Skip to content

Welcome to the Aladdin® site

Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction.

By entering this site you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, the Client and Vendor Privacy Notice, which explains how we collect, use, and disclose your personal information and how it is protected, and the Cookie Notice, which explains how we use cookies on our sites.

By confirming that you have read this important information, you also:

(i) agree that all access to this website by you will be subject to the disclaimer, risk warnings and other information set out herein; and

(ii) agree that you are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S., public distribution. In Canada, public distribution. In the UK, professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA").

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.. In Singapore,for Institutional Investor only as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore.. In Hong Kong, for professional Investor only (as defined in the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) and any rules made under that ordinance). . In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, for wholesale clients only as defined in the Australian Corporations Act 2001 (Cth). In Brunei, Indonesia, and Malaysia, Institutional Investors only. In Latin America, institutional investors and financial intermediaries only (not for public distribution). In Mexico, institutional and qualified investors only (not for public distribution).

This Contents are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and are subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any license or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

BLACKROCK STORY

THE WAY FORWARD – PART 2

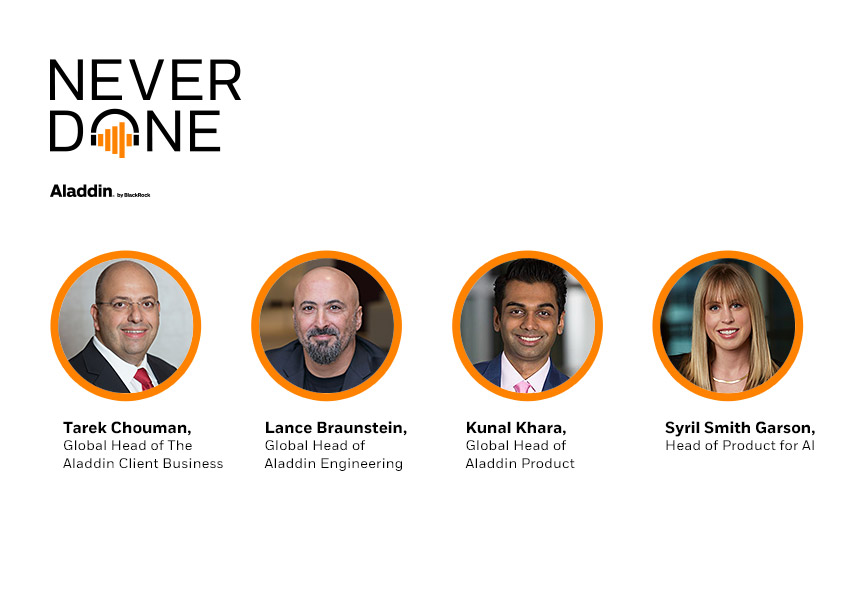

NEVER DONE podcast

NEVER DONE podcast /

The Way Forward - Part 2

Episode description:

Our Aladdin Client, Engineering, and Product leaders discuss the transformative impact of the tech trends on business, emphasizing the importance of data for AI, the inevitability of cloud computing adoption, the potential of blockchain beyond cryptocurrency, and the future of UI/UX design influenced by AI.

Our Aladdin Client, Engineering, and Product leaders discuss the transformative impact of the tech trends on business, emphasizing the importance of data for AI, the inevitability of cloud computing adoption, the potential of blockchain beyond cryptocurrency, and the future of UI/UX design influenced by AI.

READ THE FULL TRANSCRIPT

[SYRIL SMITH GARSON]

If we think about data, we think about the cloud, digital assets, are there two tech trends that you would pick that, when combined together, really are going to have sort of outsized impact for our clients?

[LANCE BRAUNSTEIN]

So, I think the foundation of everything that Kunal and Tarek both talked about is data. So, when you think about what informs workflow augmentation, automation, insight, productivity enhancements, it's all the data that you feed it. Is that a complete data set, a high-quality data set, a biased data set? I think that there is this duality between our data strategy and our AI strategy that we have to keep at the forefront of our thinking.

So, data to me is foundational to any AI work that we do. I think there is still a lot to be done in the cloud, especially as we think about elastic compute and as we think about our operating model evolving to be much more dynamic to our client needs. That again informs the earlier comments around scalability and performance.

And then I think importantly, blockchain, and I'm not talking about crypto. I'm not talking about a new kind of ETF. I mean, a token. The idea that we can create value, we can create tokens around different dimensions of value across asset classes – to me is foundational. I think that changes the industry over the next number of years. I know there's been an outsized focus on cryptocurrency to this point.

I really do think it's going to change the way we interact, the way we think about intermediaries, the ways we think about connecting sources of capital and demand for capital. I think that is going to be informed by blockchain in a way that we are just beginning to understand today.

