Skip to content

Welcome to the Aladdin® site

Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction.

By entering this site you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, the Privacy Notice, which explains how we collect, use, and disclose your personal information and how it is protected, and the Cookie Notice, which explains how we use cookies on our sites.

By confirming that you have read this important information, you also:

(i) agree that all access to this website by you will be subject to the disclaimer, risk warnings and other information set out herein; and

(ii) agree that you are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S., institutional investors. In Canada, institutional investors. In the UK, professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA"). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. In Singapore, for Institutional Investor only as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore. In Hong Kong, for professional Investor only (as defined in the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) and any rules made under that ordinance). In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, for wholesale clients only as defined in the Australian Corporations Act 2001 (Cth). In Brunei, Indonesia, and Malaysia, Institutional Investors only. In Latin America, institutional investors and financial intermediaries only (not for public distribution). In Mexico, institutional and qualified investors only (not for public distribution). In South Africa, a provider who provides products or services to a client other than financial products or financial services, must disclose to the client the fact that the additional products or services are not regulated under the Act and therefore the client is not afforded the same protections in respect of those additional products or services that may apply in respect of the provision of financial products or services in terms of the Act.

This website and its content are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and are subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any license or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

Stress testing is a dynamic and powerful tool for measuring and explaining the risks associated with potential market events. When advisors address risk head-on with real world scenarios, it highlights the value of the relationship, encourages conversations that support long-term investing and helps align client goals with their risk tolerances.

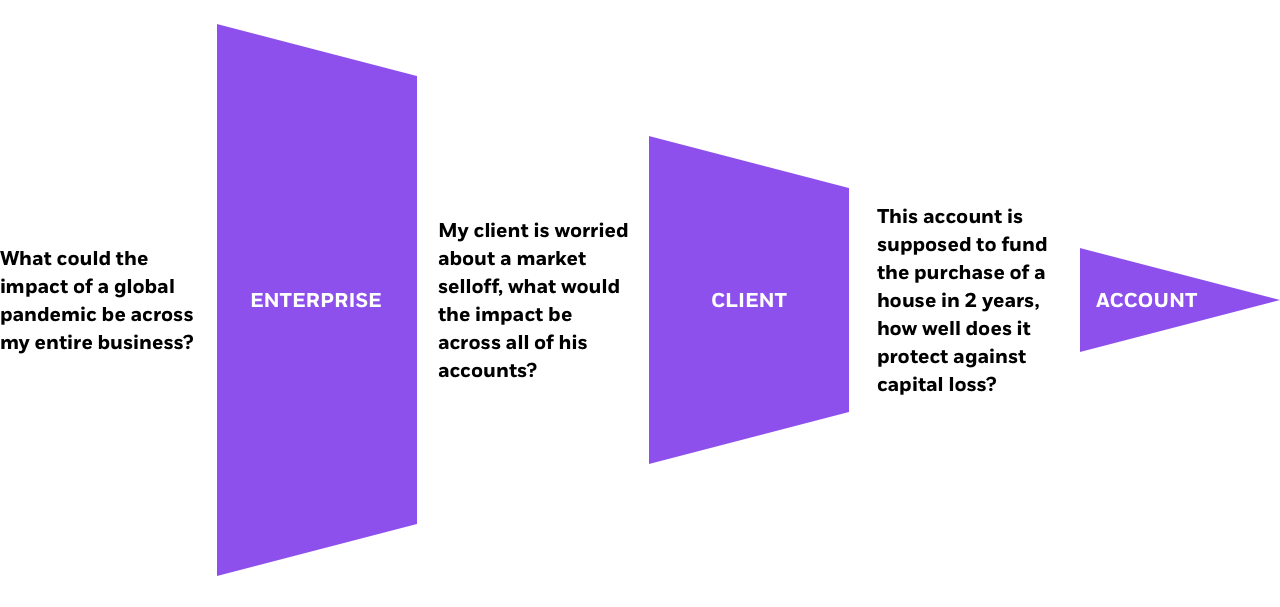

Evaluate impact across your whole business, for a specific client, or a single account

Stress testing is not just for individual accounts. With the right capabilities, firms can conduct stress tests across their entire enterprise, while advisors can assess the implications of market movements across clients’ whole portfolios, including accounts held away. Identifying which portfolios may deviate from intended goals is an important mechanism to focus your advisors’ conversations with clients and prospects as well as to enhance your firm’s oversight process. The Aladdin Wealth platform lets you do that at each level of your organization.

