Systematic investing

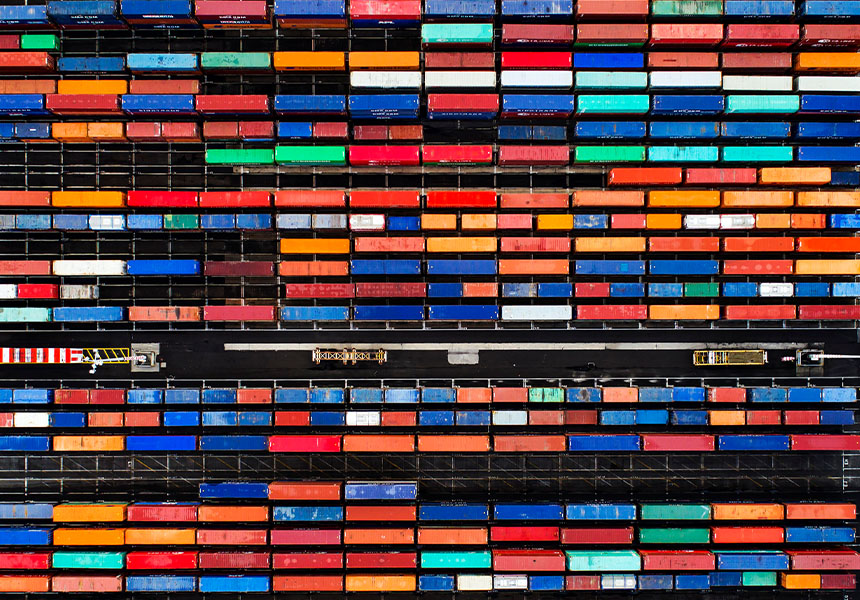

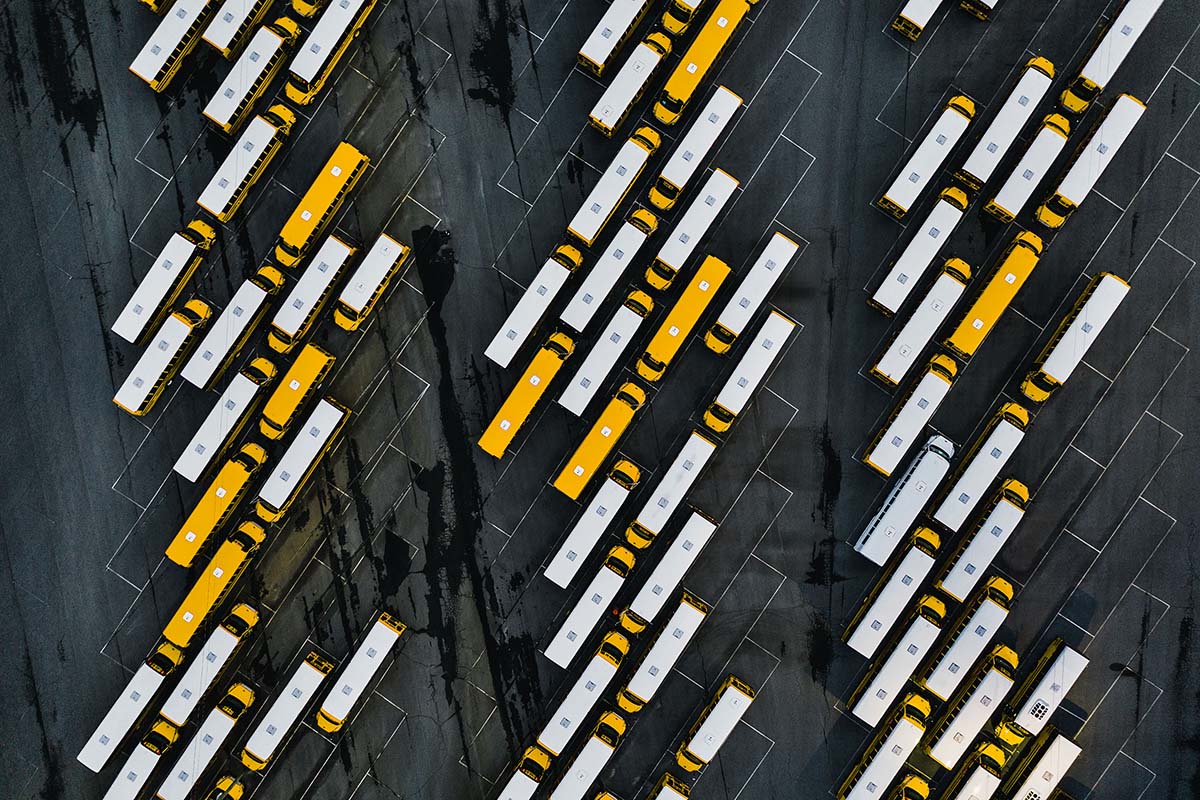

Portfolios powered by technology

Systematic investing combines alternative data, data science and deep human expertise to help modernize the way we invest and construct portfolios. By leveraging data-driven insights, scientific testing of investment ideas, and advanced computer modeling techniques, we constantly innovate new approaches as we seek to improve investment outcomes on behalf of our clients.

What’s different about this moment for AI & machine learning for investors?

What the advent of large data sets in the investment process has been about for over 20 years, has been this idea of moving things that were considered qualitative to quantitative. You probably heard this, this, this saying that investing is both art, and science. And I think the art part is this idea that some things are hard to quantify, and science part is the part that we all agree with.

Risk models, transaction cost model, advanced portfolio construction techniques. We can we can treat in analytical fashion. The explosion of machine learning and artificial intelligence has made so that a lot of what we consider only approachable with qualitative analysis is now lending itself to quantitative analysis and the scientific approach to take advantage of of these trends, of course, you need you need a team that can do both the art and the science of of investing.

And so the type of question we can ask and the type of answer we can get requires very strong analytical skills computer science, machine learning and, and large language models.

What market trends are prompting investors to take a more active approach?

The first one is of course, interest rates are not at zero anymore. and this creates a lot of opportunities to invest both in equity markets, and in, in fixed income assets.

And then I think the other the other thing that is happening also is that we're seeing less synchronization across the major economies. Partly is a slowdown in globalization, partly is different inflation regimes and monetary policies regime. But dispersion across global markets has gone up. And this is this is very good for, for active investors.