[SYRIL SMITH GARSON]

One of the ones that you pulled out was the cloud, which it sounds like is really critical to underpinning a lot of what we want to do. Tarek, I'll ask you a question here, which is, should all of our clients be on the cloud? Should every business be on the cloud? How do we start to think about that trend in particular?

[TAREK CHOUMAN]

This question is entrenched with the sentiment of fear, sometimes concern, of people feeling that by giving their data, their assets, to someone else and outsourcing and getting the data that they are relying on on a daily basis and putting it outside of their walls is something that is risky. It takes time culturally to adapt to this concept. And you see it, if you look at how between different countries, different regions, it's not the same perception of the risk and of the threat that is related to being on the cloud.

My personal conviction is that it's a no brainer. We will operate everything on the cloud when it comes to future ability to upgrade systems, interact and integrate systems within the ecosystem of all those systems that our clients are operating. It's something that will happen. It will take time, it’s not totally understood yet. It's also a responsibility for the industry to make sure that from a security perspective, from a vulnerability perspective, we are doing the right thing to secure for our clients the access to the cloud and everything that is being done to secure their data.

This being said, this is the trend that nobody is arguing with today in the industry. This is where we are heading and this is what will allow us to do much more in a better way going forward.

[LANCE BRAUNSTEIN]

It's funny, Tarek, ten years ago we would have had this debate –should we put sensitive workloads in the cloud? That was a debate, a legitimate debate. I think what we've seen is the maturity of the cloud. More importantly, in cyber, infosec, operational stability has advanced to the point where it's not a debate anymore. Now it's a question of how do you enhance your security posture, you protect your data, your transactions in a way that doesn't entirely depend on the cloud provider? So, I think the question now is, how do I operate in the cloud in a way where I control my own destiny? This is not something that you defer to a provider and let them manage for you.

[SYRIL SMITH GARSON]

Yeah, absolutely. And Kunal, you had sort of said in one of your examples you were seeing really cool applications of these technologies. So, I actually want to ask all of you, but maybe Kunal, I'll pick on you first. What is a really cool application of any of these technologies you're seeing? You don't have to limit to just BlackRock, we can say more broadly.

[KUNAL KHARA]

I have experimented with a couple of these. I love the music AI apps. They're absolutely incredible. I dabbled as a DJ in college. I was not particularly good. There are some really, really awesome applications for music creation, and I think this is what I love about humanity in general. This notion of driving creativity and then finding applications of things like AI to really accelerate that creativity – it's fascinating.

[SYRIL SMITH GARSON]

That's really cool. Tarek, are you a music guy or are there other applications that...

[TAREK CHOUMAN]

Not at all. I am not into music. As many of you know, I am more into video games. But this being said, there is something that is way more dull than music and video games that I am thinking of, it’s the impact of AI on the way we design screens, basically UI and UX.

[SYRIL SMITH GARSON]

Yeah.

[TAREK CHOUMAN]

Because this is something that we usually don't mention ,because we are so conscious of the human in the loop, and we don't realize that a system with whom you are interacting through English, are you going still to need a scroll bar, a tab, a list, a combo?

Maybe it will change drastically the way we interact with a UI with a UX system and change drastically the way we design screens, dashboards, workflows. And then this is something that if you extrapolate this aspect and think forward about it, how are we going to be in a situation where there are firms, companies, people who are operating in a certain way that will have to operate drastically differently, let alone the UI and UX of a system because something is going to work differently.

We use several examples here at BlackRock, translation services, contracts and law firms, data scraping, multiple examples. All this is going to be looked at differently, will be really operating in a way that is significantly different from the way it operates today. And I find this quite exciting. Not as much as the music, but still.

[SYRIL SMITH GARSON]

And one of the things that we've talked about here is you have to make the computer work for you, and maybe in the future there's a space where you can just speak to it as you're saying, and it will do everything it needs to behind the scenes. Do you think that's true?

[TAREK CHOUMAN]

Definitely. And this is what will make companies and people at one point become better, is how much they are able to leverage this AI, this computer, to work for you. And it's happened to us in the past. It's not necessarily different from, and I don't want to be the old person on this podcast, but it's not totally different from what we have seen with the arrival of all the technologies that we have seen in the past, where it was always the same sentiment, excitement and fear.

The two sentiments are exactly the same with AI, just that it's in a different context. So, I think we should tame those two emotions and use them to the benefit of our business in general.

[SYRIL SMITH GARSON]

And Lance, you talk about the user experience quite a lot. How do you think about it?

