BLACKROCK INVESTMENT INSTITUTE

Mega forces: An investment opportunity

Mega forces are big, structural changes that affect investing now - and far in the future. This creates major opportunities - and risks - for investors.

BLACKROCK SUSTAINABILITY

Please read this page before proceeding as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold.

By entering this site, you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, and have consented to the collection, use and disclosure of your personal data as set out in the Privacy section referred to below.

By confirming below, you also acknowledge that you:

(i) have read this important information;

(ii) agree your access to this website is subject to the disclaimer, risk warnings and other information set out herein; and

(iii) are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S.: public distribution. In Canada: public distribution. In the UK and outside the EEA: professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, qualified clients, and qualified investors. For qualified investors in Switzerland, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. In DIFC: 'Professional Clients’ and no other person should rely upon the information contained within it. In Singapore, public distribution. In Hong Kong, public distribution. In South Korea, Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, Professional Investors. In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, public distribution. In China, this may not be distributed to individuals resident in the People's Republic of China ("PRC", for such purposes, excluding Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services. For Other APAC Countries, Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, institutional investors and financial intermediaries only (not for public distribution).In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx.

This Contents are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and is subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any licence or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

Privacy

Your name, email address and other personal details will be processed in accordance with BlackRock’s Privacy Policy for your specific country which you may read by accessing our website at https://www.blackrock.com.

Please note that you are required to read and accept the terms of our Privacy Policy before you are able to access our websites.

Once you have confirmed that you agree to the legal information herein, and the Privacy Policy – by indicating your consent – we will place a cookie on your computer to recognise you and prevent this page from reappearing should you access this site, or other BlackRock sites, on future occasions. The cookie will expire after six months, or sooner should there be a material change to this important information.

BLACKROCK INVESTMENT INSTITUTE

Mega forces: An investment opportunity

Mega forces are big, structural changes that affect investing now - and far in the future. This creates major opportunities - and risks - for investors.

BlackRock serves clients around the world to help them achieve a better financial future, striving to meet their unique needs. As the world shifts to new energy systems, it creates significant investment opportunities and risks for our clients.

It is our role to seek optimal returns and outcomes for our clients in line with their investment choices, while managing the risks as effectively as possible.

Mark :We're here at the Tengeh Solar Farm in Singapore, built by Sembcorp. What we're going to be seeing here is how they’re decarbonizing their energy sources, as well as assuring energy, independence, and security. And they're doing it all with a floating solar farm.

OOO Intro

Jen: We are here at Sembcorps Tengeh floating solar farm. It has 60 megawatt solar panels on the reservoir.

Mark: So floating solar on a reservoir. Break it all down for me.

Jen: So the floating solar farm is about putting solar panels on the reservoir. Singapore is a urban area with a lot of buildings. There is no large pieces of land. So we do have solar panels on the rooftops, but it is to generate 1.5 gigawatt, which is Singapore's target, I think we need to look at all different areas, including the reservoirs.

Mark: How much of the reservoir are we covering with the solar panels?

Jen: We are covering around one third of the reservoir.

Mark:So should we go take a look?

Jen: Yes, let's go take a look. Let me bring you onto sunshine. Sunshine is our boat that is fully powered by solar panels.

Mark :We're going on an electric boat to look at floating solar panels.

Jen: Yes, yes.

Mark: Game on Jen.

***B-Roll Montage***

Mark: What are the different things you see here?

Jen: Well, you see right in front, the gray plastic things. They are actually HDPE food grade floats. They are called the floaters.

Mark: Yep.

Jen: Then you have the solar panels. There's the solar panels. Then further down you see the combiner box, and then...

Mark: That's the combiner box way down there.

Jen: Yes.

Mark: That's taking the DC power in from all of these panels nearby?

Jen: Yes.

Mark: So Jen, how many panels are there here?

Jen: There's a total of 122,000 solar panels here.

Text: At peak, Tengeh Solar Farm produces enough energy to power 16,000 households in Singapore.

Mark: What are the advantages that you find in producing power here on top of a reservoir?

Jen: Well, there are two key advantages. The reservoir is normally unshaded. There's no trees, no surrounding buildings. It is anything that is coming down from the sun directly converts to the electricity. The second point is on the reservoir it's cooler. Actually solar panels function better when it's cooler, less voltage loss.

Text: Floating Solar Plants can produce 5-15% more energy due to the cooling effect of the water.

Mark: Why not cover the whole reservoir?

Jen: Well, we do have to take care of the biodiversity nature of the water. Covering the whole reservoir will affect the sunlight, the oxygen level in the reservoir. So, it is a calculated coverage that we have to make sure that there is no impact at all.

Mark: What is this water used for?

Jen: It's drinking water.

Mark: It's drinking water?

Jen: Yes.

Mark: So, the people of Singapore are drinking this water. They're getting power from the solar panels on top of it.

Jen: This is classic two-in-one.

Mark: What is not to love?

BlackRock end card

(outtakes)

Mark :We're here at the Tengeh Solar…What do they call it?

Producer: Solar Farm.

Mark: Solar Farm. Okay. We’re here at the Tengeh Solar Plant…Ah Solar Farm!

Mark: It’s actually not a farm, its a plant but ok! Farms have grass and you know, okay.

Jen: This is the heart of the solar plant. No! Solar Farm!

Sources:

Sembcorp, July 2021 “One of the world’s largest inland floating solar farms” https://www.sembcorp.com/sg/news-and-insights/insights-and-stories/singapore/one-of-the-worlds-largest-inland-floating-solar-farms/

Singapore Green Plan 2030 https://www.greenplan.gov.sg/targets/#:~:text=2025%20targets%3A,needs%20of%20around%20260%2C000%20households

Sembcorp Tengeh Floating Solar Farm press release, July 2021 https://www.sembcorp.com/media/drtdjung/sembcorp-and-pub-officially-open-the-sembcorp-tengeh-floating-solar-farm.pdf

Sembcorp Floating Solar, Sembcorp.com

sembcorp.com/sg/our-solutions-in-singapore/renewable-energy/solar/floating-solar/

PUB: Singapore’s National Water Agency Floating Solar Systems pub.gov.sg/Public/WaterLoop/Sustainability/Solar/Floating

Disclosures

This document is marketing material: Before investing please read the Prospectus and the KIID available on www.blackrock.com/it, which contain a summary of investors’ rights. Capital at Risk.

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities, funds or strategies to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are as of August 2024 and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks. BlackRock does and may seek to do business with companies covered in this video content. As a result, viewers should be aware that the firm may have a conflict of interest that could affect the objectivity of this video.

