectively.

Modest Impact on IRR

Aggregate impact on IRR across 16 vintage years

For illustrative purposes only. Source: BlackRock, Burgiss Private iQ. The table above summarizes the differences in performance between simulations with and without subscription lines. As an example, the average change in IRR is +0.5%, which signifies that the mean performance with and without subscription lines are 16.4% and 15.9%, respectively. Please note this does not mean that a fund with an IRR of 15.9% gets an increase in IRR of +0.5% by using a subscription line as the relation between IRR and delta IRR is not linear but convex. Duration represents Macaulay duration. Data set includes over 6,000 buyout deals with initial investment dates ranging from 1994 to 2013. More than 95% of the deals are fully realized and each deal has a capital investment of at least five million, denominated in either USD (55%), EUR (39%) or GBP (6%). All included deals were held for at least nine months and the most recent cash flow was registered at July 31 2017. The results discussed here are at the end of the fund and that the impact on performance during the life of the fund, especially during the investment period and while raising the next fund, might be substantially higher. Maturity and size of the loan were six months and 25%, respectively. The figures shown relate to simulated past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Key conclusions

Subscription lines are more useful as a portfolio management tool that simplifies the operations of both the fund manager and its investors rather than as an instrument to boost performance and obscure performance evaluation.

- Shorter holding period: Effectively delaying capital calls thereby shortening the investor’s holding period by six weeks on average

- Potential Boost in IRR: Shorter holding periods may help increase IRR by +0.5% on average

- Cost borne by LPs: Slightly lower multiples by -0.02x on average

- Many dependencies: The impact is influenced not only by loan terms but also by prevailing economic environment and returns

- Minor impact on benchmarking: Quartile rankings are positively impacted for just 2.4% of all simulated funds

- Negligible impact on profit sharing: In aggregate, absolute amount of carry decreases by 1.0%