KEY TAKEAWAYS

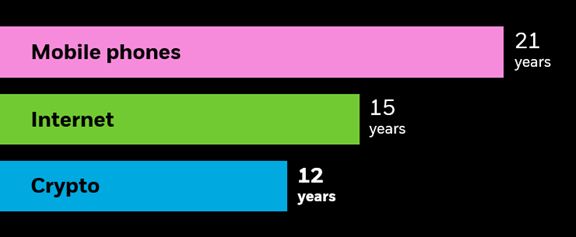

- Bitcoin, the world’s leading cryptoasset,1 has experienced rapid adoption, catching the attention of individual and institutional investors alike.

- Traditionally, investing directly in bitcoin comes with several obstacles, such as opening new accounts, potentially high trading fees and addressing security challenges.

- IBIT offers convenient access to bitcoin exposure through a familiar and commonly-traded investment vehicle — the ETF.