In the U.S. and Canada, this material is intended for public distribution.

In the UK and Non-European Economic Area (EEA) countries: this is issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

In Italy, For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

In Switzerland: This document is marketing material.

For investors in South Africa: Please be advised that BlackRock Investment Management (UK) Limited is an authorized financial services provider with the South African Financial Services Board, FSP No. 43288.

In Latin America: this material is for educational purposes only and does not constitute investment advice nor an offer or solicitation to sell or a solicitation of an offer to buy any shares of any Fund (nor shall any such shares be offered or sold to any person) in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction. If any funds are mentioned or inferred to in this material, it is possible that some or all of the funds may not have been registered with the securities regulator of Argentina, Brazil, Chile, Colombia, Mexico, Panama, Peru, Uruguay or any other securities regulator in any Latin American country and thus might not be publicly offered within any such country. The securities regulators of such countries have not confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx

In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong

In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL). This material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. Refer to BIMAL’s Financial Services Guide on its website for more information. Before making any investment decision, you should assess whether the material is appropriate for you and obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2024 BlackRock, Inc. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners

The low-carbon transition is reshaping production and consumption across regions and sectors. It’s affecting how people buy, sell, make, and move things.

We see the transition to a low-carbon economy having implications for macroeconomic trends and portfolios. We are providing clients with the solutions and tools to help them achieve their investment objectives.

To serve our clients, we have 700+ global sustainable and transition specialists focused on providing customized insights, data and a choice of investment solutions and technology tailored to our clients' needs.

We approach this work solely in service of our clients' best financial interests. That is the foundation upon which we built BlackRock into the most trusted asset manager in the world1 – a total focus on our clients, underpinned by our respect for their diverse preferences and uniqueness.

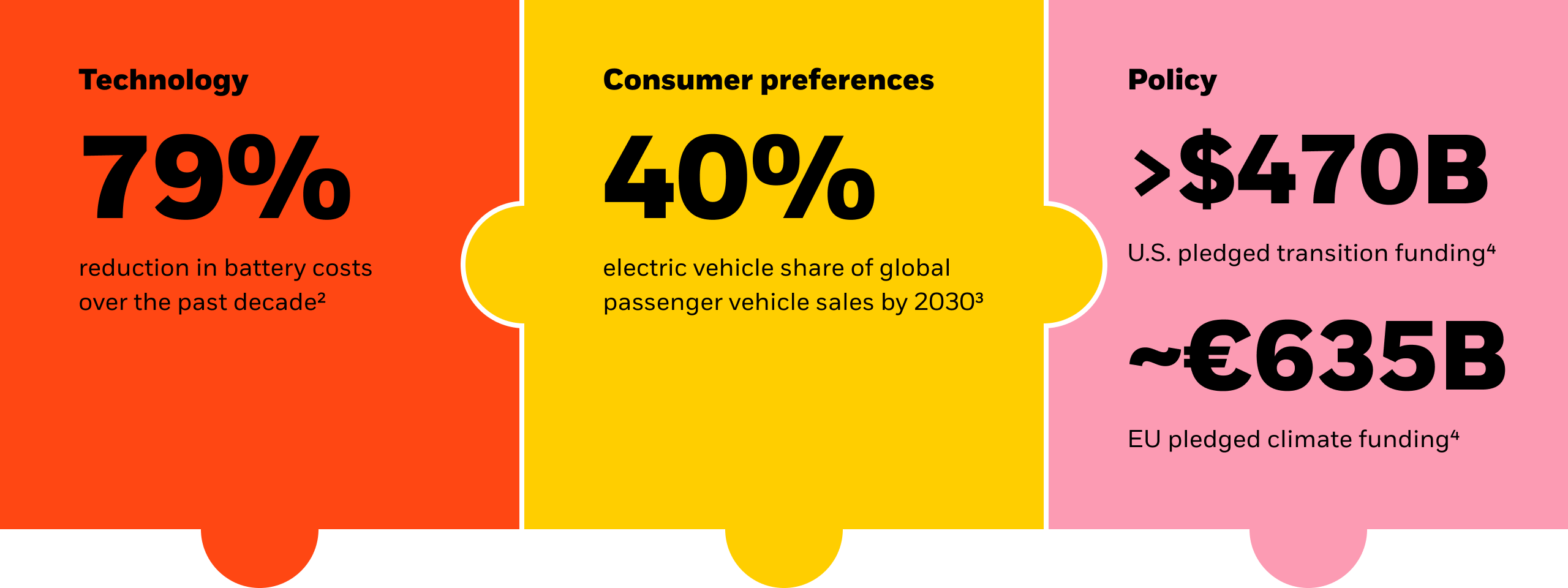

Structural shifts associated with the low-carbon transition – technological innovation, consumer and investor preferences for lower-carbon products, and shifts in government policies – are reshaping production and consumption and spurring capital investment.

Our global team of investment and sector specialists, climate scientists, data analysts, and engineers research macroeconomic and investment trends related to the transition, in order to evaluate risks and opportunities and deliver unique insights to clients.

1 BlackRock is trusted to manage more assets than any other global asset manager, with an AUM of $9.1 trillion as of September 30, 2023.

2 BloombergNEF, Top 10 Energy Storage Trends in 2023

3 BloombergNEF, Electric Vehicle Outlook, June 2022. This figure reflects the report’s Economic Transition Scenario.

4 BII, Rocky Mountain Institute, and European Commission, December 2022. $ figures are shown in USD.

TEXT: The world is transitioning to a low-carbon economy.

TEXT: Technological innovation is spreading

Carolyn Weinberg: Wow, so this is the nerve center?

Dickon Pinner: Each one of those is one of these automated trucks?

Alvin Foo: Automated guided vehicles.

TEXT: Climate and transition policy initiatives are driving transformation.

Chris Kaminker: Recent shifts in U.S. policy have sparked a global clean energy race that is creating investment opportunities on both sides of the Atlantic.

TEXT: Companies are transforming and supply chains are evolving

Martin Lundstedt: This is the beauty.

Mark Wiedman: Fully electric!

Martin Lundstedt: Fully electric.

Mark Wiedman: I am driving a proper truck.

Martin Lundstedt: Yeah, yeah, absolutely.

TEXT: The shape of the global economy is changing.

TEXT: And new investment risks and opportunities are emerging.

Anne Valentine Andrews: The low-carbon transition is a once-in-a-lifetime opportunity for our clients and BlackRock has the breadth, expertise and whole portfolio solutions to meet our clients needs.

