Listen to The Bid – BlackRock’s investment podcast

Subscribe to The Bid wherever you get your podcasts and never miss a single episode

214. The Rise of Growth and Venture Debt

Episode Description:

When people think of how early-stage companies finance their initial growth, venture capital and private equity are often the first things that come to mind, but growth and venture debt have become increasingly prominent in the financial landscape, especially in the wake of the collapse of Silicon Valley Bank. Ross Ahlgren, a portfolio manager in the growth debt team at BlackRock, joins Oscar to help us understand the current themes driving growth and venture debt opportunities, how his team identifies and evaluates emerging trends, and the role of relationships and local presence shaping the future of this market.

Written disclosures in each podcast platform and each episode description:

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

<<THEME MUSIC>>

<<TRANSCRIPT>>

Oscar Pulido: When people think of how early-stage companies finance their initial growth. Venture capital and private equity are often the first things that come to mind, but growth and venture debt have become increasingly prominent in the financial landscape, especially in the wake of the collapse of Silicon Valley Bank.

These forms of debt are now seen as vital compliments to equity raises, offering unique advantages in loan structuring and security. So, what's driving this shift towards debt financing and how are these trends reshaping the way companies finance themselves? As compared to previous cycles,

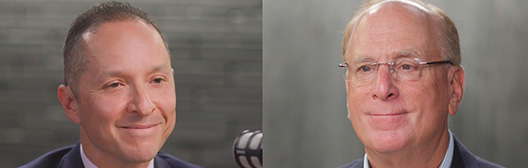

Welcome to the bid where we break down what's happening in the markets and explore the forces changing the economy and finance. I'm Oscar Pulido.

Here to help me understand this investing trend is Ross Ren a portfolio manager in the growth debt team at BlackRock. He'll help us understand the current themes, driving growth and venture debt opportunities, how his team identifies and evaluates emerging trends, and the role of relationships and local presence shaping the future of this market

Ross, thank you so much for joining us on the bid.

Ross Ahlgren: Thank you, Oscar, for having me. It's a privilege.

Oscar Pulido: So Ross, we're here to talk about venture and growth debt, which is perhaps a term or terms that people are not familiar with and maybe taking a step back. When I think about an entrepreneur or somebody starting a new company, I know that they need capital, they need money to help fund their growth. And I think we usually hear the terms venture capital and private equity, that this is the way that entrepreneur usually gets some of their financing. These investors take an ownership stake in the entrepreneur's company and one day hopefully the entrepreneur has a successful venture, and investors make money from that early investment.

So, venture and growth debt, I think is the other side of that equation where similarly, they're helping fund early-stage ideas, presumably from lending money, earning some sort of interest rate. But maybe you can help elaborate a bit more on this space, I think I'm down the right track, but you're the expert.

Ross Ahlgren: Well, you're definitely down the right track. If you break it down, there's an invisible ozone layer of profitability. So, companies that have traded profit for growth are normally on the venture capital side where companies that are profitable are normally on the private equity and, other lender side.

So we're talking about that collective of companies that have traded profit for growth, some of them become profitable and move on, but as you said, the equity providers are the ones that fund the business plan of a company. So, they usually fund a company depending on type of company it is, whether it's a healthcare or technology company. They will fund the business plan for the next 12 to 24 months. That is to say that they organize hiring and firing and the growth of the company. But if something comes along, for example, a company is rolling out across Europe or they're rolling out across America and a state is going better than expected, or a country initiative is doing better than expected, that's where they would like to put more capital to work.

And what they up doing is using venture debt for that expansion use case. So it can be a geographic location, it can be a new product, it can actually be inorganic growth through acquisitions. So it's something that is an expansion use case, and we provide a non-dilutive, or at least a less dilutive option, than equity through debt.

Oscar Pulido: It sounds like an opportunistic infusion of capital is what you described that, hopefully is expected, but sometimes unexpected, and a company needs additional capital to help continue their growth profile.

