1475

iShares Core TOPIX ETF Traded on TSE NISA Growth

Overview

Performance

Performance

Growth of Hypothetical¥10,000

Distributions

-

Returns

| From 31-Mar-2020 To 31-Mar-2021 |

From 31-Mar-2021 To 31-Mar-2022 |

From 31-Mar-2022 To 31-Mar-2023 |

From 31-Mar-2023 To 31-Mar-2024 |

From 31-Mar-2024 To 31-Mar-2025 |

|

|---|---|---|---|---|---|

|

Total Return (%)

as of 2025/03/31 |

41.94 | 1.88 | 5.73 | 41.23 | -1.63 |

|

Index (%)

as of 2025/03/31 |

42.13 | 1.99 | 5.81 | 41.34 | -1.55 |

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | -0.39 | 14.73 | 15.37 | - | 8.58 |

| Index (%) | -0.31 | 14.82 | 15.46 | - | 8.69 |

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | -3.14 | 0.34 | -3.27 | 0.23 | -0.39 | 51.02 | 104.35 | - | 119.25 |

| Index (%) | -3.12 | 0.33 | -3.25 | 0.26 | -0.31 | 51.37 | 105.23 | - | 121.42 |

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Total Return (%) | 7.25 | 12.62 | -2.52 | 28.16 | 20.36 |

| Index (%) | 7.39 | 12.74 | -2.45 | 28.26 | 20.45 |

Growth of Hypothetical of ¥10,000 chart, returns data, and distributions data, are based on past performance and are not indicative of future performance. Investment results are not guaranteed.

Growth of Hypothetical of ¥10,000 chart reflects a hypothetical ¥10,000 investment and assumes reinvestment of dividends before taxes. Fund expenses, including management fees and other expenses are deducted. The performance quoted represents past performance and does not guarantee future results.

The fund returns shown above assumes reinvestment of returns. Fund expenses, including management fees and other expense are deducted. The total return performance represents cumulative changes to the NAV and assumes reinvestment of distributions before taxes.

The Distributions data shows historical distributions based on the fund distributions policy. The distribution amount is quoted on a per unit basis before taxes. As a general rule, accumulated dividend income after the deduction of expenses will be distributed from the fund on each record date. There is no guarantee that distributions will be paid in the future.

The cumulative index performance prior to October 31, 2022 reflects the performance of the price return index the fund was tracking before the benchmark change.

Please click here (Japanese only) for more information on the benchmark change, effective November 10, 2022

Key Facts

Key Facts

| Distribution Frequency | Semi-Annual |

| Record Date | Every Year on Feb 9th and Aug 9th |

*The fund employs a tiered fee structure where the trust fee varies based on the fund size. Refer to the prospectus for details.

*Investors, including non-residents, would be subject to fees inclusive of Japanese consumption tax, which are deducted daily from the NAV along with the trust fee.

Portfolio Characteristics

Portfolio Characteristics

Holdings

Holdings

※ Holdings are subject to change

Exposure Breakdowns

Exposure Breakdowns

% of Market Value

* The data source for the holdings data has changed on June 30th 2019. Exposure Breakdowns on or after June 30th 2019 is based on data sourced in-house. Exposure Breakdowns shown prior to June 30th 2019 is based on accounting book of records

*The data source for Exposure Breakdowns data is sourced in-house.

How to Buy

Financial Instruments Business Operators Handling iShares ETFs

Please refer to this page for information related to trading iShares ETFs and Financial Instruments Business Operators handling iShares ETFs. (Japanese Only)

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Literature

Participating Dealers

Participating Dealers

Important Information

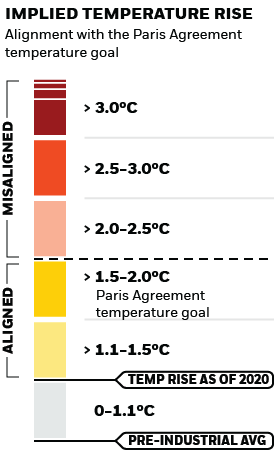

Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1ESG Fund Ratings; 2Index Carbon Footprint Metrics; 3Business Involvement Screening Research; 4ESG Screened Index Methodology; 5ESG Controversies; 6MSCI Implied Temperature Rise

For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with ESG criteria. Please refer to the fund’s prospectus for more information. The screening applied by the fund's index provider may include revenue thresholds set by the index provider. The information displayed on this website may not include all of the screens that apply to the relevant index or the relevant fund. These screens are described in more detail in the fund’s prospectus, other fund documents, and the relevant index methodology document.

Certain information contained herein (the “Information”) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (“MSCI”)), or third party suppliers (each an “Information Provider”), and it may not be reproduced or redisseminated in whole or in part without prior written permission. The Information has not been submitted to, nor received approval from, the US SEC or any other regulatory body. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between equity index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties (which are expressly disclaimed), nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.