CONCLUSION

VO: The transition to a lower-carbon world is happening.

VO: And at BlackRock…

VO: We’re ready.

Corporate site Disclosures

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities, funds or strategies to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks. BlackRock does and may seek to do business with companies covered in this video content. As a result, viewers should be aware that the firm may have a conflict of interest that could affect the objectivity of this video.

In the UK and inside the EEA: Until 31 December 2020, issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. From 1 January 2021, in the event the United Kingdom and the European Union do not enter into an arrangement which permits United Kingdom firms to offer and provide financial services into the European Economic Area, the issuer of this material is: BlackRock Investment Management (UK) Limited for all outside of the European Economic Area; and (ii) BlackRock (Netherlands) B.V. for in the European Economic Area, BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

In Switzerland: This document is marketing material. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded.

In the U.S. and Canada, this material is intended for public distribution.

In Latin America: No securities regulator has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx

In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

In South Korea, this is issued by BlackRock Investment Management (Korea) Limited. For information or educational purposes only, not for reuse, redistribution, or any commercial activity, and does not constitute investment advice or an offer or solicitation to purchase or sells in any securities or any investment strategies.

In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600.

In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances.

In China, this material is provided for informational or educational purposes in People’s Republic of China (“PRC”, for such purposes, excluding Hong Kong, Macau and Taiwan) only and does not constitute a solicitation of any securities or BlackRock funds.

This material is provided for informational or educational purposes in People’s Republic of China (“PRC”, for such purposes, excluding Hong Kong, Macau and Taiwan) only and does not constitute a solicitation of any securities or BlackRock funds or any financial services in any jurisdiction in which such solicitation is unlawful or to any person to whom it is unlawful.

©2023 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

The investment landscape is being shaped by big structural changes, or mega forces, that we think could create both investment risks and opportunities across public and private markets.

5. BlackRock iResearch Services global survey of 200 institutional investors with US$8.7 trillion of assets. May-June 2023. Survey covered institutional investors’ attitudes, approaches, barriers and opportunities regarding transition investing.

BlackRock speaks to thought leaders and industry experts from around the globe about the biggest trends moving markets. Listen to companies, business leaders and investors at the forefront of the transition to a low-carbon economy.

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

The Bid: “Low-Carbon Transition Investing 101”

Episode Description:

The transition to a low-carbon economy has emerged as a key player in the 5 mega forces that the BlackRock Investment Institute have been outlining for us in recent episodes. But what exactly does it mean to “invest in the transition to a low-carbon economy”, how are investors seizing this opportunity, and why is this transition seen as a “mega force” for investors?

Helen Lees-Jones Co-Head of the EMEA Sustainable & Transition Solutions group at BlackRock will reveal the questions investors are asking about the low carbon transition and explain the driving factors.

Sources: BlackRock iResearch Services global survey, sample size n=200, May-June 2023; BII Investment Perspectives Tracking the low-carbon transition (2023); Morningstar, Simfund, Broadridge. Data includes Sustainable Mutual Fund, ETF, Institutional and Alternative AUM, as defined by third party data sources, excluding integration/engagement flags. MF and ETF data as of Oct '21, Institutional & Alternatives data as of Jun '21.

Written Disclosures in Episode Description:

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

TRANSCRIPT:

TRANSCRIPT:

<<THEME MUSIC>>

Oscar Pulido: Welcome to The Bid, where we break down what's happening in the markets and explore the forces changing the economy and finance. I'm your host, Oscar Pulido.

The transition to a low-carbon economy has emerged as a key player in the 5 megaforces that the BlackRock Investment Institute have been outlining for us in recent episodes. But what exactly does it mean to “invest in the transition to a low-carbon economy”, how are investors seizing this opportunity, and why is this transition seen as a “mega-force” for investors?

My guest today is Helen Lees-Jones, EMEA Head of the Sustainable & Transition Solutions group at BlackRock. Helen, will reveal the top questions investors are asking about transition investing and will highlight the particular areas in this field that are exciting investors. We'll also delve into the timing, the regional variations, and driving factors behind the transition. Helen, welcome to The Bid.

Helen Lees-Jones: Thanks so much for having me.

Oscar Pulido: So Helen, in recent episodes of The Bid, we've been discussing the five mega forces that Alex Brazier has introduced us to, and these are forces that are affecting investing both now and in the future, and creating opportunities and risks that investors can't ignore. The transition to a low carbon economy is one of those forces. So can you tell us why this is one of those mega forces?

Helen Lees-Jones: So, as you've heard, this is one of those mega forces, it's not the only one and as we think about advising investors and talking to them about what's happening in markets. We see that alongside the future of finance, the advent of digital technologies like AI, the transition to a low carbon economy is rewiring economies, sectors and businesses. And we see as a result of this transition the average investment in the energy sector increasing to $4 trillion per year over the next 30 years, that's up from only $2 trillion over the years past.

And so, as part of this rewiring of economies, that is creating both risks and opportunities for investors. And what we're seeing is that it's also channeling investment into both high carbon sectors and low carbon sectors. So, it's really a transition that is affecting the whole of finance and we are trying to put as much information into the hands of investors as possible.

When you think about this transition, there are really three key drivers behind it. You've got policy forces like the Inflation Reduction Act in the U.S. or the EU Green Deal, you've got the advent of new technologies like carbon capture, and you've got real changes in the way consumers and investors like to think about their investments. We also know that the transition to a low carbon economy, is playing out at different speeds in different regions, particularly when you look at developed markets versus emerging markets, as one example.

We see that the electrification of light vehicles is largely on track for 2050, whereas other sectors that perhaps have harder to abate emissions in the emerging markets need a significant amount of investment and or policy in order to drive that transition ahead.

Oscar Pulido: Okay, so just to reiterate, you're saying $4 trillion per year of investment in the energy sector over the next 30 years. That's a huge increase from what we're seeing now, and maybe we can take a moment to think about what does it mean to invest in the transition to a low carbon economy. In other words, what are some of the ways that investors are thinking about this opportunity?

Helen Lees-Jones:Great question! The definition of transition investing is something that continues to evolve, we're operating in a quite new space when you think about it. So, we at BlackRock have tried to put our own framework around it just to help investors think through the risks and opportunities associated with it. And we define transition investing in four ways, but the first area is around preparing for the transition. And that's where companies are investing in assets that make them better positioned for the transition, such as those improving and or leading on mitigating GHD emissions within their industry, either through their business operations, or their business models.