Where does the influence of AI create risks for investors?

We always had machine learning and data at the heart of investment processes. But, but it was very much something that only experts could access. Now I think what's happening is these models are accessible to people that are might not be machine learning expert. And that's drawing in a lot more insight into, into, the investment process. While there might be some risks, I think the opportunities are much more plentiful and is what’s getting us exciting.

One of the things that is really special about this generation of artificial intelligence model is how conversational they are, and the breadth of use cases that you can apply to. The idea that a lot of what was qualitative in an investment process, and important, can also now be brought in and quantified and integrated more fully in an approach that is using systematic tools like optimization.

As these models become more and more powerful and more prevalent in any investment process, of course, asking the right question and judging the quality of an answer becomes even more important.

What should clients be asking their active managers?

The first one, how are you using technology in your investment process that's going to be a stronger, stronger driver of success in the future, I believe. And the second one is how do you make sure that what you're doing is different and stays ahead of, of the competition. Whether it's public or private, whether it's on, on equities or fixed income, whether it's a fundamental style or a systematic style.

I think that an efficient use of technology, and the sort of promise of AI, is going to be a bigger part of, of investment success.

Important information

This material is provided for educational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Reliance upon information in this material is at the sole risk and discretion of the reader. The material was prepared without regard to specific objectives, financial situation or needs of any investor.

THE INFORMATION CONTAINED HEREIN MAY BE PROPRIETARY IN NATURE AND HAS BEEN PROVIDED TO YOU ON A CONFIDENTIAL BASIS, AND MAY NOT BE REPRODUCED, COPIED OR DISTRIBUTED WITHOUT THE PRIOR CONSENT OF BLACKROCK, INC. (“BLACKROCK”). These materials are not an advertisement and are not intended for public use or dissemination.

This communication is not an offer and should not be deemed to be a contractual commitment or undertaking between the intended recipient of this communication and BlackRock but an indication of what services may be offered subject to a legally binding contract between the parties and therefore no reliance should be placed on this document or its content.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Any reference herein to any security and/or a particular issuer shall not constitute a recommendation to buy or sell, offer to buy, offer to sell, or a solicitation of an offer to buy or sell any such securities issued by such issuer.

In the U.S., this material is for institutional use only – not for public distribution.

In Canada, this material is intended for institutional investors, is for educational purposes only, does not constitute investment advice and should not be construed as a solicitation or offering of units of any fund or other security in any jurisdiction.

Capital at risk. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed.

Opinions, assumptions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. The opinions expressed are as of January 2024. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This communication and its content represent confidential information. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. You should consult your tax or legal adviser regarding such matters.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of yields or returns, and proposed or expected portfolio composition. Moreover, where certain historical performance information of other investment vehicles or composite accounts managed by BlackRock, Inc. and/or its subsidiaries (together, “BlackRock”) has been included in this material, such performance information is presented by way of example only. No representation is made that the performance presented will be achieved, or that every assumption made in achieving, calculating or presenting either the forward-looking information or the historical performance information herein has been considered or stated in preparing this material. Any changes to assumptions that may have been made in preparing this material could have a material impact on the investment returns that are presented herein by way of example.

Past performance is not a guarantee of future results. Asset allocation and diversification strategies do not guarantee profit and may not protect against loss. Risk management and due diligence processes seek to mitigate, but cannot eliminate, risk nor do they imply low risk. Investment involves risk, including a risk of total loss. Indexes are unmanaged, are used for illustrative purposes only and are not intended to be indicative of any fund’s performance. It is not possible to invest directly in an index.

Stock and bond values fluctuate in price so the value of your investment can go down depending upon market conditions. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage- or asset-backed securities may be prepaid at any time, which will reduce the yield and market value of these securities. Obligations of US Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US Government. Investments in non-investment-grade debt securities (“high-yield bonds” or “junk bonds”) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax. International investing involves risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging / developing markets or smaller capital markets.

The BlackRock Investment Institute (BII) leverages the firm’s expertise and generates proprietary research to provide insights on the global economy, markets, geopolitics, and long-term asset allocation.

The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock, Inc. and/or its affiliates (together, “BlackRock”) to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to pass. Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof. BlackRock believes that the information in this document was correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents.

©2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK, iSHARES and ALADDIN are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BSYSH0724U/M-3696920

Unlocking innovation through systematic investing

Raffaele Savi, Global Head of BlackRock Systematic, examines what sets this moment apart for AI in the eyes of investors, why investors are considering a more active approach, where the influence of AI creates risks and the questions clients should be asking their active managers.

Next generation portfolio construction

AI-enabled decision-making and alpha research is paired with market expertise to maximize the economic soundness of investment ideas.

Detailed quantitative attribution helps constantly refine portfolios and targets distinct sources of return to help deliver specific investment outcomes.

Quantitative data-analysis techniques yield scaled insights across large sets of securities, enabling high-breadth portfolios.

Scientific testing helps validate return potential, while simultaneously mitigating behavioral basis and cognitive errors.

Portfolio positions sized by disciplined risk budgeting and optimization processes seeks to balance a complex set of trade-offs in portfolio construction.

Detailed quantitative attribution helps constantly refine portfolios and targets distinct sources of return to help deliver specific investment outcomes.

Quantitative data-analysis techniques yield scaled insights across large sets of securities, enabling high-breadth portfolios.

Scientific testing helps validate return potential, while simultaneously mitigating behavioral basis and cognitive errors.

Portfolio positions sized by disciplined risk budgeting and optimization processes seeks to balance a complex set of trade-offs in portfolio construction.

Investment strategies

Our systematic approach to investing can be applied across a spectrum of strategies. We manage both highly diversified and specialized investment capabilities to provide clients with solutions that best compliment their portfolios.

How does BlackRock’s Systematic team seek an edge in markets?

Decoding the Markets Webcasts

Join us for our quarterly Decoding the Markets Webcast where Blackrock Systematic experts apply a data-driven lens to help navigate the current market landscape.