Ross Ahlgren: It's a symbiotic relationship between the venture capitalists that are providing the equity and the venture debt providers that are providing debt. So, they tend to work together. Their jobs are slightly different and as I said, it's more of an expansion use case for the debt on that side. But in the grand scheme of things, there's normally when you do a venture debt or a growth debt facility, it's usually single digits or 10, 11% of the value of the company. So unlike equity, which you mentioned earlier, which is the leveraging of a balance sheet, maybe 60 or 70% of the funding of the company comes from debt. This is very small this is maybe 10% of the funding for the company.

Oscar Pulido: Ross, as you're educating us a little bit about growth in venture debt and, the differences with venture capital and private equity, are there any misconceptions about, this space that you work in?

Ross Ahlgren: Probably the biggest misconception is that we are providing debt facilities with venture capital risk. So, we are getting paid debt prices for taking venture capital risk, that is the biggest misconception that initial investors have and other people on the outside of the business have. But that is actually not the case. What we're providing is a different risk reward than the equity. So, the equity goes into a company, and it could be a two year journey or it could be a 15 year journey before they ever get their money out through an exit.

The venture debt provider comes in and they provide short term, usually three to year facilities of debt to provide a more, non-dilutive, funding option for the company, but they get paid back on a monthly basis.

So, from an investor's point of view, they're getting a risk-reward that's very different than the equity. So, it may not have the upside, it definitely has more of downside protection because it's senior secured and it's paying back monthly

Oscar Pulido: Right, when you said venture capital risk, and that being one of the misconceptions that investors might have, I think you mentioned one of these things which is venture capital risk means you might have to have a very long-term time horizon in terms of exiting the investment, but also that the potential reward and the potential loss, there's greater variation about what those could look like.

Ross Ahlgren: People used to say, when I started way back when, that in venture capital, a third of their companies go under a third go sideways and a third go up, and they often make their fund on one, two, or three investments out of a dozen.

In venture debt, what you try to do is, you never want to be in the losers and you never necessarily want to be in the top binary companies that are either going to make it big or fail, you want to be somewhere in the middle. And if you have a three year or a four-year debt facility, you would hope that that company on their growth trajectory, that they naturally grow into the facility and they pay it off as go along.

So the business model of running a fund like this is that the facilities themselves are self-liquidating. So as a company takes a debt facility, it might take on, when it's early, it might be 3 to 5 million, but they pay that off over a two, three-year period. As they do that, they may have a new use case that comes along where we can- if the company is doing extremely well- we can re-up with that company and do another debt facility and continue to grow. Those that don't do well, they pay it off, self-liquidating and we get off that company and we move we move on to something else.

Oscar Pulido: It is clear there are different, like you said, risk-reward, trade-offs between being a venture capital or private equity investor and a venture debt investor. Ross, if I could take a step back and just provide a little bit of market context. Two years ago, we were talking about the failure of Silicon Valley Bank.

Here’s a quick reminder of the events that led to Silicon Valley Bank’s collapse from our episode with Alex Brazier in March 2023, then deputy head of the BlackRock Investment Institute…

Alex Brazier: The story goes back some way, but really what's happening here is that the fastest rate hiking cycle since the 1980s It was clear that was always going to cause some economic damage and expose some cracks in the financial system.

So that's really the scene setter, but then what actually happened with Silicon Valley Bank… well, it was a bit of an outlier in two important respects. The first is that it had a very large share of its deposits, greater than $250,000. So, they're uninsured deposits, and those are typically more flighty and more likely to, be withdrawn in stress than insured deposits. And the second thing it had in which it was an outlier, was that it had a very large book of US treasuries and mortgage-backed securities. And of course, as interest rates have gone up a lot the market value of those securities has fallen a lot.

Now, Silicon Valley Bank hoped that it wouldn't have to sell these securities. It hoped to just hold them until they matured. But to link these two outlying characteristics together, a lot of its depositors were spooked and asked to withdraw their money, and as a result, it was forced to sell some of these securities at today's market prices and realize some of the losses. That meant that more depositors withdrew their money as the bank realized some losses. and so, it entered this kind of spiral, downward and the authorities then stepped in to take control of what was at that stage, a failing bank.

So what did the authorities do when they stepped in? Well, they’ve seized control of these banks written down the equity, and they've protected the insured deposits as they normally would. But very importantly in these cases, they've also used what's called a systemic risk exemption, which allows them to protect the uninsured deposits as well.