So, you're probably sitting there thinking, what on earth does that mean? Let's bring it to life a bit. As an investor, you're going to be thinking about companies that are outperforming their peer group, and we'd see in this category someone who is placing particular emphasis on reducing emissions intensity in their own operations and or deploying more CapEx than their competitors in that space into lower carbon solutions. So that's the first definition, those companies that are preparing for the transition.

The second is those that are aligned to investing in portfolios or assets on a decarbonization pathway that's aligned to an industry accepted low carbon scenario. So, you are an investor, you're looking at your portfolio, here, it might be an index or a portfolio that's aligned to a Paris aligned benchmark.

Thirdly, those companies that are really benefiting from the transition They're investing in assets such as those that are providing key inputs necessary for decarbonization that will benefit from the macroeconomic trends offered by the transition. Here you might think about the mining sector and a company that produces lithium. That's a key input into electric vehicles and the batteries within electric vehicles. So, a company that is leaning into lithium production, we would see as benefiting from the transition to a low carbon economy.

And then finally, those companies that are contributing to the transition. So here this might be companies who are investing in solutions or interim low carbon alternatives that are needed to mitigate emissions in the real world. So here examples might be wind farms, or grid scale batteries. So those are really the four ways in which we are defining transition investing here at BlackRock.

But when we think about investors and what's driving their preferences in transition investing, you see a range of interest from investors worldwide. Some want to look at it through a whole portfolio lens, you tend to find the big institutions who have made whole portfolio commitments seeing this as really something they want to see throughout their whole portfolio. Others who are very much focused on the thematic opportunities associated with the investment, like investing in specific sectors, minerals, materials, would want to play it thematically. But the prevailing interest that we are seeing is in the private market space because we see that the transition is driven by new technologies and new businesses that don't exist today. The real innovation that's going into this space requires an awful lot of private capital.

Oscar Pulido: That framing was very helpful that description of the various ways in which somebody can go about investing in the transition to a low carbon economy. I wonder if you could maybe give us a few real-life examples that might help someone who's learning about this investment space for the first time. You mentioned batteries. What are some of the opportunities that exist in the battery and carbon capture space?

Helen Lees-Jones: Of course, two exciting areas in which to invest. When we think about carbon capture, we have a brand-new joint venture with a US oil major on this very topic because as you will know from what I've talked about so far, traditional oil and gas producers are really key to meeting the world's growing energy. Even with the rapid build out of clean energy infrastructure, we still see that there's a space for emissions removals capabilities to come online. So, carbon capture is really there to use new technology to remove large amounts of carbon dioxide from the atmosphere and put it back into the ground.

On the battery side of things, they're essential to the transition to a low carbon economy, whether it's from powering electric vehicles or ensuring grid reliability. And we have also in our infrastructure business invested in a super battery in Australia, it's there to ensure that it stabilizes energy grids as they shift to renewable sources. When you think about it the wind only blows for a certain amount during the day, the sun only shines for a certain amount during the day, so being able to harvest that renewable energy supply, store it and then transmit it when it's needed, those grid scale batteries are critical to ensuring that we can make the most from those renewable energy sources. So those are just two examples, carbon capture, grid scale batteries.

Perhaps the third space, whilst we're talking about batteries is next generation materials that are needed. Batteries are now prevalent everywhere, whether it's in your electric car, or in other parts of your Day-to-Day life and those batteries need to become higher performing more efficient, more sustainable. So, looking at new materials and minerals that are required in order to make those batteries better, is also another interesting area for investment opportunities.

Oscar Pulido: And so, Helen going back to the numbers you referenced earlier about the investment in this space doubling, what impact will that have on opportunities for investments going forward?

Helen Lees-Jones:So obviously with that significant scale of CapEx going into new energy sources, there's an array of opportunities across the world. This transition isn't happening just in one sector or one country, this is something happening globally. I talked about, a super battery in Australia or a carbon capture facility in the U.S., there are other areas in which we are investing in transition assets. Pipelines as one example, we're looking at ways in which we can invest in building thousands of miles of critical infrastructure to help transition from oil to natural gas and clean hydrogen. So, it is about taking some of that infrastructure that exists and finding ways in which it can both continue to deliver the oil and gas that is being produced today but also be converted in the future into a way of transmitting newer energy sources like clean hydrogen.

Electric vehicles, we've made a pretty significant investment into a continental European EV charging company, which installs and manages high speed electric charging stations. Their goal is really to be the biggest charging facility provider across Europe, and they're already operating one and a half thousand chargers across the continent today. As we see wider adoption of electric vehicles coming online, those drivers are going to want the convenience of being able to charge wherever they wish. you can charge your vehicle at a petrol station wherever you like today, but the infrastructure still needs to be built out in order to charge your electric vehicle. And the goal there is to ensure that around every 150 to 200 kilometers on European highways, you can access the convenience of EV charging as you drive.

Perhaps if we look at the more renewable end of the investment opportunity set, you can think about solar power. We can see big opportunities in solar power, we have significant investments across our portfolio today, we've invested, in a renewable energy developer in the Philippines as another example of where we see global opportunity. So yes, this is happening in, developed markets, but increasingly we're seeing much more opportunity coming across in the developing markets.

And those transition assets are not only helping transition from browner sources today to greener sources tomorrow, but they're also providing resilience and security, which importantly we see as key characteristics of the transition. Yes, of course we want it to be green and lower emissions, but also it needs to be consistent, and it needs to be stable. Things like solar power and battery storage are a key component of that transition, so for investors, there's a wide array of infrastructure, assets and technologies in which to invest globally.

Oscar Pulido: So Helen, you may have recently listened to an episode we did with Portfolio Manager Charlie Wilford around electric vehicles, and he commented on some of the charging infrastructure challenges that you mentioned as well.You also mentioned policy as a driver of the transition, and you touched on the Inflation reduction Act in the us. And the EU’s Green Deal package. What impact does policy have on investment opportunities and what challenges might it present?

Helen Lees-Jones: Great question because the policy landscape is a really critical input into how you think about making investments, particularly as long-term investors. What we've seen with new policy come online, whether it's the US Inflation Reduction Act, whether it's the EU's Green Deal package, there's been a significant investment of policy and subsidy into both the US and European marketplaces, we're seeing other parts of the world also come online, Japan most recently. The policy support is huge in this space, that catalyzes investment, which is what we want to see, but it also does create risks when you think about how that policy is going to be deployed.

