Over the past three decades, the ETP market in Australia has swelled to almost $170 billion in assets under management and more than 360 products1. With such a huge range of choice available for investors, it’s important to do your due diligence and understand exactly what you’re getting with any ETP you decide to invest in.

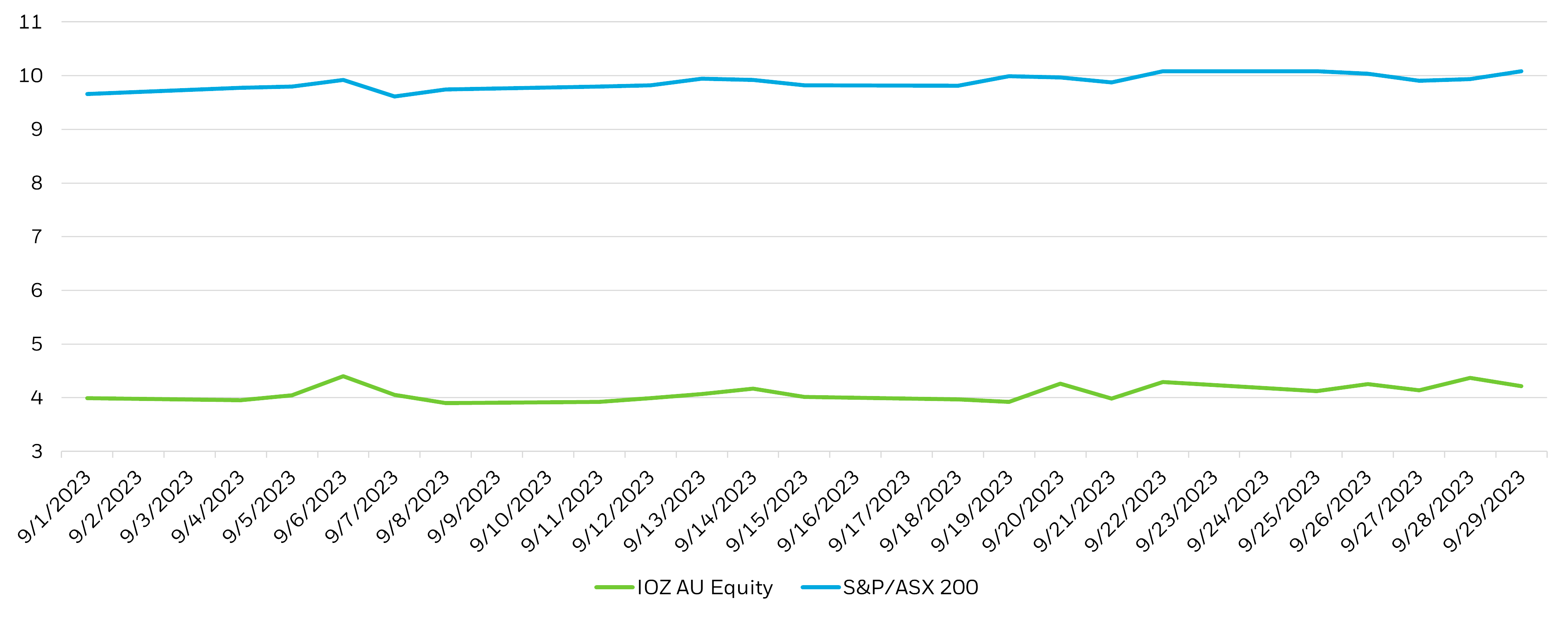

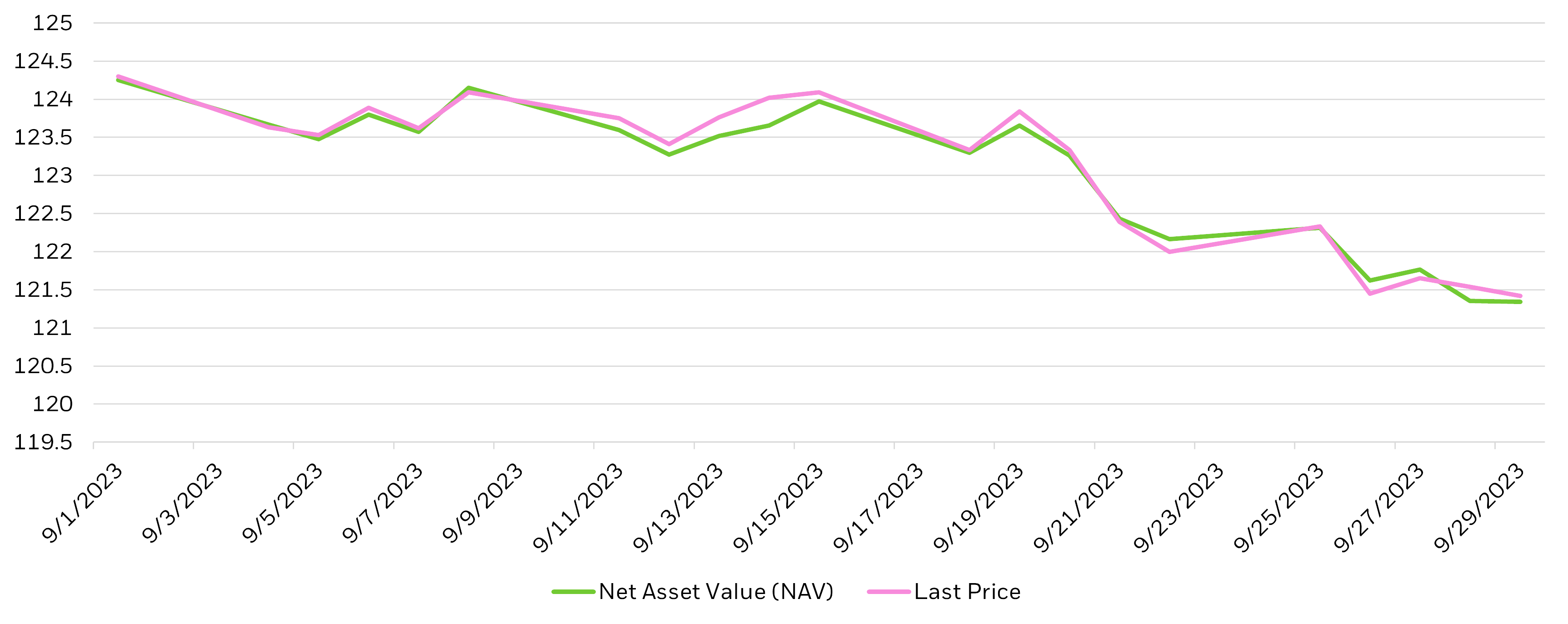

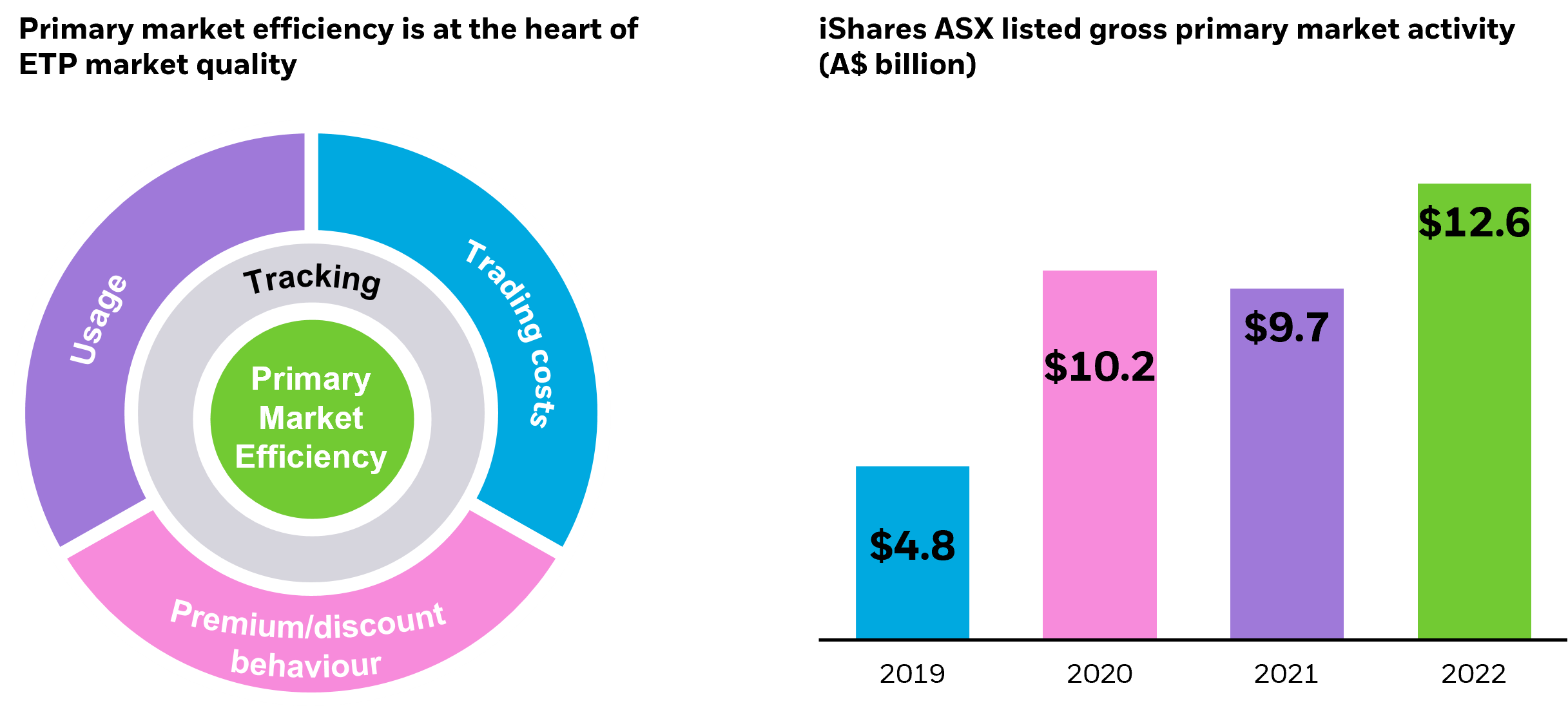

A key aspect of this is how efficiently your ETP will function. There are many moving parts which influence this, from how often the ETP trades on exchange, to the costs involved in trading, how closely it tracks the relevant index, and whether its price accurately reflects the value of the underlying securities. Taken together, factors like these will help you assess what we call the market quality of the ETP.

While there are many ways to evaluate ETP performance, this page explores five key metrics—usage, trading costs, premium/discount behaviour, tracking and primary market efficiency—that can help investors assess the market quality of an ETP. Together, these metrics can reveal an ETP’s ability to offer liquidity, price discovery and efficient access to markets in all market conditions.

For further information on terms that may help you to understand how an ETP functions, see our glossary at the bottom of this page.