Decoding the Markets: Investing in an era of flouted rules

JEFF ROSENBERG: Hi, I'm Jeff Rosenberg, Senior Portfolio Manager in the BlackRock Systematic Fixed Income Group, and your host for this quarter's Decoding the Markets. Joining me is the Head of BlackRock Systematic, Raffaele Savi, Senior Portfolio Manager, Ren He, in our Systematic Active Equity Group, and Brad Betts, Head of our KDT Systematic Research Group. This quarter, we're going to talk about the market's outlook and our special topic, knocking what everyone else is fixated on, which is the election. We're focused on looking at the developments in artificial intelligence. Obviously, we've seen recently the Nobel Prize winners in both chemistry and physics around artificial intelligence. We'll be joined by Brad to talk about his perspective on artificial intelligence, the seminal moment in history with the Nobel Prize winners, and most importantly for you and us, our application of this technology in the pursuit of investment returns. So, with that, let's get started. And I'm going to talk about the main theme for this quarter from the macro perspective, investing in an era of flouted rules. This draws on the perspective from something Jerome Powell said in one of the press conferences, that the rules investors have applied to predict economic recessions have been flouted. They've been frustrated by a historical economic environment, mostly due to the COVID shocks, that has made following the rules a pretty bad prescription for predicting recessions. A year ago, that rule was the inversion in the yield curve. More recently, it's been the rise you see on the upper right-hand chart here, the rise in the unemployment rate, the so-called Sahm Rule that got a lot of attention and a lot of bond market pricing for a very aggressive path of Fed cuts, as this rule and the tightening that we were seeing in the labor markets was suggestive of the onset of a recession. One of the things we're highlighting here, this comes from the Head of Systematic Fixed Income, Tom Parker. I asked him, do you want to call it the Parker Rule? He said, no, no. So, we're calling it the augmented Sahm Rule. And what we're augmenting the Sahm rule, the rise in unemployment rate, the three-month average over six months, over the recent trough period of 50 basis points, predicts every historical recession with the orange line above that, which is corporate profit margins. And so, the other thing that we see, and this is really the key to systematically decoupling what is the source of the rise in the unemployment rate. Is it demand driven or is it supply driven? The critique of this Sahm Rule is that it's more indicative of a supply side story rather than a demand side story. And it's the predictive power to recession is more if it's from the demand side. What can help to systematically inform that differentiation in the Sahm Rule is corporate profit margins. When margins are tightening, it's giving corporations an incentive to try to restore their margins by reducing their variable costs, by cutting employees. And almost every historical recession, also predicted by the Sahm Rule, is also associated with declining corporate margins. It tells you that it's the demand side that's driving the unemployment rate increase. And look at the far right-hand portion of that chart. What do we see? Which is that it's distinctive in this cycle, corporate profit margins are going up, not down, telling you or helping to validate that this is really much more about a supply side story and therefore, much less relevant as a signal, as a recessionary indicator. If you look on the left-hand lower chart, another thing that we've seen in this market environment on the data side is data revisions matter a lot. We saw the revisions between GDP and GDI. There was a long debate here that GDI was the better measure. Economic data, especially this type of growth in national accounts data gets revised often. The savings rate picture, which had been fueling some of these recessionary concerns, because the consumer was tapped out and that savings rate had gone low, that just got revised back up. So, the consumer is doing quite well. And the lower right-hand chart is perhaps one of the reasons for that, that the tightening, the green line, the tight level that the Fed perceives as restrictive is not as restrictive as it seems when you look at financial conditions. And it's these easier financial conditions that's translating through the wealth effect to the benefit. It's a K-shaped recovery, both for corporates and for consumers on the consumer side, the high end benefiting from that higher wealth, those easier financial conditions helping to support that economic growth outlook. So, another rule here is the Sahm Rule, flouted. Raf will come on a bit later and talk about this perspective from some other of our data, but the recession concerns are really kind of overstated by these rules. Let's move on to the next slide. You know, the other thing we're seeing in terms of fixed income of importance and, you know, talking about the election, one of the main investment implications of the election is the heightened fiscal policy uncertainty.

JEFF ROSENBERG: And heightened fiscal policy uncertainty for the bond market relates to our bond investors getting paid appropriately a term premium for that added level of debt that we see in an environment of 7-8% deficits. We see that that's not the case. And then, you add the Middle East uncertainty. Yes, recently, this has dissipated a bit in terms of oil prices, but the potential oil price shock creates the scenario of the inflationary shock. So, a bad risk off environment, but with an inflationary shock from higher oil prices, it means that where you hold your hedge in fixed income land matters a lot. And that's what we're showing in this chart, which is the performance, the stock-bond correlation, buy maturity. What you see in each of the gray shaded areas is that this is an environment where each time you needed that hedge, the hedging performance is really varied quite dramatically across the short end, which is outperformed. The most negative stock bond correlation means the most efficacious of hedging behavior in the fixed income market happening in the short end, while the long end lacking a term premium being pressured by inflation and fiscal policy concerns lags during those crisis periods. And so, where you hold your duration, where you hold your hedge matters, you know, even more than how much duration you hold. And so, it's really having to think a little bit deeper about the kind of Fed is cutting. I should just back up the truck and buy duration. Look at what happened when the Fed cut 50 basis points. The bond market had negative returns. So, we've seen this kind of twist steepener environment that we have to pay attention to when you're allocating the fixed income. Let's go ahead. One more slide. I'm borrowing work here, great work from Andrew Hussey and our tactical team. What we're looking at here is the performance of what we call hard landing portfolios. You create a group of stocks that performs well in a recessionary hard landing scenario versus the soft-landing portfolio stocks. And so, the differential of that performance is basically telling you equity market performance in the cross section across these two macroeconomic scenarios. It's hard versus soft landing. And then, we're splitting that by what is the after first Fed cut performance of those portfolios between 50 basis points and 25 basis points. And not unsurprisingly, what it tells you is that when the Fed has to cut 50 basis points, it tends to be followed by outperformance of the hard landing portfolio, i.e., it tends to signal that you're more likely to get a hard landing. So, this is where, again, investing in the era of flouted rules comes in because here we have a 50-basis-point cut. Do we read that 50 basis point cut as again, being a signal that the hard landing is more likely to occur? I would be more cautious about that interpretation. And I think we know why. Number one, we've seen from the minutes that the debate around the 50 basis points versus 25 basis points was much more split than was first advertised. And secondarily, the data that I showed before, that the subsequent data revisions that we've seen across employment, gross domestic income, are really pointing to the potential that the Fed has overreacted to that short-term data. And after revisions, it kind of looks like 25 was the better measure, which is going to support more of a soft-landing type narrative. Raff, I want to turn it over to you to bring about some more of our unique thesis perspectives.

