- Interest rates are likely to remain higher for longer on the heels of better-than-expected growth.

- Fixed income remains our highest-conviction trade, although we see select opportunities in high-quality equities such as energy and industrials.

- We see potential upside in countries like Japan, Mexico, and India, which benefit from structural global events like deglobalization and nearshoring.

iShares Fall 2023 Investment Directions

Sep 26, 2023

KEY TAKEAWAYS

Our Fall 2023 Investment Directions couples our macroeconomic views and market positioning to unpack key themes across U.S. equities, fixed income, and international exposures. As detailed in our full report, our view is to take advantage of opportunities in fixed income and position against volatility in equities, while remaining invested.

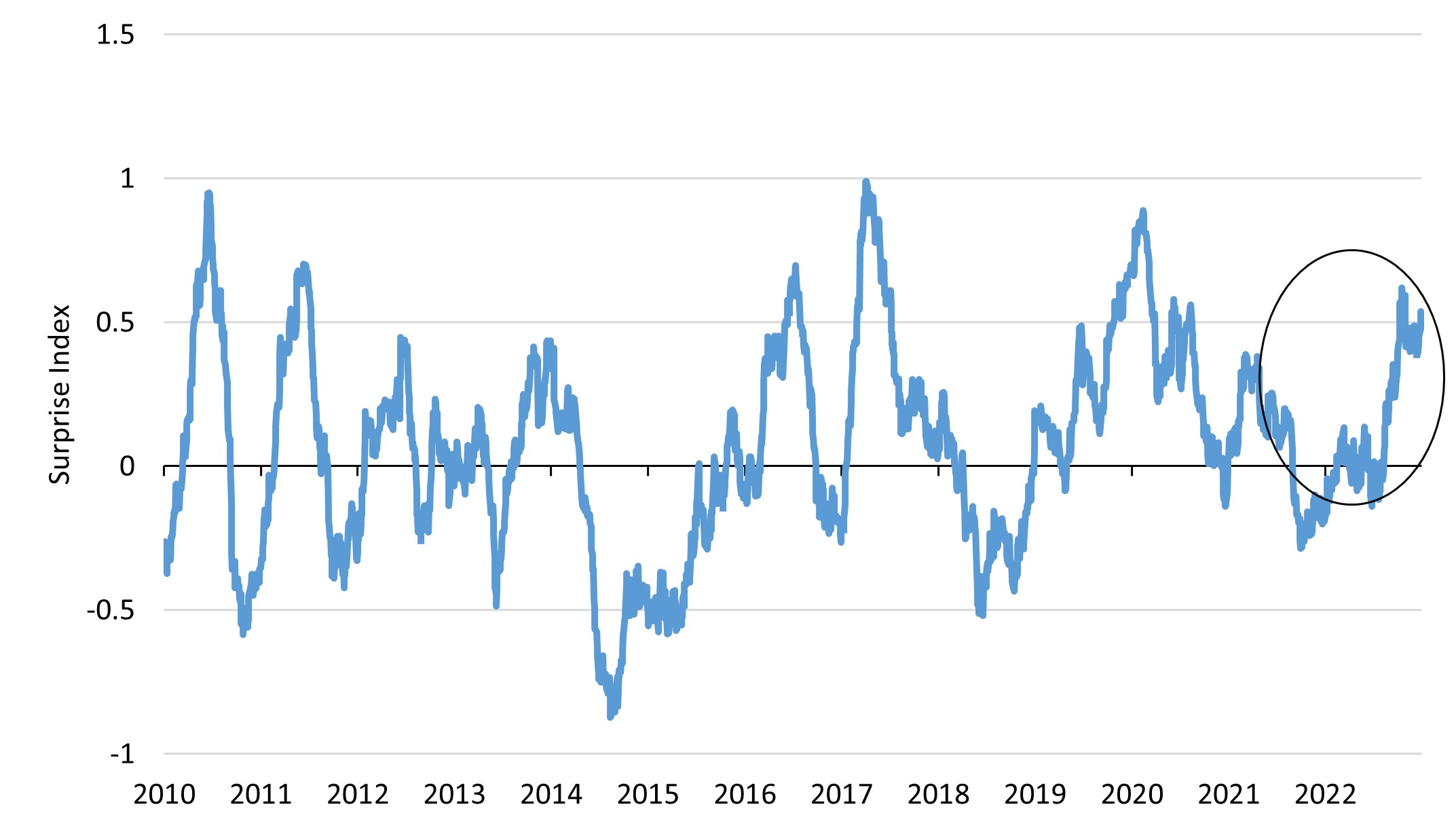

Figure 1: U.S. economic surprises trend up

Source: BlackRock, Bloomberg. Index as represented by Bloomberg ECO US Surprise Index. As of September 15, 2023. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Line chart showing the US Economic Surprise Index since 2010. The surprise element is calculated as the percentage difference between the actual economic data release and the median of analysts' forecasts for that release, smoothed with a six-month decay. Each of the data releases is given an equal weight within its sector and the overall index. The index has risen since 2022 and now hovers around 0.5.

ROTATION TO DURATION

Fixed income remains our firmest conviction. Consistent with our expectation for gradually slowing, but positive, economic growth, we think the time has come to move out in duration and into the ‘belly’ of the yield curve to take advantage of higher rates at the end of the Federal Reserve hiking cycle.

QUALITY STANDS OUT

This type of environment – where event risk premia remain high and implied correlations are low – underscores our continued preference for identifying quality characteristics within equities. Based on our preference for quality, three equity sectors stand out: energy, industrials, and information technology.

SHIFTING GLOBAL NARRATIVES

We see three primary narratives driving international exposures until year end. Central bank policy divergence opens up potential opportunities in emerging markets; global growth expectations influence broad emerging market allocations; and structural trends bolster particular regions.

For more insights and to read about our rationale for the recommendations, download the full 2023 Fall Investment Directions.

iSHARES FUNDS

Explore a range of iShares ETFs to meet your clients investing goals.

Subscribe for the latest market insights and trends

RELATED RESOURCES

Access exclusive tools and insights

Explore My Hub, your new personalized dashboard, for portfolio tools, market insights, and practice resources.