So, these banks failed, over the weekend and on Monday morning, all the depositors. Whether their deposits were insured or previously uninsured had access to their money on Monday morning. So, the authorities have dealt with these banks not by giving a bailout to the shareholders. This isn't shareholder friendly, but by protecting, the depositors in those banks.

Oscar Pulido: Ross, talk to us about why that event is significant for this space of private lenders that, your team works in.

Ross Ahlgren: Well, you almost have to go back to the 1980s when the industry was created. Around that PC development, and they were building fabs and labs and, funding a lot of hardware. That's where debt was created. And at that time, through the eighties and nineties, as the market matured in the US, there were two big winners. One was a fund called ComDisco, one was Silicon Valley Bank. And throughout the period of the nineties and the growth almost to today, until two years ago, Silicon Valley Bank was the only bank that was consistently focused on this industry. They didn't come in and out of the market as other banks did.

They were the best bank at this. And they got so embedded in the US market that they funded some of the VC funds, they funded the VCs themselves for their houses, their mortgages, et cetera, but they were focused on this ecosystem. And when they failed, they had such an outsized market share that it was a very big shock to the market in the US and it's time to fill that void.

Now, several funds have filled that void. It wasn't naturally filled with other banks. When you look outside the US, Silicon Valley Bank was in Europe, maybe 10 years. So, the type of relationship they had with the market, the market share, how embedded they were, was much less. But you still saw how the industry was when you saw some of the governments stepping in to help HSBC over here, take them over and again in the US as well. So they became an important part of the innovation, economy. But I would like to just add one thing because I know them well and knew the people there. They did not fail because of the loans they were giving or the relationships they had with the ecosystem. They failed at the C-suite level with a balance sheet mismatched. But the underlying business they had was very strong.

Oscar Pulido: It's clear that they played a big role in the venture debt community, is your point and there's a gap there and it makes me think a little bit about one of the mega forces that we talk about, which is this future of finance. This changing, in the industry, from banks being a primary lender to the economy, and then other private market participants that are stepping in to help fund growth in companies in the economy. Perhaps you can, talk to us a little bit about that trend. Do you agree with that? And maybe what are some of the other big trends that you're observing in this space?

Ross Ahlgren: Totally agree. I think the funds have a consistent mandate to do just this. The banks and other players the market, depending on, in Europe anyway some of the smaller regional banks may have an influence or have, but they tend to do very small and they just naturally don't take risk. They use a specific credit scoring model and it takes a while develop somebody like Silicon Valley Bank.

I think the bigger mega forces are the funds that are coming into play, the bigger players coming into this market. But when you look at what we do and what we have been focused on, is innovation and growth within tech and healthcare, these are the mega trends of the digitization of industries or the use of technology in general.

We've been through eras of machine learning and, cloud computing, and now it's AI and there's quantum computing coming. All of these things are not necessarily businesses themselves, but cut across wide sectors. So there's a number of business use cases and so, the venture debt community has evolved very quickly, over the last, in Europe since ‘98 when we started, but in the US it's proven to be incredibly resilient to fill the void that was left by Silicon Valley Bank.

Oscar Pulido: Ross, you've alluded a little bit to some differences in the US versus Europe, you talked about differences in how banks might approach lending to some of these companies and their risk profile, but talk to us a little bit more about these regional differences that you might see and how does it affect the way you go about investing in this space?

Ross Ahlgren: First of all, the is obviously the biggest market, it's the most mature market, a single sort of common set of rules, bankruptcy procedures, language, everything. When you go across pond and you look at Europe, it's much more fragmented. There's many languages, regional differences, legal systems, bankruptcy systems, et cetera. And when you are a debt provider, a venture debt provider, you to be able to perfect security in each of the locations you are. So, most of the US players that come to Europe will come to Ireland or the UK, where there's obviously common language much common legal practices. The fragmentation in the rest of Europe is much more of a spaghetti mix of many different things.

But when you have a mantra like we do that says, we want to invest in the best companies with the best venture capital backers, no matter where they are. It means that you can cherry-pick around different regions that different expertise, whether it's Switzerland, which has healthcare, or Finland that has a lot of very tech stuff going on, Germany, et cetera. So there's a lot of different areas with different, expertise and for other players, it's difficult to break into those markets.