RAFFAELE SAVI: Thank you, Jeff. And actually, I'll start from the same place where you started, this idea of flouted rules. We've been talking about it for a number of quarters with the DTM, which is sort of what's been happening is that we found more data-heavy approaches to be more predictive in the last couple of years than theory-heavy approaches. And, you know, we can go back and maybe Brad will cover it in the section of artificial intelligence, you know, there's something really interesting I think that is playing out. You know, we used to understand the world. You know, in a world that was data poor, science was coming up with theory and I think we're moving into a world that is very data rich and some of these theories are proving out to be useful and some of these theories are proving out that to be sort of incorrect approximation, and data might turn out to be a better a better guide in decision making. I want to talk about a couple of things and I'll start from the top right chart. That is our aggregate forecast of recession probability within one year. Two things here that are worth noting. One, we're still below market consensus. Market consensus has come down.

RAFFAELE SAVI: So, markets were really worried, to your point, you know, inverted yield curve and past hiking cycle in history, inflation shock, there were a lot of good reasons to be concerned about a possible recession in the last 18 months. That concern represented by the yellow bar has come down in sort of the marketplace. We're still below consensus and we have been for this period of time. I think that's been one element, one of the various elements that have helped delivering good performance throughout this market cycle. We're still below. We did, as you see, some of the orange bars are going up a little bit. But again, I would say some of the comments you were making about labor market are feeding through some of this data, but the view is still, the cost is clear in this regard. And when I move at the bottom left, left-hand side of this page, we're seeing a similar picture on inflation. You know, here is sort of web scraped inflation, really high granularity and high velocity data. Every type of indicator seems, again, to be pointing to normalization. We exclude Japan. I'll talk a little bit about Japan in a minute. So, in aggregate, when we look at the two key elements of what can differentiate between a soft landing and a hard landing, we see soft landing as the scenario that data is showing us to be dominant and staying increasing more likely. Now, there's an interesting corollary and an interesting sort of observation on rates. The aggregate, when you and I were talking about it before this call, you know, on aggregate, we have a positive view in the sense we're thinking that this inflation normalization will lead to rates coming down. But there's some interesting cross-sectional differences and I want to toss it back to you to comment on that one, Jeff.

JEFF ROSENBERG: I mean, the green line on web inflation and the alternative data view, you know, really supportive of kind of the normalization in rates and aggregate. This is kind of developed market G6 duration view from the G6 model. But what's really interesting and I look at this as a fixed income person a lot is underneath the surface in the cross-sectional. And this lower right-hand chart is some cross-sectional model work from our SAE Macro Team. What you see is some of the largest dispersion in that cross-section and really big developments over the quarter. So, US duration has gotten much less attractive. And that kind of reflects the growth dynamic that I was talking about, the movement from kind of recession fears to really solid growth. And the flip side is Europe and the UK, going on the positive side. We've seen that recently with the actions of the ECB, the inflation and growth outturns in Europe. We're starting to see some dispersion, and that reflects the divergences in the macroeconomic data. And the models and the model perspective and the positioning is picking up on that. So, I wanted to highlight that, but back to you, Raff, for more.

RAFFAELE SAVI: A couple of other interesting tidbits that we pulled out of our model, if we could go to the next slide. So, two things here that we want to show. Bottom left side, the green chart, I've seen a lot of sorts of evidence that has been put out there by commentators and market strategists that talks about things that are concerning, whether it's concentration in the index, whether it's... And here, I was being a little cheeky and playful. And you can always find data that actually can tell you the opposite story. So, this one, for example, is the number of companies that are trading in a PE ratio in the S&P 500 that is below the recession average. And that has not gone down. So, to a certain extent, that, to me, is also somewhat ties with the chart we were talking about before. The market has been worried about recession and a good part of the equity market has reflected that. So, you know, the science, of course, if we're just looking at the areas of markets like AI and some parts of technologies, of course, we're seeing that with strong margin expansion and revenue growth and profit growth, there's been also evaluation premium. But there's economic sensitive part of the market that are discounting somewhat mixed picture. The right-hand side chart is something that I personally find really interesting. And this idea, what we're trying to get at here is, if this inflationary episode that we lived through in the last few years is a shock.

RAFFAELE SAVI: And, you know, you remember at the beginning of this episode, there was the whole discussion of temporary versus permanent. If you will believe that is temporary, how much of that has reversed? And the answer is not much, almost none. And then, for comparison, we're showing the same type of analysis around COVID. And so, here, we're basically looking at companies that outperformed over the beginning, the initial part of the COVID shock, what happened as we move through that shock. And, you know, there was a complete normalization. And so, here the message is, if it will turn out that actually this inflationary period, it is indeed sort of temporary, maybe longer than expected. But if we revert towards the long-term target of 2% or slightly above or slightly below, there seems to be some adjustments in market internals that can happen. Now, moving on to the next slide, and this is going to be a little bit of a back and forth with Ren. One theme that has been really interesting this year in markets, of course, has been Japan. Japan has been a little bit neglected by investors in the global asset allocation, market that hasn't been that interested for equity allocators for a while. This year, definitely, we've seen much more action with a lot of flows, volatility both ways. You know, we've seen very strong performance from the back end of last year to the summer. We've seen sharp reversal at the beginning of the summer. And then, interestingly, you know, in the same time frame, there's sort of China that is coming back in the zoom of major global investors after having been neglected for quite some time. So, we want to take a temperature check on these two markets and try to get a little bit of a sense of what the data is saying in these regards. So, a lot of the story about Japan was a story of, look, there are some structural changes around inflation and there are some structural changes in consumption. And here is what we're trying to show with these charts, what we're tracking. And I would say the summary you can see in the slide on top right chart is that on the inflation side, it does seem to us that some of the trends that have been discussed are showing staying power. So, there's this period of higher inflation that in that market is seen as a positive is continuing. Interestingly, when we go at the bottom right chart, we actually do see that sort of the fiscal support has been waning a little bit, whether this is the ETF purchase program from central banks and monetary authorities. And so, that is somewhat of an offset to the point above. Consumer activity seems to be healthy. You know, this seems to us that the core story about Japan being a place where, from a microeconomic standpoint, some of the stasis of the last 20 years might be sort of undergoing a change, the case is still intact. If we're moving on to the next slide, this is also the second big pillar in the case for Japan, which is corporate reform and sort of companies being more invested and more attractive, more sort of shareholder friendly. And we're seeing, you know, we're trying to sort of track at the bottom side of this slide whether this is sort of reform stated under consideration or implemented at the corporate governance level in the topics. We're looking at sort of activist activity in Japan and the response of sort of markets and companies to that. Again, it does seem to us that the story is playing out in data. So, from that perspective, you know, we see some of the volatility around major indices in the summer has been more driven by technicals than by some revelation that some of the Japan story is not there anymore. I'd say that in the technical side that investors, global allocators have always options to choose from, Japan was one of the best places in Asia. And now, the question that I'm posing to Ren is, is China once again, you know, a competitive place where investors can allocate resources? Up to you.