Things that you might want to consider are things like policy changing. So, policies are enacted normally aligned to political cycles, what happens if a different, political party comes in or the government is managed differently, will those policies endure or will they look different or be removed entirely. And so that's a risk to consider when you think about just the feasibility and long-term nature of policy.

The second thing is that huge wave of investment that it generates can also create bottlenecks, whether that's in your supply chains, getting hold of critical raw materials and minerals, that wave of demand can also generate bottlenecks in your supply chains. And then you've got the issue of permitting risk. The policy support is there, the money is there to put to work, but are you allowed to actually go ahead and build that new project? And often you require permits in order to put those infrastructure projects in place.

And that in itself comes with risk, not all projects actually end up getting the permits they expected to get, and we've seen some of that play out recently. So, policy is a great mechanism. It comes with huge opportunity, but it does come with some risks as well. And importantly investors in this space want to work with a partner who can understand and help navigate all that complexity that I just talked about.

Oscar Pulido: And do we have any data how many institutional investors are already thinking about this for the future or are they already investing in the transition?

Helen Lees-Jones: So that's a timely question, Oscar, because we recently surveyed 200 institutional investors globally over the summer, and a whopping 56% of them indicated that they plan to allocate more to the low carbon transition over the next few years. Some are looking at it through a whole portfolio lens, they want to really think through how do they hit net zero targets if they've made them, others think about it from an asset class perspective, so where can they generate the highest and best, investment return in their portfolio and or manage the risk that it generates.

Oscar Pulido: So 56%, that's a significant portion of the investors you surveyed, and I'm curious, as this is a relatively new space, how has that number changed in recent years? Is that a big shift in investor preferences into investing in the low carbon transition?

Helen Lees-Jones: We have seen a change in investor preferences particularly since three years ago. We've seen the world change around us, we've seen a shift in the geopolitical context, we've seen, unfortunate crises with energy supply, with geopolitics. That has changed to some extent the way investors think about their objectives as fiduciaries to their assets. thinking out over both a, 1, 3, 5, 10, 30-year horizon, you've got to adjust to, what's going on around you. And of course, the transition. Isn't necessarily linear. So perhaps three years ago, investors who were interested in the space would've been very much focused on things that you'd perceive to be green today.

They'd be very invested in your renewable energy sources like solar and wind, and having quite restrictive exclusions in their portfolios, they might have chosen particular sectors that they felt were not aligned to sustainable investing and excluded them from the portfolio. And as I said, today, we've seen the conversation shift quite considerably, and investors are much more interested in assets that are greening, so they're transitioning, and hence why we're so focused on the transition in all its frames.

Because when you think about what this means in a portfolio, an exclusionary approach doesn't get you to where you want to be necessarily. You understand that the biggest drivers of this transition are also perhaps the industries, sectors, companies who aren't necessarily the greenest today, they've got big plans to transition and they're putting a significant amount of time, energy, and resources into thinking through how do they get to where they'd like to be over a long horizon.

But those things can't be done overnight, and we're seeing a much bigger preference towards transition assets. And I think importantly, the dialogue is really shifting as well between investors and corporates, and we're seeing much more of a partnership approach between incumbents and disruptors.

Rather than just seeing the new technologies recast the playing field, we're seeing much more interaction between traditional sectors today in traditional companies within those sectors, partnering with the challenger technology providers, challenger companies in the same sector. And we see that coming to life in investors’ portfolios. So, whilst they'll invest in perhaps the traditional sectors today, they'll also be investing in newer technologies through their private markets allocations to almost go alongside what they have in their public markets portfolios. This is something that we see as an important part of the transition investing opportunity set that it really is a whole ecosystem opportunity and that, investing across a wide range of assets, sectors, capabilities is just a great opportunity for investors.

Oscar Pulido: So basically what you're saying is that the good news for investors is that there are a whole multitude of ways to think about investing in this transition to a low carbon economy. Helen, thank you so much for this 101 on transition investing. It really does sound like there are a lot of exciting opportunities in the space right now. And thank you so much for joining us on The Bid.

Helen Lees-Jones: Thanks so much for having me.

Oscar Pulido: Thanks for listening to this episode of The Bid. If you enjoyed this episode, check out our recent episode “The Race is On For EVs” where portfolio manager, Charlie Lilford, unpacks the contribution of transport and electric vehicles in the transition to a low carbon economy.

Subscribe to The Bid wherever you get your podcasts.

<<THEME MUSIC>>

<<SPOKEN DISCLOSURES>>

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

MKTGH1223U/M-3276293

The transition to a low-carbon economy has emerged as a key player in the five mega forces that the BlackRock Investment Institute has outlined in recent episodes. But what exactly does it mean to "invest in the transition to a low-carbon economy"?

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

The Bid - The Race Is On For EVs

Episode Description:

Electric vehicles, or EVs, have been hailed as the future of transportation. They promise cleaner air, reduced dependence on fossil fuels, and a seismic shift in how we commute. But as we navigate this high-speed journey towards an electric future, there are certainly some speed bumps ahead, whether it's concerns about range anxiety, the availability of charging infrastructure, or simply the price tag of EVs.

Charlie Lilford, Portfolio Manager for BlackRock's Fundamental Equities business, joins host Oscar Pulido to talk about the rate of adoption of electric vehicles across the world. and where he sees the most exciting investment opportunities.

Sources: IEA, July 2023; S&P Global Mobility, May 2023; US Department of Transportation, data for 2022; BlackRock Fundamental Equity analysis, with data from China Passengar Car Association, Oct. 2022; BlackRock Fundamental Equity analysis, with data from IEA, April 2023

Written Disclosures in Episode Description:

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

TRANSCRIPT:

<<THEME MUSIC>>

Oscar Pulido: Welcome to The Bid, where we break down what's happening in the markets and explore the forces changing the economy and finance. I'm your host, Oscar Pulido.

Electric vehicles, or EVs, have been hailed as the future of transportation. They promise cleaner air, reduced dependence on fossil fuels, and a seismic shift in how we commute.

Charlie Lilford: When I work in the office, I take my bicycle which is obviously lowering my carbon footprint significantly when I travel.Yes, we can buy electric cars and we can utilize that in an EV, but when we think about our mobility and our transportation around our daily lives, it becomes much more significant.

Oscar Pulido: But as we navigate this high-speed journey towards an electric future, there are certainly some speed bumps ahead, whether it's concerns about range anxiety, the availability of charging infrastructure, or simply the price tag of EVs.

Charlie Lilford:These cars are much cheaper, in some cases even cheaper than a lot of combustion vehicle cars today. And so the next question is then, what is the challenge today?

