With over 30 years of history now in the rearview, ETFs have emerged as one of the most transformative financial innovations of this generation. ETFs offer a wide range of highly precise, transparent exposures with low cost and intraday liquidity—features that have driven widespread global adoption. ETFs have also become the go-to vehicle for transferring risk, particularly in times of extreme market volatility. This was evidenced by surges in ETF trading volumes during both the global financial crisis and, more recently, the coronavirus pandemic.

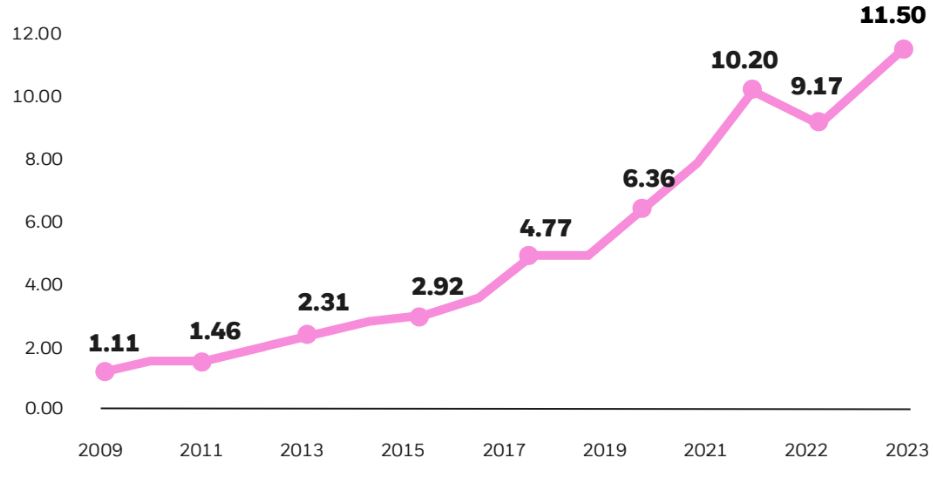

The ETF industry has increased significantly in size over the last decade, growing from $1.1 trillion in 2009 to more than $11.5 trillion today.

1.1 THE BIG SHIFT

Global ETF assets under management (2009-2023)1

What is an ETF?

ETFs are pooled funds that trade like a stock on a regulated stock exchange. They can provide access to a broad range of investment strategies across index and active, in a convenient wrapper. ETFs take the simplicity and benefits of a listed single stock - such as liquidity, on-exchange trading, and transparency of holdings - and (typically) combines this with the benefits of an open-ended mutual fund –such as instant diversification, cost-efficiency, and the ability to create and redeem fund units.

1.2 THE BENEFITS OF ETFs

Liquidity

ETFs trade on-exchange and investors can buy or sell in real time, just like stocks.

Diversification

Many ETFs provide exposure to a variety of underlying individual securities, providing diversification and insulating investors from single security price swings.

Accessibility

ETFs are like passports to numerous asset classes and market exposures (some broad, some specific).

Operational efficiency

ETFs provide immediate exposure to a portfolio of securities in a single line item without the high operational costs and complexities of managing numerous individual securities and derivatives.

Tax-efficiency

Investors can be insulated from the tax consequences of their fellow shareholders,’ particularly when it comes to exploring European UCITS vehicles. *Tax efficiency may not be available in all jurisdictions.

Transparency

ETFs are straightforward about their investment objectives. They generally disclose holdings daily.

Flexibility

Investors use ETFs for a variety of applications, including long-term core allocations, short-term tactical adjustments, and risk management.

Low cost

The average ETF management fee is generally lower than an active mutual fund invested in the same asset class. Buying an ETF is often more cost effective than buying the underlying securities individually.

Operational efficiency

ETFs provide immediate exposure to a portfolio of securities in a single line item without the high operational costs and complexities of managing numerous individual securities and derivatives.

2.1 ETFS: A COMPARISON WITH INDEX MUTUAL FUNDS

Both ETFs and index mutual funds are a collection of securities packaged into a fund, with most ETFs designed to track an index. Exposures for both types of funds can range across fixed income, equity, and commodities. However, there are some differences between ETFs and mutual funds - primarily in how they trade.

Index mutual fund

Index mutual fund investors can trade directly with the fund once a day.

ETFs

ETFs are traded on stock exchanges throughout the day.

ETFs vs. index mutual funds

Similarities

- Diversification

- Management fees

- Valuation frequency

- Portfolio management

Differences

- Tax-efficiency (may vary across regions)

- Fee structure(s)

- Transaction costs

- Transparency

2.2 THE MULTIPLE LAYERS OF LIQUIDITY

ETFs trade on open exchanges

ETF investors do not interact directly with fund providers when buying or selling fund shares, like mutual fund investors do. Instead, ETF investors buy and sell shares on-exchange like they would with individual stocks.

A separate ‘primary’ market involves large institutions transacting with ETF issuers to create or redeem ETF shares based on market demand. For investors, this entire process is managed behind the scenes by a highly regulated network of financial institutions (often banks) called authorized participants.

Authorized participants dynamically manage the creation and redemption of ETF shares in the primary market. This process adjusts the number of ETF shares outstanding and helps keep an ETF’s price aligned with the value of its underlying securities.

Each share of an ETF represents partial ownership in an underlying portfolio of securities, such as stocks and bonds.