REN HE: Thank you, Raff. I mean, what a roller coaster ride for Chinese markets since end of September as we chatted about just now, it's never boring there.

REN HE: But I think it's helpful to think in a slightly longer horizon to do a background check to see what's going on right now in China. And there are two major problems in Chinese economy right now. Number one is the domestic demand problem. And number two is a confidence problem. The demand problem is primarily a property-led balance sheet recession but it's happening in both of the local government sector and also the household sector. Raff is talking a lot about Japan. I think there's a lot we can learn from Japan in its lost decade to what's going on in China right now. And this balance sheet recession counts as particularly real right now in China for two reasons. Number one, we know for the past decade, local government has been really expanding their balance sheet, almost entirely funded by the proceed of future land and property sales. At the same time, Chinese families have all levered up in housing as well, with more than 70% of their family wealth all stored in the property value. And now, within a very short time, with 20% and some places 40% decline in property value, this caused a huge hole in their balance sheet. What do they do? They stop spending and live frugal.

Now coming on to the confidence problem. For long, China's growth is about being market-driven reform and grow like capitalism even more than some western countries. This got challenged since COVID with a series of crackdown actions from government for one sector by the other sector. And the private entrepreneurs react as stop investing and stop hiring. In our China team, we monitor a lot of the job posting data as shown on the chart. We can see right now the job listing in China is almost at all-time low as an indication of the private sector's confidence. So, put them all together, we have three most important agents, local governments, households, private corporate, all-in stall or in outright decline. How could the China economy grow? So, this comes from the policy angle. We tend to think about the Chinese government policy less about their objectives because change all the time, but more on their constraint. And there are two constraints right now we think are really important. Number one is local government funding. It has been two years where we are seeing a double-digit decline in local tax revenue. Coupled with the housing crisis, there's extreme difficulty in local government financing right now to the verge that they might stop functioning without a change of revenue. Similarly, on the unemployment side, we all know the story about the rocketing high unemployment rate that's really causing pressure on the government. In our opinion, they have to respond to these two hot constraints to make the system work. That also makes our view about their future policy outlook to be they need to continue to do something substantial, more substantial than what they announced so far to really solve those two constraint problems. Of course, what happened in the past couple of weeks, you got all the stars aligned, a major policy shock, major consensus short positioning on all the hedge funds in China equities and the extreme valuation that caused this short squeeze rally in the past two weeks. What does it mean for the investment perspective? Does this make China all uninvestable again? Our answer is no. If you look at the history of China on the next slide, about the thousand years history, it always oscillating from left to right, right to left. There's nothing that new in China But now we know the Chinese market is full of efficiency. It's a good place for alpha capturing. And we believe so, even more so with now rocketing high retail participation again. And then, since the onset of the policy shock in September, we'll see extreme cross-sectional stock dispersion again.

REN HE: With that, the China story, of course, is never ending. I'll pass back to Jeff to talk more about how we think using AI and big data machine learning can be an edge for all of us in China and also in the world.

JEFF ROSENBERG: Ren, thank you so much for that. As you said, the China story is not ending, and we look forward to having you back on the DTM to talk more about that evolution. Certainly, that's got a lot of attention. Something else that's gotten a lot of attention has been artificial intelligence. Recently, we saw the Nobel Prize announcements across both physics and chemistry back-to-back days. And it prompted me to push to the side the other kind of thing that's getting a lot of attention, the US elections and bring Brad Betts into the conversation. So, I'm super excited. Brad heads our KDT team. We love our acronyms here at BlackRock. I think officially, Brad, KDT stands for Knowledge Discovery Team. But for this conversation, I think it probably better is representing knowledge through data and technology, because that's, I think, what we get in artificial intelligence. So, we're going to talk about that. Brad and I had the opportunity when he was in New York recently to have a really fascinating conversation. I hope we can get to some of that here. So, let's just get to it. Brad, I want to get your, you know, what was your reaction to the announcement of the both Nobel Prizes?

BRAD BETTS: Amazement. It's good to be with you, Jeff. Thanks for the invitation. And, you know, I think Raff and I had been agreeing, you know, sort of shaking our heads that if you'd asked either of us just 10 years ago, the probability that the prize for both physics and chemistry would go in the same year. A day separated to artificial intelligence inspired work; we might have... You know, we both agreed that we would likely have thought that improbable despite all that we've known. The award in physics going for such foundational work in artificial neural networks, the, technologies that are powering this current wave of interest and in artificial intelligence, and the prizes in chemistry going for the enhanced understanding of proteins that that artificial intelligence of giving us including the just unbelievable work from Google DeepMind in AlphaFold and and us understanding the three-dimensional realities or three-dimensional structures of proteins that will lead to such amazing benefit for humans in terms of drug discovery and so much else. I know that was a long answer, Jeff, but just one word would just be amazement.

JEFF ROSENBERG: Amazement. And, you know, when you and I were chatting in New York, it was on this kind of theme of amazement. I went back a little bit, and, you know, you and I came from, you know, slightly different backgrounds. I did one of the first MFE programs. It was kind of late 90s, built off of derivative pricing. And at that time, it was really kind of like you can take a mathematical approach to derivative pricing, which I spent a lot of time studying Stochastic Calculus with Steve Shreve, one of the founders. And it was kind of on par with the computational aspect. And then, you fast forward 25 years and the computational side has just gotten so much further ahead than the mathematical side. And we kind of were talking about that. So, one of the questions is just, how did we get to this point where we're seeing such incredible advancements in the application of this technology?