Oscar Pulido: Here to dive into the fast lane of EVs is Charlie Lilford, Portfolio Manager for BlackRock's Fundamental Equities business. Charlie talks with hundreds of companies across the electric vehicle and renewable energy supply chains every year. Today, he joins us to talk about the rate of adoption of electric vehicles across the world. and where he sees the most exciting investment opportunities.

<<THEME MUSIC>>

Oscar Pulido: Charlie, welcome to The Bid.

Charlie Lilford: Thanks, Oscar. It's a real pleasure to be here today.

Oscar Pulido: Maybe we can start by talking about what is driving this shift towards electric vehicles? We hear a lot about the transition to a low carbon economy, so I think these two things are related.

Charlie Lilford: Yeah, they definitely are related. I think what's really exciting right now is the fact that electric vehicles are truly accelerating. This is becoming a mass market opportunity, we're seeing more and more of these EVs proliferating in our cities, in our economies, and we've really taken a totally new step change in terms of the future of electrification and electric vehicles.

As these cars become much cheaper, much more affordable to the consumer, we will see more and more of these cars being owned and purchased in all segments of the population. Historically, people thought of electric vehicles as something that's quite exclusive, whereas now it's really democratized.

We often see Government regulations and subsidies has having been very supportive to get that initial take up of electric vehicles and that's certainly been the case in a number of markets such as in Europe and China for instance where EV penetration rates are now in excess of 20 percent in new car sales.

But that was really just the first step and now what we're seeing is this more broad and holistic adoption of EVs which I think is very exciting for the net zero transition and what it means for just our ability to reduce our impact on emissions in our cities. But also, this advancement in technology and mass market opportunity for electric vehicles

Oscar Pulido: And you talk about the net zero transition and the reduction of, carbon output, the lower reliance on fossil fuels, this is something we hear a lot about. What is the contribution that this transition to EVs is making to that transition? Because certainly there's a lot of other things that are contributing to that transition, but what's the EV contribution to that?

Charlie Lilford: There's certainly a lot of other things that contribute to this and that there has also been an evolution what it means to be able to emissions more generally. And so, it is clear that this is something which is holistic and will need to be done in variety of industries and sectors.

But transportation accounts for approximately 25 percent of global CO2 emissions today. And then road transportation, passenger vehicles and freight, that's about two thirds of that amount. It's a huge component of emissions, and yet it's hugely addressable in the sense that we can actually create change over the coming decades very effectively just from moving from mechanical to electrical transportation.

Passenger vehicles typically see that car owners own their cars for 12 years or in some cases more than that that's clearly an area where we will see electrification expanding and evolving and increasing penetration rates of electric vehicles over time.

But commercial vehicles are typically used for six to eight years on average the turnover rate of those vehicles is much higher compound that with the fact that many of these companies have net zero targets. They're trying to also reduce their costs and clearly electric vehicles do reduce your operating costs. It suggests that we will potentially see much higher acceleration and adoption of electrified vehicles in these segments than what we've seen to date. And that all comes down to the fact that it's becoming much more affordable, it's being driven by cost incentives and operating costs, and these adoption rates could accelerate.

Oscar Pulido: So, it's not the only way in which the world can transition to lower carbon, but it is a major contributor is what you're saying.

Charlie Lilford: Exactly, Oscar. But as I said before, the fact that we are seeing these vehicles becoming cheaper every year, they're democratizing into our economy so that opportunity is no longer something that we are forced to do. It's something that we will naturally choose, it's cheaper for us, it's a better solution and actually it has a much, more sustainable outcome.

Oscar Pulido: So, let's talk about the consumer, and I have to admit I'm actually one of those consumers in recent years of having purchased an electric vehicle, but what are the barriers to more mainstream adoption of electric vehicles? is it still price? You mentioned government subsidies before played a role early on, but is price the biggest barrier or are there other factors at play? Are people concerned about the range of the vehicle, maybe you can talk a little bit more about that.

Charlie Lilford: Historically it had been about price, this is changing, and this is actually changing very quickly. Now that we're seeing Not just one or two car manufacturers in the world producing electric vehicles, we're seeing many more. For instance, this year alone, there are over a hundred new designs that are being launched in Europe, close to 50 in the United States, China is even more, about 150 new designs.

So, the opportunity for us as consumers to purchase electric vehicles is expanding. And so, we are spoilt with choice, and we will be even more spoilt with choice in three, five, 10 years’ time, because these manufacturers are producing electric vehicles at scale at affordable prices. That affordability question and the price point is becoming relatively mute in the future. These cars are much cheaper in some cases even cheaper than a lot of combustion vehicle cars today. And so, the next question is, then, what is the challenge today?

There's still challenge around charging, and I think people's anxiety around range. Can I get to my destination without having to stop and charge? To some degree that's people getting used to using electric cars and being familiar with how they would utilize them day to day.

It's clearly also a factor of building more charging infrastructure. And we're seeing a lot of that being built out. So longer distance charging. A lot of work being done with automotive manufacturers to work together to find solutions so that they solve the problem for the consumer.

And then also the fact that ironically, we've over built the batteries in the cars. The average US driver drives 40 miles in a given day. And if you think about the efficiency of battery in a pack, we are effectively looking at a car that is overbuilt by a factor of four or five times in terms of battery capacity. So, there are ways that we can evolve the cars to be best suited to the use cases of the end consumer.

Oscar Pulido: And it's interesting you mentioned all the new models, new companies coming out with electric vehicles, and I've had this experience of walking on the street and seeing a car and not recognizing the manufacturer of the model and more often than not, it does appear to be an electric vehicle. So that resonated with me as you said that.

Before there were electric vehicles, we had something called hybrid vehicles, and they still exist, but there was this sort of steppingstone where people used hybrid cars before they went fully electric, and now people making that jump to just go more fully electric. So, what is that role of the hybrid vehicle these days then?

Charlie Lilford: Well, I think the hybrid still has a place. Particularly for those making that are using the car more frequently, want to have the opportunity to use electric, but also that range anxiety means that they want to fill their car with gas when they need it.

That being said, the progress and the advancements that are being made in EVs, pure EVs, battery electric EVs, is so significant. Really the core of the matter is hybrid is just a transition story as we move to a full electric marketplace. With the advancements in technology around electric vehicles there is the opportunity to see more and more of these EVs coming to the market. If you think about some of those step changes in technologies, the chance to have higher voltage electric batteries being able to charge faster. I mean, that’s the key right? As a consumer, you don't want to waste too much time charging your car If you're out and about you want to be able to charge it quickly.