[LANCE BRAUNSTEIN]

I love that example. And I'll tell you why. I actually think that the human/computer interface changes. This is a moment where we start to prompt more than click, navigate, pulldown. And I think there is a fundamentally different future of design than we've experienced over the last decade. And so, I think, Tarek, you are spot on. The ways in which we think about user design, information architecture, changes through prompts.

And I also think that it creates a democratization of complex models that perhaps you wouldn't have been able to access historically. But now you know what? Like a liquidity model, a mortgage model, these things become a prompt, like can you tell me my liquidity in this portfolio? And the risk of climate transition risk? Those things now become much more viable than having to navigate complex user interfaces, which perhaps didn't have the fullness of those capabilities.

So, I think you touch on a critically important point. And to be clear, there is an educational component to this, which is we all better get way, way more precise in the commands and the prompts that we provide than we have historically been through chat assistance.

[SYRIL SMITH GARSON]

That's a very important topic, and I think it'll be really interesting to see how it changes. So, I want you to pick any application, but I also maybe want to tilt you towards blockchain, tokenization, distributive ledgers. Is there a cool application of that that you're seeing?

[LANCE BRAUNSTEIN]

So, the AI example that I like to give, and the one that I've played around with most is what we call multimodal. The idea of taking images and text and creating something new. So, the idea that you could go from ideation to working code in many of these generative AI tools is like a magic trick to me. So, drawing a picture of a workflow on a whiteboard, and I mean doing it in a rudimentary way, and then asking your gen AI to create code, to run the code, to modify the code, to write a business requirements document based on that picture.

It largely just works. And when you see it in action and you go from ideation to a working app in the space of a couple of minutes, it's a profound moment. You realize that we are going to code differently. We're all going to be developers in the future, and the idea that we engineer solutions through this set of handoffs, that changes.

I think that changes over the next number of years. And I mean, like single digit years, not decade. And I think that will change how we work. That'll change how we create solutions for our clients. The blockchain and the notion of tokenization, I think, has tremendous promise across so many of our businesses. I think especially in our illiquid businesses, where there is not a public market for kind of exchanging value, I think there is a huge opportunity to exploit blockchain and the notion of a token, assigning a token to an element of value, whatever that value happens to be, a piece of a portfolio, somebody’s time. I think we are just scratching the surface now on figuring out where we can apply those technologies.

But I think this idea of an immutable ledger that is sort of public, that is not intermediated is an incredibly powerful concept. And again, I think in the exchange of value, this is something that's going to be important for the industry.

[SYRIL SMITH GARSON]

One of the things, Lance, that you said was around how everyone is going to start leveraging these technologies within their day-to-day job, right? Our workflows are going to fundamentally change. We're going to become more productive. I think, Tarek, you said this, the sort of fear aspect of it. How do we get ahead of it? How do we start to prepare and educate ourselves for these technologies? Kunal, I'll start with you. How do you think about that?

[KUNAL KHARA]

So first off, if you go back even 10 or 15 years and maybe you could start with something as revolutionary as the iPhone, that maybe changed the way we look at touching screens. I think each of those things had a certain element of behavior modification in the traditional ways that we, as a society and as a community, tended to interact with technology.

I think there are similar concepts that you could think about in the context of AI, as well as with my colleagues. We're talking about in the context of user experience and user interfaces. I think to me this is all about training, education and then rightly calling out what things are really, really problematic let’s say from a risk perspective and just getting ahead of them.

End of the day, I think we as a society will continue to thrive because we are excited about what these new technologies bring to us. And the one thing that, as Tarek and Lance were talking about, the UI, UX concept. Now, just imagine that if you're not even five years, like two years out, in fact, this may be in six months, you combine AI, this notion of multimodal prompting and multimodal interactions with speech driving action, in an interface that, first of all, is not limited to your desktop and second, doesn't require you to actually have a desk.

So, you think about things like augmented reality and spatial computing on top of then what is an incredibly rich potential experience of interaction with technology? One, it's the dream of all those people like me who watched Minority Report in the 1990s and said, “I want to be like Tom cruise and move my fingers around and have screens move in the sky.”

[SYRIL SMITH GARSON]

Yeah.

[KUNAL KHARA]

That's actually real. And you're seeing some of that happen in certain industries today, particularly the manufacturing sectors. It all comes back again to training, and how we make sure that we give all people everywhere.

And one of the things we've spent a lot of time talking about at BlackRock is what does this mean for our talent profile? What does it mean for the skills of the future, and how do you imbue those skills across the entirety of teams of different types of people at all levels and in a lot of cases, modify or augment the skills they already have to ultimately figure out how best to not worry that these things are ultimately driving away jobs or anything else. I think it's all about changing the dimensions of the way we are productive as a society.