Oscar Pulido: Ross, you've mentioned healthcare and tech. These sound like two sectors that are maybe focal areas for entrepreneurial early stage growth. Maybe talk more about the investment opportunities that you see more broadly, does it extend beyond those two sectors? And also, what are some of the risks in this space that investors need to consider?

Ross Ahlgren: From an investor point of view, when you're at this market, many investors that want access to innovation and growth will think that your natural entry point is to think about this sector is venture capital. And if you want to access market, investing in a venture capitalist often means that the fund might have 15 or 20 investments a fund, and by nature they're very, very focused. Whether it's enterprise, SaaS, software, optical photonics, quantum, they can be, very, very focused. So it's hard for investors to know which one back because you're taking such a single point of failure or single risk.

With a venture debt fund one of the benefits is we are sector-agnostic. So when I say technology, that's such a wide area of focus. But we tend to work with each of those venture capitalists at different stages, different companies, so we try get a portfolio of 110, 120 companies. Spread across, all those sectors and stages.

So, I think, from an investment point of view, it's just hard to know how to the industry for most of the investors.

Oscar Pulido: And Ross, what about some of the risks? Is it, liquidity? is it, time horizon? Although you've mentioned that maybe the time horizon of exiting an investment is different than if you were a venture capital or private equity investor. But what are some of things that, that you think investors should be aware from the risks standpoint?

Ross Ahlgren: All these markets, there's different stages, sectors, all of those things, some people want access to different parts, may want the early stuff because that has a higher potential upside.

Some other ones just want the growth companies because they're not going to get as large a multiple, but there's less risk. So most of the risk of any fund you're to invest in is the scale of the team, the scale of their ability to go from 2 million to a hundred million.

So they can pick and choose what stage they want invest in, the access have, they're not just in English speaking side or a particular state or a particular region in the us but they're broader that. So the core risk of any investment is going to be the access the team has and the underwriting the team known for, and as long as those teams are well run they stick to that, that's probably a better indication of where the real risk lies.

Oscar Pulido: And if you're an investor, how, do you think about this as part of a portfolio? Where does it fit in the broader, allocation across public and private markets, when we think about stocks and bonds, how do you see that fitting in that pie?

Ross Ahlgren: Primarily when we fundraise, we're talking to investors that want an allocation in private credit, and that access to private credit can be the stuff that you sleep easy night which, is the corporate debt. It may only yield single digits, mid-single digits. Once have that core, they may want access, for example, to debt or growth debt. They may want that because it gives them higher returns, it gives them junior-like returns with a senior security down below it. So what we provide is that juice or that little bit of access to innovation. So once they've got core debt strategy and private credit portfolio taken, they often bolt on investments in venture debt or, growth debt to add a bit of upside to their portfolio.

Oscar Pulido: And I used the word opportunistic before, is, that a fair characterization of maybe these are areas of the market where you can be a little bit more opportunistic and look for some higher return potential.

Ross Ahlgren: I would guess so. When you've been doing this a long time, it's much more methodical than opportunistic, but at the same time, I think most investors that come to asset class come to it because they've heard about it from other people that have invested. And there's always that misperception, again, that we talked about earlier, the misperception of what we do and what risk is.

Oscar Pulido: Well, Ross, I have to say this is a new, topic even for me, something that you've helped educate me on. I appreciate you helping us venture into a new space, a new asset class that, can learn about, and thank you for, teaching us this on The Bid.

Ross Ahlgren: And thank you for having me, Oscar, it's a pleasure.

Oscar Pulido: Thanks for listening to this episode of the Bid. Next up on the bid, we revisit the topic of India and why Indian equities might warrant a larger role in long-term portfolios than traditional indices. Suggest. If you want to keep up with what's happening in the economy and the latest market trends, make sure to subscribe to the bid wherever you get your podcasts.

<<THEME MUSIC>>

Spoken disclosures at end of each episode:

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

MKTGSH0325U/M-4307446

The rise of growth and venture debt

Growth and venture debt have become increasingly prominent in the financial landscape, especially in the wake of the collapse of Silicon Valley Bank. So, what's driving this shift towards debt financing, and how are these trends reshaping the strategies of investors compared to previous cycles?