That's one of the key changes that we see underway, and a lot of these car companies and a lot of the manufacturers are focusing on that. How do they produce batteries that have much higher energy density that can enable us to charge our cars faster?

Then car manufacturers asking the next question, where do we find greater efficiency? Where do we improve the technology? And then it comes down to the aerodynamics. It comes down to the rolling resistance. So how much resistance is applied from using your tires or the inertia? All of these incremental improvements mean that we can find ways to be far more efficient with the electricity that we're using in our cars and enable further adoption of electric vehicles.

Oscar Pulido: Everything you've mentioned certainly highlights that there's progress for the consumer, there's more choice, and there's progress being made in terms of transitioning to lower carbon emission. For you, as somebody who comes to work and is investing in stocks and companies, it sounds like the automobile ecosystem has changed dramatically over the last couple of years. So, what does that mean in terms of investment opportunities?

Charlie Lilford: This is such a great question, Oscar, because You're getting a collision of effectively the legacy environment with this new onset of what it means to be in an environment with electrification and electric vehicles.

And so, when you take a step back and you think about the automotive sector or the transportation sector, we've seen these companies historically engineering change. The fact is that this is the first time in over a hundred years that we've actually seen a totally new power train technology. We're moving from a mechanical to an electrical world. And what that means for me and our team as investors is that you see new companies coming into the space, new technologies emerging. There's a lot of change and that as an active stock picker really represents a huge opportunity for us.

We see companies that are legacy, or companies that are incumbent, that are able to change, that will evolve, that will survive, that will succeed. That being said, some other companies that are legacies will not be able to do that. And I think that's where it gets truly exciting, this change that's underway, the emergence of new players, the emergence of new technologies, creates true opportunities for us at BlackRock as active stock pickers.

Oscar Pulido: And so, what's that one innovation that you see coming to electric vehicles that could, be a game changer in terms of performance and price and how far away is that innovation from being in mass production?

Charlie Lilford: We get this question quite often. We’re certainly looking for these game changing technologies. So, if it's advancements in battery technology, to get very technical, some of the anode technologies that we're seeing, where these companies are progressing on that front. Even just the advancements in the chemistries for the batteries, and furthermore, when you think about longer term, a lot of people talk about, solid state batteries. There is evidence that this could be very exciting and a game changer in its own right.

When I say solid state battery, what that means is there is a different technology that we can see being able to be used in cars, which is, much safer, but also has much greater performance. if we were to get into this achieving solid state status, it does unlock a lot of the issues around charging times.

But I often reflect on what is the key game changer. And the key game changer for me here is efficiency. The ability for the manufacturers, for the supply chain, for the providers of technology to find much, much more efficient solutions to the problem.

When you think about it, how does a car company scale? How does a car company manufacture millions of vehicles very cost effectively so that it is cheaper for you and I, when we want to buy our next car. How do manufacturers of batteries, get into a position where they can produce batteries at an affordable level so that those batteries are much cheaper when going into the electric vehicles?

And so, there are a lot of really interesting game changing technologies out there, but it comes down to efficiency and the entire ecosystem to become more and more efficient, to improve day in, day out, year on year, to bring a product, which is going to be far more cost effective, far more affordable for everybody, not just a premium product.

Oscar Pulido: That's interesting because we live in a world where we want something, and we want it right away. We expect it on our doorstep. And what you're saying is there's great technology already in these vehicles. So certainly, there could be improvements. There always is, but it's just these companies getting to a point where if a lot of people actually want these vehicles right away that they can do it in an efficient and scalable manner.

Charlie Lilford: Yeah, exactly. Like you said, it's really about providing something to the consumer they want, that solves some of their problems. People want to have a car that's easy to use, cheap to run, comfortable, safe, reliable. All of these factors come into play in this sector, and I think electric vehicles do solve a lot of those issues.

Oscar Pulido: You mentioned before that one of the anxieties that potential buyers have is the range of the vehicle and where am I going to charge it? Is that the biggest obstacle right now for electric vehicles or is there something else that is precluding this industry from growing faster?

Charlie Lilford: That is the case. We've seen that costs are coming down. In fact, costs will come down even more dramatically when we think about buying our next car. Really the key factor right now is, can I charge my vehicle? And I think this is, also very interesting when you think about it, and I often use this quite flippantly, but it’s incredibly true. Electrification is all around us. If you think about electrification and the access to electricity, in many cases it's more accessible to us as urban dwellers than combustion engine or combustion fuels are.

So, if you think about where do we source our electricity to charge our cars, it's in our apartment buildings, our homes, in our offices, on our streets, and so the fact that electrification is permeating all around us is one of the key constraints which we believe is there but in fact isn't, and so it's really about changing some of the behaviors.

And very similarly to when you think about when you go home and charge your mobile phone, you charge it overnight. And then I wake up in the morning and I go to work with my phone fully charged.

When you think about electric vehicles, The best solution is to charge it slowly overnight, take eight hours, let your car charge. it's a behavioral factor that will evolve and emerge over time as people become more accustomed to using these new technologies and become accustomed to how they can optimize those technologies.

Oscar Pulido: So, imagine you wake up 10 years from now and it's the year 2033 is the adoption of electric vehicles now mainstream? Have we gotten to that point where that's what you own?

Charlie Lilford: So, ask this another way, in 2033 when you're looking for your next car to buy will you be buying an internal combustion car? That's the key here. There are obviously some very optimistic scenarios around this many people think that internal combustion cars will disappear overnight. The reality is they won't. internal combustion cars will be with us for many years to come. And that's a factor of, we as drivers of these cars own these cars typically for 12 years. So that turnover rate is relatively slow, but nonetheless, what we're seeing is a dramatic increase in escalation in EV adoption.

And you just have to look at what's happened over the last few years. this year we should have EV penetration rates close to 20%, on a global basis, forget about certain markets where we see dramatic penetration rates, but if you reflect on that a few years prior, this was barely at 3 or 4%.

So, we've seen a 5X development in this just over the last four or five years. And when you think out to 2030, given the costs that we're seeing coming down, and given the nature of the design releases that we're seeing coming out of the manufacturers, there's nothing to suggest that we will not see significantly higher penetration rates in electric vehicles by 2030.

Oscar Pulido: So, Charlie, I have to ask, I mentioned at the beginning that, I became an electric vehicle driver myself in the last couple of years, but do you practice what you preach? Do you drive an electric vehicle?