Address a variety of needs, flexibly

Stress testing plays an important role in identifying and explaining the risks and opportunities introduced by market events, for advisors as well as your broader enterprise. When assessing investment risk at the portfolio level, advisors can use stress testing to understand the impact of events on clients’ goals and build trust through more effective communications. When looking at risk across your entire business, stress testing portfolios in aggregate can help you determine where to focus and align teams across your organization to solve for any associated business risks. Here are a few examples of where stress testing can help:

Replay historical events or test a new hypothesis

With the Aladdin Wealth platform, you can validate your thinking across a range of possible scenarios. Our industry-leading risk models let you analyze current portfolio composition and exposures against historical events as well as a variety of market factors.

Historical events

Access scenarios that occur over a specified date range, such as the 2008 financial crisis

The Aladdin Wealth stress testing capability shows a ‘replay’ of historically stressful periods to assess the implications for today’s portfolios. Since portfolio exposures change over time, it is critical to take into account current portfolio holdings and exposures (i.e. sensitivity of the current portfolio to fundamental drivers of risk and return) instead of relying on analyses that use the realized returns of the portfolio at the time of the historical event, which by definition uses the portfolio composition and exposures in that historical period.

By incorporating current exposures, the Aladdin Wealth platform provides a more accurate picture of the current portfolio’s sensitivity to scenarios and how those scenarios may react to similar future market events. For example, when we ‘replay’ the Global Financial Crisis on the S&P 500 index, we take into account how the composition of that index has changed and evaluate the results based on its current composition. This means the results are based on our expectations of the future instead of how it actually performed historically.

Source: BlackRock Solutions. Data as at 31 March 2020. Scenario Time Range: Jul 31, 2007 to Mar 9, 2009. Scenario risk parameters: 120 monthly observations, constant-weighted.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

Hypothetical market events

Test your hypotheses by shocking one or multiple factors

Sometimes your concerns don’t mirror past events. The Aladdin Wealth platform lets users select hypothetical scenarios and test multiple variables -- with a high degree of flexibility -- to show the range of outcomes that could occur. This allows you to simulate various magnitudes and directions of shocks to equity markets, credit spreads, interest rates, commodity prices, or foreign exchange rates based on current correlations. By doing this, you can simulate the portfolio impact from a variety of local, global market or macro events. For example, what will happen to portfolios if the S&P 500 index and U.S. interest rates were to increase or decrease by 10% and 1% respectively, oil prices were to increase or decrease by 10%, or the U.S. dollar were to strengthen versus the Euro? This kind of hypothetical, multi-variable stress testing helps you understand the range of potential future outcomes.

For illustrative purposes only. Portfolio represents hypothetical “aggressive” portfolio compared to equity benchmark.

The power of stress testing

Risk can be complicated to explain to clients, but managing risk is absolutely critical to helping clients achieve their goals. Stress testing is a powerful and intuitive way to connect with clients and show them what happens under different historical or hypothetical scenarios.

The Aladdin Wealth platform’s stress testing functionality helps at all levels of your business. It gives advisors a clear picture of clients’ portfolios to help align them for the road ahead. This visibility reduces the sense of uncertainty and builds trust when communicating with clients. Stress testing also positions your firm to act quickly – at scale across your entire business – when responding to market, regulatory or compliance-oriented events. Get in touch with us to learn how Aladdin Wealth can help support your specific business needs.

Stay in touch with us

Please try again