While technically funds, ETFs are typically categorized as securities rather than investment funds. As such, all bond, equity, and commodity ETFs are given an equity ticker on Bloomberg - indicating they trade on-exchange.

Do ETF investors have credit exposure to the ETF provider?

Most investors are careful when choosing investment vehicles, as they know they can have different ownership implications and levels of investor protection. For example, iShares ETFs are open-ended umbrella investment companies. Legally, they are distinct and separate from BlackRock, which serves as an appointed manager for the funds. The assets of securities held within the iShares funds belong exclusively to the respective funds themselves, and are ring fenced and entrusted to a third party custodian for safe keeping. In the unlikely event BlackRock should cease to exist, iShares funds could continue to operate with another investment manager.

Do ETFs have a credit rating?

The vast majority of ETFs do not have a credit rating at the fund level, but the credit ratings of the ETF’s underlying assets should be readily observable. iShares ETFs allow for daily look through, however, not all ETF providers offer this feature.

3.1 THE FIDUCIARY’S CHECKLIST FOR SELECTING AN ETF

There are several factors to consider when choosing from the increasingly large ETF marketplace. iShares institutional clients frequently ask the following questions as they conduct due diligence:

Exposure: Does the ETF offer the right exposure?

Key considerations

Benchmark quality

High-quality benchmarks are backed by index providers that ensure they are trackable, complete, and accurately represent the investment opportunity.

Targeted exposure

TFs may target specific countries, sectors, or investment themes, or they may offer broader market exposures.

Investment outcome

ETFs may provide access to market exposures, be designed to deliver a specific investment outcome or have a goal to outperform.

Questions to ask

- What is the ETF's investment objective?

- What is the underlying index methodology?

- How widely followed is the index and how long has it existed?

- How often are holdings published?

- How does the ETF track its benchmark?

- How closely has the ETF tracked its benchmark in the past?

- Does the ETF use leverage or inverse strategies?

- What is the underlying investment strategy?

- Is this ETF designed to deliver a specific outcome or generate alpha?

Provider: Know your provider.

Key considerations

Experience

Work with providers who manage and develop ETFs that have track records of delivering intended outcomes.

Analytics

The provider should regularly use analytics to evaluate the product’s exposures.

Transparency

The provider should offer risk, performance, and factor evaluations on a regular basis to ensure the product is delivering the intended outcomes.

Product breadth

A diverse menu of options allows solutions for a wide variety of intended investment outcomes.

Size

Large ETF providers can create efficiencies of scale that may reduce the costs of their ETFs.

Questions to ask

- What experience and expertise does the provider have in managing ETFs?

- What risk management and performance analytics does the provider use to monitor the product’s performance and intended exposure?

- What is the provider’s total assets under management (AUM) and ETF product breadth?

- What are the provider’s risk management processes?

- What other services does the provider offer (e.g. Portfolio Analysis, Model Portfolios, etc.)?

4.1 BOND ETFs

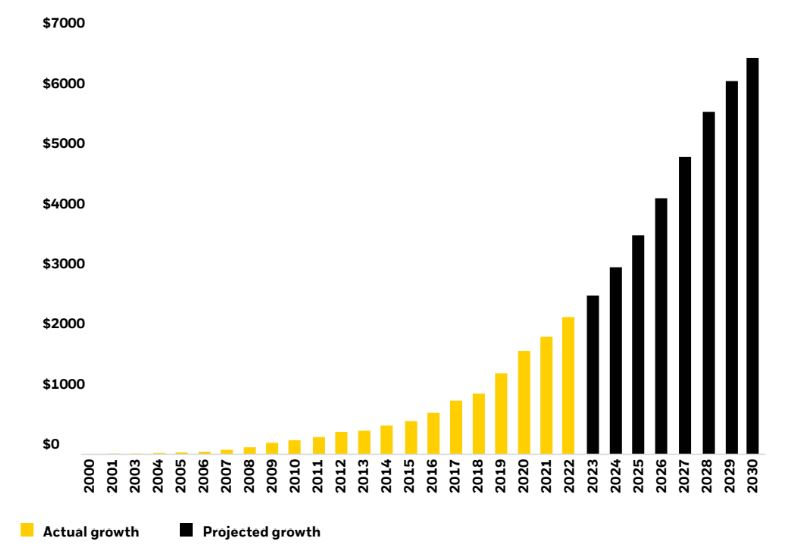

A bond ETF is a portfolio of individual bonds that trades on an exchange, making bond investing simple and transparent. Bond ETFs offer markets on-demand and provide diversified access to both broad and more precise exposures in a single trade. Simple, fast, and efficient, bond ETFs can act as investment building blocks or be part of highly customized strategies. BlackRock projects that global bond ETF AUM will reach USD 6 trillion by the end of 2030.

Investors are rapidly adopting bond ETFs1

Actual and projected growth of global bond ETF AUM (USD B)

FOUR POWERFUL BOND ETF GROWTH TRENDS

- Building blocks in evolved 60/40 portfolios

- Tools for seeking active returns

- Catalysts for modernizing bond markets

- Increasingly precise sources of potential returns

5.1 ETF BASICS ON BLOOMBERG

ETFs typically provide exposure to a diversified basket of securities. This enables investors to achieve beta objectives, while offering the potential to mitigate headline risks associated with more concentrated exposures.

There are several functions on Bloomberg that allow investors to look under the hood of an ETF for visibility into the fund’s composition, characteristics, and risks.