Charlie Lilford: I do, but I think it's even broader than just that. what's really interesting is that it's becoming a question of electrification in our lives. Yes, we can buy electric cars and we can utilize that in an EV, but when we think about our mobility and our transportation around our daily lives, it becomes much more significant.

When I go to London to work in the office, I take my bicycle. I use mass transportation, which is obviously lowering my carbon footprint significantly when I travel. So, it becomes far more holistic, EVs are just one piece of that puzzle in terms of, how we can address our own impact and what it means in terms of our own impact on net zero, but also how we travel more efficiently in cities. And so how can we be much more sustainable in our daily lives?

Oscar Pulido: So, I feel really charged after this discussion. I was trying to think of a witty pun to match, many of the ones that you had as you were describing this space. But, Charlie, thanks for your insights on electric vehicles and what's to come ahead. And thank you for joining us on The Bid.

Charlie Lilford: Thanks, Oscar. we will see more and more electric vehicles in the future, and it's just going to be such an exciting next couple of years.

Oscar Pulido: Thank you for listening to this episode of The Bid. If you enjoyed this episode, check out our conversation with Cristiano Amon, CEO and President of Qualcomm, where we discuss the digital transformation and how that's already affecting the electric vehicle market. Subscribe to The Bid wherever you get your podcasts.

<<THEME MUSIC>>

<<SPOKEN DISCLOSURES>>

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

MKTGH1223U/M-3276293

Charlie Lilford, portfolio manager from BlackRock’s Fundamental Equities business joins host Oscar Pulido to talk about the rate of adoption of electric vehicles across the world and where he sees the most exciting investment opportunities.

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

Mark Wiedman: Welcome to The Bid, where we break down what's happening in the markets and explore the forces changing the economy and finance. I'm your host, Mark Wiedman. Today we're talking about food: from the farm to your fork, to your recycling or compost bin. I'm pleased to welcome Mark Schneider, the CEO of Nestle. Nestle is the world's largest food and beverage company1 with more than 2000 brands and products in 188 countries. What does Nestle have to do with the transition? Well, the processing, the packaging, the distribution and the consumption of food actually produces about a third of human greenhouse gas emissions2. In this episode, we're going to talk about why and how Nestle is transforming their value chain in the transition to a low carbon economy. Mark, welcome to The Bid.

Mark Schneider: Thanks for having me.

Mark Wiedman: Why don't we start by talking about Nestle and your business?

Mark Schneider: To a US audience, Nestle is mainly known as a chocolate maker, but of course we do cover wide range of food and beverage products. In fact, we're the world's largest food and beverage company with about 94 billion Swiss francs of revenue in 2022. And we cover all the main categories in food and beverage from coffee to pet care, to medical nutrition, infant nutrition, and of course, the chocolate that we're so well known for. And, that also means, we are exposed to a wide number of agricultural commodities that are needed to make these products.

Mark Wiedman: Let's talk about Nestle and carbon emissions and start by why does it matter to Nestle what your carbon emissions are?

Mark Schneider: It matters to Nestle because when people think about greenhouse gas emissions, what comes to mind first is: air travel, automotive, energy generation, a heavy industry. But in fact, food production around the world is very much linked to greenhouse gas emissions. So depending on what study you look at, between a quarter and a third of the world's greenhouse gas emissions are caused by agriculture, so food and beverage production, and unlike many other activities, eating and drinking is not something that we can go without. As the leading company in this space, we feel an obligation to do something, and I believe this is part of future proofing the business. Just like you futureproof the business through convincing research and development and new products. So one additional feature that you want to work for is a better greenhouse gas footprint.

Mark Wiedman: What is your roadmap layout in a few simple bullets, and how are you tracking?

Mark Schneider: So minus 20% by 2025. This is judging from 2018 levels and it's regardless of the growth we achieve in between and it's the totality of all greenhouse gases, so not just co2. So that means we also need to tackle methane, which in some cases is trickier than co2. It's minus 50% by 2030. then it's that famous net zero by 2050.

Mark Wiedman: What are you most concerned about in terms of achieving your 2030 objective? What's the biggest obstacle?

Mark Schneider: There's a set of pretty steep mountains to climb. There's not just one individual obstacle here, but, clearly, we all had to run these projects. Some of them have tremendous lead time, so something you're doing now may give your results two or three years down the road only. And so learning how to try that to be sure that there is consistent improvement over time. I think that's also something that we had to train the organization on because, we had not done it before.

Mark Wiedman: Could you explain how food and the production of food and its disposal emits carbon? How does that work?

Mark Schneider: There's of course the carbon footprint of our operations. Some of the operations in our factories, the logistics both inbound in factories and outbound. All the things you would associate with the company's operations, including travel. That is the easiest part. And that's the part where we are already picking a lot of low-hanging fruit. And then there is about more than two-thirds that really sit in our agricultural supply chain. So this is the greenhouse gas emissions that come about as the key commodity ingredients that we use for our products are produced. And that's the hardest part, and that's the steepest hill to climb.

Mark Wiedman: So what produces those carbon emissions in the chain from planting food to getting it into your factories?

Mark Schneider: Well, It depends on the ingredient. But the key greenhouse gas emissions are related to everything associated with livestock. Think about dairy production. Think about meat. So there you have to first of all generate the food. And then, cattle in particular, you have methane emissions that come from the digestion and so it all adds up to a very powerful mix of CO2 emissions, methane emissions, that are very significant and a lot higher than with plant-based products.

Mark Wiedman: So animals, especially cows, lead to lots of carbon emissions, but there's also carbon emissions even with producing plants and vegetables, and other ingredients that feed into your food. Where does that carbon get emitted?

Mark Schneider: So a lot there has to do with the way we do our farming. In some cases, unfortunately there's deforestation to begin with, to create farmable land. Then the way we look after our soil, we tend to deplete the soil and that of course leads to a lot of, CO2 release from that soil into the atmosphere. It also leads to degradation of the quality of soil over time. So clearly changing our methods of farming and switching to either conservation agriculture or regenerative agriculture is a key unlock when it comes to improving the greenhouse gas footprint.

Mark Wiedman: What is regenerative agriculture?

Mark Schneider: Some of the common themes as part of regenerative agriculture are taking good care of the soil, keeping it covered at all times, having cover crops, having intermittent cropping minimum or low tillage. And just trying to keep the water management of the soil at its optimum. This way over time, not only do you avoid the depletion of the soil, but you can also in fact add to it and capture some additional carbon. There's also conservation agriculture. All of them are a material improvement over some of the traditional agricultural methods that are being used widespread today.

Mark Wiedman: So how are you working with your supply chain? How do you work with farmers?