BRAD BETTS: Sure, well, I think that you and Raff have already laid it out fairly well in terms of the ubiquity of data, the prevalence of data. But stepping back, how have we gotten to this point? Quite obviously, we're stating from decades and decades of hard work by many people in the field of science. This work, again, powering this current wave and transformers and generative AI, its lineage ties very directly into the 1950s, very directly, very straightforwardly into the 50s. And so, more specifically, it's what Raff has already said, that three big things powering this wave have been the abundance, the vastness of data available for training these algos, the cleverness and advancements in the architectures that we use, more specifically even the architectures of artificial neural networks. And then, the third one is advances in the hardware that we use, and again, more specifically the hardware of NVIDIA that has enabled this. So, it's the combination of these factors and decades of hard work by so many people that have advanced to where we are.

BRAD BETTS: And you raised the sort of computation, you know, versus closed for. And, you know, one might argue that the most amazing machine that we know of currently in the universe is the human brain. All of our art and our music and our science and our mathematics and our sports and our language and our writing, all of it comes right now at least from our human brains. Our understanding of the universe and our modification of the universe comes from this. And you might argue... And important caveats, but you might argue that, you know, we are inching towards in these architectures. Things that are starting to vaguely resemble this remarkable machine, the human brain, and that is to say the combination of those factors of data, architecture, and the hardware of NVIDIA in particular right now. Important caveats, quickly. I mean, one is the crudest right now approximation. The human brain is an extraordinary machine. And of the many ways, you know that it's a crude approximation. Look at these staggering amounts of power that we have to pour into these algos for them to produce. When I was still a fairly young boy, I remember asking my parents, my parents sitting me down and talking about what nuclear meltdown was because of Three Mile Island. Yet, here we are in 2024 with Microsoft. If you had asked me as a child when my parents were explaining nuclear meltdown, that Microsoft would be reactivating Three Mile Island, I would have thought that improbable. But here we are. So, we have to pour huge amounts of power. And also, I'm confident that many of our listeners have already read, and if not, would strongly encourage the recent article in the journal from the brilliant computer scientist, the Turing Award winner, Yann LeCun, who, you know, was like the human brain. I mean, this stuff isn't even remotely as sophisticated as a cat. So, you know, please, strong caveats. But in terms of this supremacy, you might argue, given that all our ability to compute had come from human brains, and now we're in effect starting to inch towards artificial ones, maybe it's not so surprising that computation is starting to dominate. And this seems a trend that is likely going to continue.

JEFF ROSENBERG: Super, super interesting. Let's turn the conversation a little bit more towards investing and how... You know, I think you and your team have spent a lot of time, 15 more years, working on artificial intelligence applications to the investment problem. And a lot of that is kind of the pre-gen AI, and obviously a lot of the attention is generative AI. But just talk to us a little bit about, you know, what we've done and had success with in broad artificial intelligence in the applications to the investment problem. And then, what do you see, you know, currently and then going forward as the really exciting applications of the newer generative AI technologies?

BRAD BETTS: Yeah, sure. I mean, so one, thanks for broadening it past just sort of the generative AI, which is a type of artificial intelligence. But as you exactly and correctly have stated, Raff and I and all of us here have worked for so long, for so many years now, and have been very actively trading this out of sample and broadly, the fields of machine learning and artificial intelligence, algorithms inspired by that work. And by the way, that comes about because of a tremendous amount of work that I think is often underappreciated. The amount of effort you have to pour in to build the systems that surround. Or really, I think, tackle any problem effectively with artificial intelligence, you need to build an ecosystem that allows you to manipulate data very straightforwardly, make it available very easily. You need... Every time you hear artificial intelligence and machine learning, if you just substitute the words data plus optimization, it's a more realistic sense of what's actually going on under the covers. Of course, it doesn't, in a way, sound so exciting when it's put that way, so we use these other terms. But that's the reality, as Raff has already laid out. And so, we continue, and what makes this job so exciting is, of course, what an unbelievable proving ground, what an unbelievably difficult environment the markets are. The signal-to-noise ratios tend to be very low; the markets are highly non-stationary, highly dynamic, highly adversarial.

BRAD BETTS: And all of these things come together to put a tremendous premium on your investment in these capabilities to effectively and practically to make money. In part to your question around continued use of generative AI in particular, has unquestionably been the use of these algorithms to make alpha from textual sources of information, usually vast amounts of textual information. And these algorithms, artificial neural nets included, tend to be very, very effective at parsing through. And if you know what you're doing, being able to translate that into alpha. So, you know, this is not theoretical. This is stuff that we very actively and for a very long time have been training at a sample. Raff, what would you add to it?

RAFFAELE SAVI: Well, I mean, I think one way I've been thinking about it is that sort of the two family of algorithms that have been very powerful for us in practice is sort of natural language processing, the various generations from the very simple work counting to transformers. And then, you know, I'd say aggregator algorithm, whether it's all the way from random forest to deep nets. And the reason why I think that is because if you're thinking about it in any investment process, I would argue that the two fundamental functions are research and portfolio management. And so, the research side essentially is about reading and sort of processing and connecting large bodies of information. That's where natural language processing is so powerful. And then, you know, you have on the other side this idea of, okay, once I process all this information, how do I put it together and generate a portfolio, a trade list? And that's where sort of these algorithms that aggregate are very powerful. And, you know, I think about it this way because again, in investment, these are the two strands of machine learning AI that are more powerful. If you're trying to do a self-driving car, it would be a different family of algorithms. There would be a lot of computer vision. There would be a lot of reinforcement learning. If you're into sort of solving a game like go or chess, it would be, again, a lot of Monte Carlo research and again, reinforcement learning. So it's a huge... You know, we talk about oftentimes that sort of AI is a big tent. And depending on the field that you are applying it to, certain parts of that tent are more profitable. In our case, again, I'd say natural language processing and sort of, you know, everything from regression to deep nets, things that put together a vast amount of information and generate, you know, one forecast, one portfolio.

