Why BlackRock for private equity?

Private equity is an essential element of investors’ portfolios. Investors are seeking differentiated strategies for their private equity allocations based on their unique needs, including risk and return objectives, cash flow profiles and overall cost. Our platform takes a holistic approach to investors’ private equity portfolios and is designed to offer strategies and solutions that align with client objectives and deliver persistent outperformance.

True alignment with client needs

Differentiated sourcing enabled by a centralized platform

Insights amplified with technology

Learn more about private equity at BlackRock

Evolution and innovation in private equity

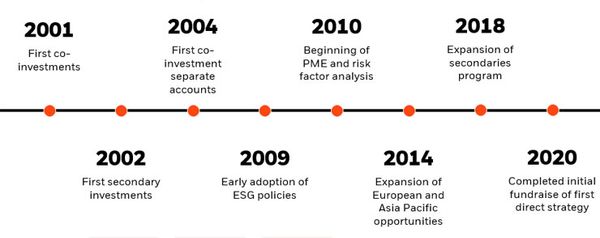

Following two decades of strong growth, private equity now presents a large collection of strategy offerings and multiple ways to invest. BlackRock has been a major contributor to this evolution, from our role as an early mover in co-investments to our early adoption of ESG policies to our introduction of an innovative, client-aligned direct strategy.

Source: BlackRock, for illustrative purposes only.

Private equity investment strategies

Our approaches span the private equity toolkit, offering investors exposure to private equity through direct, primary, secondary, and co-investment strategies. While the approaches differ, they share the strengths of a common platform as they seek to deliver top quartile performance across investment cycles.

Direct

Co-investments

Primaries

Secondaries

BlackRock's latest private equity insights

On the Historical Outperformance of Private Equity

19-Nov-2024 | By Jeroen Cornel, Kyle McDermott, Yamona Win

An evaluation of private equity returns compared to their respective public market equivalents.

Systematic Insights into Private Equity Investing

11-Nov-2024 | By Systematic Investing

This research presents a framework for late-stage venture and growth equity investing, showing how quantitative tools and alternative data used in public markets may help forecast positive outcomes in growth equity investments.

Venture capital market outlook

01-Oct-2024 | By BlackRock

Explore our analysis of the venture capital market; a dynamic and rapidly evolving landscape shaped by macroeconomic shifts and technological advancements.

Mastering private equity with the BlackRock Educational Academy (BEA)

BlackRock’s private equity team help debunk common myths as it relates to drivers of performance, the use of secondaries as a portfolio management tool and also walk through case examples within primary, secondary, and co-investment examples.