APPROACH FIXED INCOME DIFFERENTLY

INTRODUCING THE BLACKROCK BOND PYRAMID

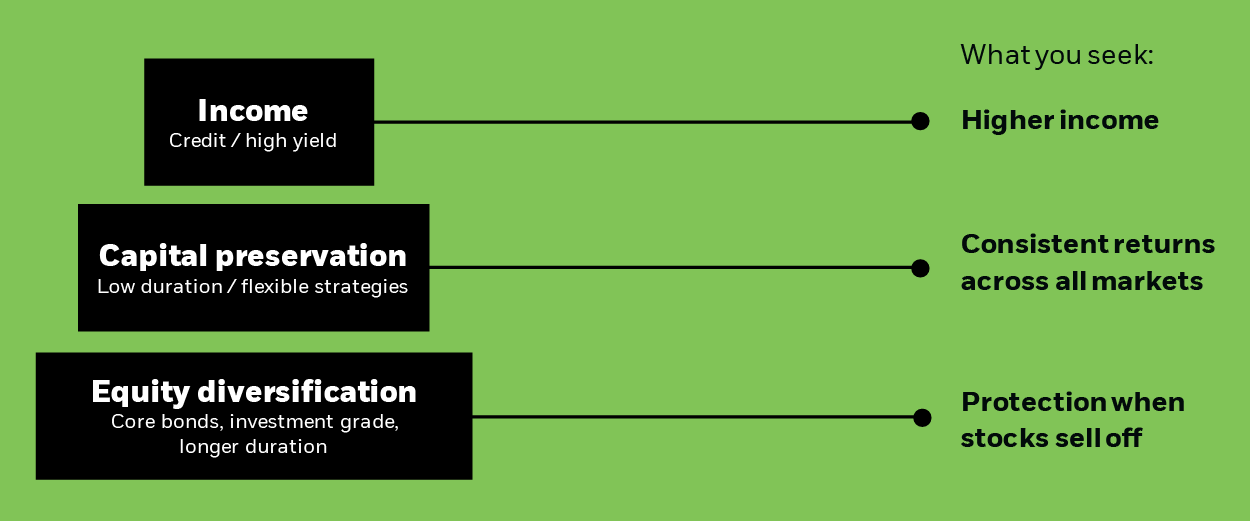

Fixed income plays an important part in all portfolios, but its role changes depending on the investor’s objective. Importantly no one bond fund can do it all. Consider first what role each fund plays, and then optimise your bond mix based on your larger asset allocation.

Your overall asset allocation determines the mix of funds you should hold in your bond pyramid. The more aggressive the overall portfolio gets, the more conservative the bonds may need to be.