BRAD BETTS: The ensembling of that information and we have all benefited so unbelievably, Jeff, in our journey here from our partnership and close collaboration with Stephen Boyd and Robert Tibshirani and Trevor Hastie and Emmanuel Candes and Mykel Kochenderfer. These are all very senior advisors to BlackRock that work in our artificial intelligence lab in Palo Alto. And Raff and I and so many of us here have had just the incredible good fortune to work with these giants of the space. And so, our work has also been so very practically benefited from just the brilliance of these partners of ours. And so, that is just what keeps making the journey fun

JEFF ROSENBERG: That's amazing. Only scratching the surface, given our time here, we're going to close the conversation. At the Decoding the Markets, we're certainly not closing the conversation on the development of AI to the applications in investing. Very exciting. Let me thank Brad, Raff, Ren for joining this quarter. Let me thank you, our viewers, for joining us. And you can find more information about BlackRock Systematic on our website, blackrock.com/systematic, and you can reach out to your BlackRock representative. With that, I'm going to wrap this quarter and thank you all very much. We'll see you at next quarter.

For investors in Italy: This document is marketing material. Before investing please read the Prospectus and the PRIIPs KID available on www.blackrock.com/it, which contain a summary of investors’ rights.

Risk Warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time and depend on personal individual circumstances.

Important Information

This material is provided to the recipient on a strictly confidential basis and is intended for informational or educational purposes only. Nothing in this document, directly or indirectly, represents to you that BlackRock will provide, or is providing BlackRock products or services to the recipient, or is making available, inviting, or offering for subscription or purchase, or invitation to subscribe for or purchase, or sale, of any BlackRock fund, or interests therein. This material neither constitutes an offer to enter into an investment agreement with the recipient of this document, nor is it an invitation to respond to it by making an offer to enter into an investment agreement.

The distribution of the information contained herein may be restricted by law and any person who accesses it is required to comply with any such restrictions. By reading this information you confirm that you are aware of the laws in your own jurisdiction regarding the provision and sale of funds and related financial services or products, and you warrant and represent that you will not pass on or utilize the information contained herein in a manner that could constitute a breach of such laws by BlackRock, its affiliates or any other person.

In the US, this material is intended for Institutional Investors only.

In Canada, this material is intended for permitted clients as defined under Canadian securities law, is for educational purposes only, does not constitute investment advice and should not be construed as a solicitation or offering of units of any fund or other security in any jurisdiction.

In Latin America, for Institutional Investors and Financial Intermediaries Only (Not for public distribution). This material is for educational purposes only and does not constitute an offer or solicitation to sell or a solicitation of an offer to buy any shares of any fund (nor shall any such shares be offered or sold to any person) in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction. It is possible that some or all of the funds mentioned in this document have not been registered with the securities regulator of Argentina, Brazil, Chile, Colombia, Mexico, Panama, Peru, Uruguay or any other securities regulator in any Latin American country and thus might not be publicly offered within any such country. The securities regulators of such countries have not confirmed the accuracy of any information contained herein. No information discussed herein can be provided to the general public in Latin America.

In Argentina, only for use with Qualified Investors under the definition as set by the Comisión Nacional de Valores (CNV).

In Brazil, this private offer does not constitute a public offer, and is not registered with the Brazilian Securities and Exchange Commission, for use only with professional investors as such term is defined by the Comissão de Valores Mobiliários.

In Chile, The securities if any described in this document are foreign securities, therefore: i) their rights and obligations will be subject to the legal framework of the issuer's country of origin, and therefore, investors must inform themselves regarding the form and means through which they may exercise their rights; and that ii) the supervision of the Commission for the Financial Market (Comisión para el Mercado Financiero or CMF) will be concentrated exclusively on compliance with the information obligations established in General Standard No. 352 of the CMF and that, therefore, the supervision of the security and its issuer will be mainly made by the foreign regulator;

In the case of a fund not registered with the CMF is subject to General Rule No. 336 issued by the SVS (now the CMF). The subject matter of this sale may include securities not registered with the CMF; therefore, such securities are not subject to the supervision of the CMF. Since the securities are not registered in Chile, there is no obligation of the issuer to make publicly available information about the securities in Chile. The securities shall not be subject to public offering in Chile unless registered with the relevant registry of the CMF.

In Colombia, the offer of each Fund is addressed to less than one hundred specifically identified investors, and such Fund may not be promoted or marketed in Colombia or to Colombian residents unless such promotion and marketing is made in compliance with Decree 2555 of 2010 and other applicable rules and regulations related to the promotion of foreign financial and/or securities related products or services in Colombia. With the receipt of these materials, and unless the Client contacts BlackRock with additional requests for information, the Client agrees to have been provided the information for due advisory required by the marketing and promotion regulatory regime applicable in Colombia.

IN MEXICO, FOR INSTITUTIONAL AND QUALIFIED INVESTORS USE ONLY. INVESTING INVOLVES RISK, INCLUDING POSSIBLE LOSS OF PRINCIPAL. THIS MATERIAL IS PROVIDED FOR EDUCATIONAL AND INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SHARES OF ANY FUND OR SECURITY.

This information does not consider the investment objectives, risk tolerance or the financial circumstances of any specific investor. This information does not replace the obligation of financial advisor to apply his/her best judgment in making investment decisions or investment recommendations. It is your responsibility to inform yourself of, and to observe, all applicable laws and regulations of Mexico. If any funds, securities or investment strategies are mentioned or inferred in this material, such funds, securities or strategies have not been registered with the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, the CNBV) and thus, may not be publicly offered in Mexico. The CNBV has not confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services (Investment Services) is a regulated activity in Mexico, subject to strict rules, and performed under the supervision of the CNBV. These materials are shared for information purposes only, do not constitute investment advice, and are being shared in the understanding that the addressee is an Institutional or Qualified investor as defined under Mexican Securities (Ley del Mercado de Valores). Each potential investor shall make its own investment decision based on their own analysis of the available information. Please note that by receiving these materials, it shall be construed as a representation by the receiver that it is an Institutional or Qualified investor as defined under Mexican law. BlackRock México Operadora, S.A. de C.V., Sociedad Operadora de Fondos de Inversión (BlackRock México Operadora) is a Mexican subsidiary of BlackRock, Inc., authorized by the CNBV as a Mutual Fund Manager (Operadora de Fondos), and as such, authorized to manage Mexican mutual funds, ETFs and provide Investment Advisory Services. For more information on the Investment Services offered by BlackRock Mexico, please review our Investment Services Guide available in www.blackrock.com/mx. This material represents an assessment at a specific time and its information should not be relied upon by the you as research or investment advice regarding the funds, any security or investment strategy in particular. Reliance upon information in this material is at your sole discretion. BlackRock México is not authorized to receive deposits, carry out intermediation activities, or act as a broker dealer, or bank in Mexico. For more information on BlackRock México, please visit: www.blackRock.com/mx. BlackRock receives revenue in the form of advisory fees for our advisory services and management fees for our mutual funds, exchange traded funds and collective investment trusts. Any modification, change, distribution or inadequate use of information of this document is not responsibility of BlackRock or any of its affiliates. Pursuant to the Mexican Data Privacy Law (Ley Federal de Protección de Datos Personales en Posesión de Particulares), to register your personal data you must confirm that you have read and understood the Privacy Notice of BlackRock México Operadora. For the full disclosure, please visit www.blackRock.com/mx and accept that your personal information will be managed according with the terms and conditions set forth therein. BlackRock® is a registered trademark of BlackRock, Inc. All other trademarks are the property of their respective owners.

In Peru, this private offer does not constitute a public offer, and is not registered with the Securities Market Public Registry of the Peruvian Securities Market Commission, for use only with institutional investors as such term is defined by the Superintendencia de Banca, Seguros y AFP.

For investors in Central America, these securities have not been registered before the Securities Superintendence of the Republic of Panama, nor did the offer, sale or their trading procedures. The registration exemption has made according to numeral 3 of Article 129 of the Consolidated Text containing of the Decree-Law No. 1 of July 8, 1999 (institutional investors). Consequently, the tax treatment set forth in Articles 334 to 336 of the Unified Text containing Decree-Law No. 1 of July 8, 1999, does not apply to them. These securities are not under the supervision of the Securities Superintendence of the Republic of Panama. The information contained herein does not describe any product that is supervised or regulated by the National Banking and Insurance Commission (CNBS) in Honduras. Therefore any investment described herein is done at the investor’s own risk. In Costa Rica, any securities or services mentioned herein constitute an individual and private offer made through reverse solicitation upon reliance on an exemption from registration before the General Superintendence of Securities (SUGEVAL), pursuant to articles 7 and 8 of the Regulations on the Public Offering of Securities (Reglamento sobre Oferta Pública de Valores). This information is confidential, and is not to be reproduced or distributed to third parties as this is NOT a public offering of securities in Costa Rica. The product being offered is not intended for the Costa Rican public or market and neither is registered or will be registered before the SUGEVAL, nor can be traded in the secondary market. If any recipient of this documentation receives this document in El Salvador, such recipient acknowledges that the same has been delivered upon their request and instructions, and on a private placement basis. In Guatemala, this communication and any accompanying information (the Materials) are intended solely for informational purposes and do not constitute (and should not be interpreted to constitute) the offering, selling, or conducting of business with respect to such securities, products or services in the jurisdiction of the addressee (this Jurisdiction), or the conducting of any brokerage, banking or other similarly regulated activities (Financial Activities) in the Jurisdiction. Neither BlackRock, nor the securities, products and services described herein, are registered (or intended to be registered) in the Jurisdiction. Furthermore, neither BlackRock, nor the securities, products, services or activities described herein, are regulated or supervised by any governmental or similar authority in the Jurisdiction. The Materials are private, confidential and are sent by BlackRock only for the exclusive use of the addressee. The Materials must not be publicly distributed and any use of the Materials by anyone other than the addressee is not authorized. The addressee is required to comply with all applicable laws in the Jurisdiction, including, without limitation, tax laws and exchange control regulations, if any.

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

This document is marketing material.

In the UK and Non-European Economic Area (EEA) countries: this is issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is issued by BlackRock (Netherlands) B.V., authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

In Italy: For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

BlackRock Advisors (UK) Limited - Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit L15 - 01A, ICD Brookfield Place, Dubai International Financial Centre, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738).

For investors in Abu Dhabi Global Market (ADGM)

The information contained in this document is intended strictly for Authorised Persons.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward-looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Bahrain

The information contained in this document is intended strictly for sophisticated institutions.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Dubai (DIFC)

The information contained in this document is intended strictly for Professional Clients as defined under the Dubai Financial Services Authority (DFSA) Conduct of Business (COB) Rules.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward-looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Israel

BlackRock Investment Management (UK) Limited is not licensed under Israel's Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law), nor does it carry insurance thereunder.

For investors in Kuwait

The information contained in this document is intended strictly for sophisticated institutions that are ‘Professional Clients’ as defined under the Kuwait Capital Markets Law and its Executive Bylaws.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward-looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Oman

The information contained in this document is intended strictly for sophisticated institutions.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward-looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Qatar

The information contained in this document is intended strictly for sophisticated institutions.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward-looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Saudi Arabia

This material is for distribution to Institutional and Qualified Clients (as defined by the Implementing Regulations issued by Capital Market Authority) only and should not be relied upon by any other persons.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in South Africa

Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the

South African Financial Services Conduct Authority, FSP No. 43288.

For Qualified Investors in Switzerland

This document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (FinSA).

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.

For investors in United Arab Emirates

The information contained in this document is intended strictly for Professional Investors.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are forward-looking statements. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in China, this material may not be distributed to individuals resident in the People's Republic of China (PRC, for such purposes, not applicable to Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services.

For investors in Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. This material is for distribution to Professional Investors (as defined in the Securities and Futures Ordinance (Cap.571 of the laws of Hong Kong) and any rules made under that ordinance.) and should not be relied upon by any other persons or redistributed to retail clients in Hong Kong.

For investors in Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N) for use only with institutional investors as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

For investors in South Korea, this information is issued by BlackRock Investment (Korea) Limited. This material is for distribution to the Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations) and for information or educational purposes only, and does not constitute investment advice or an offer or solicitation to purchase or sells in any securities or any investment strategies.

For investors in Taiwan, Independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600.

For investors in Australia & New Zealand, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL) for the exclusive use of the recipient, who warrants by receipt of this material that they are a wholesale client as defined under the Australian Corporations Act 2001 (Cth) and the New Zealand Financial Advisers Act 2008 respectively.

BlackRock Investment Management (Australia) Limited (BIMAL) is not licensed by a New Zealand regulator to provide ‘Financial Advice Service’ or ‘Keeping, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons’. BIMAL’s registration on the New Zealand register of financial service providers does not mean that BIMAL is subject to active regulation or oversight by a New Zealand regulator.

This material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. Before making any investment decision, you should therefore assess whether the material is appropriate for you and obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide on its website for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction.