Skip to content

Welcome to the Aladdin® site

Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction.

By entering this site you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, the Privacy Notice, which explains how we collect, use, and disclose your personal information and how it is protected, and the Cookie Notice, which explains how we use cookies on our sites.

By confirming that you have read this important information, you also:

(i) agree that all access to this website by you will be subject to the disclaimer, risk warnings and other information set out herein; and

(ii) agree that you are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S., institutional investors. In Canada, institutional investors. In the UK, professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA"). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. In Singapore, for Institutional Investor only as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore. In Hong Kong, for professional Investor only (as defined in the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) and any rules made under that ordinance). In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, for wholesale clients only as defined in the Australian Corporations Act 2001 (Cth). In Brunei, Indonesia, and Malaysia, Institutional Investors only. In Latin America, institutional investors and financial intermediaries only (not for public distribution). In Mexico, institutional and qualified investors only (not for public distribution). In South Africa, a provider who provides products or services to a client other than financial products or financial services, must disclose to the client the fact that the additional products or services are not regulated under the Act and therefore the client is not afforded the same protections in respect of those additional products or services that may apply in respect of the provision of financial products or services in terms of the Act.

This website and its content are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and are subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any license or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

Impacts from market uncertainty, geopolitical events, monetary policy intervention by central banks and other types of macro shocks now carry greater weight in influencing markets compared to the past decade.

Scenario analysis can give you a potential glimpse at the future…

Applying forward-looking insights to the macroeconomic environment enables you to think about the full expanse of hypothetical investment outcomes.

Scenario analysis encourages portfolio and risk managers to think about what may happen in the future, not just focusing on evaluating what happened in the past to make more informed decisions.

But the future isn’t straightforward

The process of building a scenario analysis is as much an art as it is a science because there is no past anchor to serve as a gauge.

For this qualitative reason, the creation of hypothetical scenario analysis differs across the industry. Let’s delve into our version of scenario analysis, to show you the rigor that goes into the process of creating each one.

BlackRock’s Market-Driven Scenarios provide a solution

BlackRock originally developed our Market-Driven Scenarios (MDS) framework to mitigate the inherent subjectivity in modeling hypothetical outcomes.

The goal of MDS is to identify relevant market event risks, consider the range of potential economic and market outcomes around those risks, then analyze the hypothetical impact on portfolios across multiple variables at the same time.

Led by our Risk and Quantitative Analysis (RQA) team, we’ve spent years developing MDS across macroeconomic, geopolitical, and other policy themes. We strive to synthesize the best of BlackRock in our analysis by incorporating subject matter expert views across asset classes, geographies and skillsets.

From a critical lens, we focus on plausible market shocks. That means hypothetical scenario outcomes should represent a shift from the prevailing market environment, but they must also be sized according to our reasonable expectations for how markets could react to different shocks.

This process can involve comparing hypothetical shocks to previous market episodes, such as evaluating whether the event has a historical precedent or how extreme factor shocks appear relative to current market conditions.

Within the Aladdin Wealth™ platform, you can express market views across 3,000+ risk factors.

A brief case study

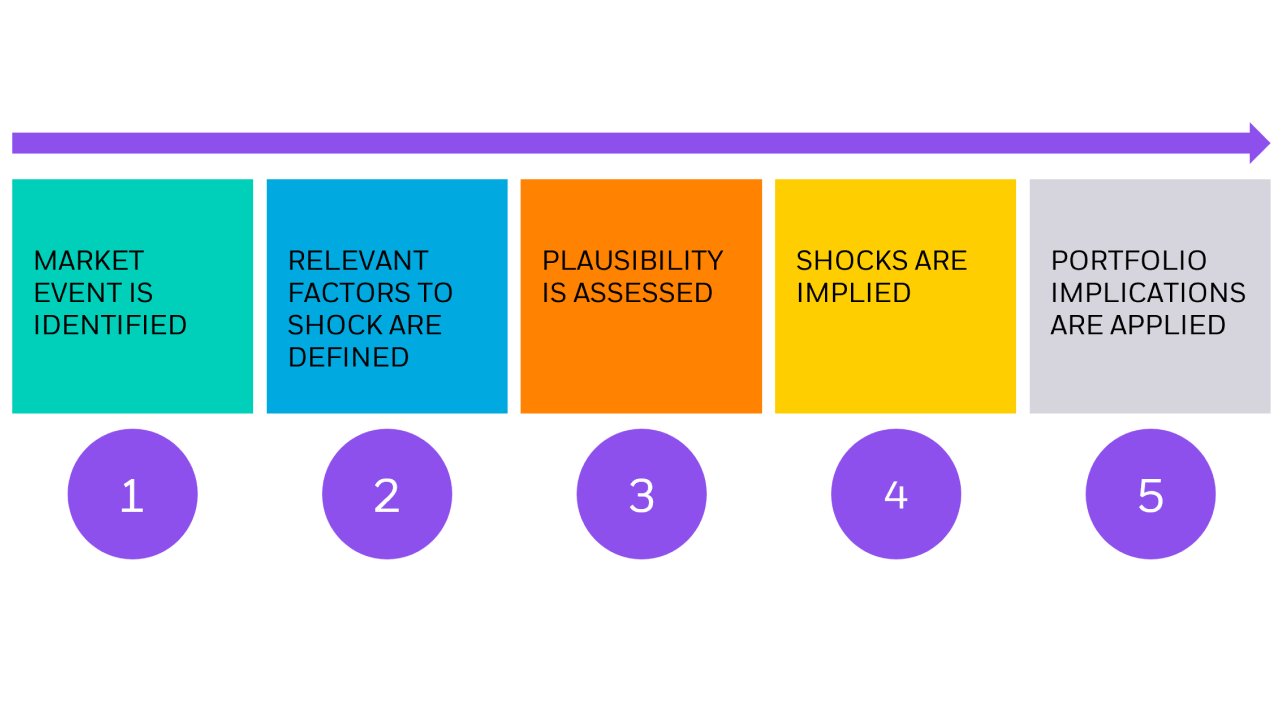

To give you an idea of the scenario development process, we’ll walk you through the way we think by showcasing what went into creating a MDS on potential policy changes by the U.S. Federal Reserve (Fed) in the face of heightened macro uncertainty. You’ll see the process flow chart below.

The BlackRock Scenario Analysis Lifecycle

Source: BlackRock. For illustrative purposes only.

Step 1: Defining the event

The first step in any scenario build is to identify an event that you’d want to get ahead of in the market. Where could markets go? How could cross-asset correlations change? Scenarios can focus on macroeconomic regimes, geopolitical risks, sustainability or policy events.

For the Fed scenarios, we wanted to consider the Fed’s policy tradeoffs in the current environment by evaluating how the Fed could respond to incoming growth and inflation data during a turbulent market.

Step 2: Defining the scenarios

The next step in the process is to consider the range of potential outcomes around the event, which often includes a good, a bad, and an ugly case.

In the Fed MDS, we decided to consider two policy paths based on the elevated uncertainty of interest rates and high inflation, and how this uncertainty could affect portfolios.

In one path, we assumed that inflation would peak and begin to ease gradually because of a consumption shift from goods to services and diminishing global supply imbalances. In this scenario, the Fed would ease its hawkish stance, while markets would partially offset year-to-date losses.

For the second path, we assumed the Fed would be unable to execute a soft landing, as inflation pressures worsened from existing and potentially unforeseen supply shocks. In this scenario, a U.S. recession would follow, resulting in a significant extension of year-to-date losses.

Step 3: Assessing plausibility

After we defined the scenarios, we focused on explicit shocks to interest rates, inflation factors, commodities, and other risk assets that would be most impacted by a pivot in Fed policy.

Once market shocks are specified for each scenario, we compute implied shocks for all other relevant market risk factors based on historical correlations. We assess the plausibility of these results – meaning we evaluate how viable they are - and iterate as needed before finalizing the shocks for each scenario.

This process of adjustment and quantitative challenge is critical. It helps ensure that our scenarios are well-specified, and that the results are more likely to be stable through time.

Step 4: Implying shocks

When the scenarios are finalized, we then imply what happens to remaining risk factors in the Aladdin® platform based on modeled relationships with the explicit shocks.

This step allows us to evaluate the market impact to factors that may not be the primary drivers behind a scenario but might still be affected. It can provide us with a more holistic view.

In the Fed scenarios, for instance, we considered the potential impacts to currency factors that weren’t explicitly shocked on either the upside or downside case.

One essential part of this step is choosing an appropriate market economy date. The dates should reflect the environment portrayed in the scenario. We often choose the most recent economy date, but sometimes choosing a historical date could be more appropriate if it gives a better picture of the scenario’s intended cross-asset correlations.

For the Fed scenarios, we went with the most recent economy date because market moves were heavily swayed by concerns over inflation and Fed policy.

Step 5: Determining portfolio implications

When the scenarios are live, they can be run against portfolios in the Aladdin® platform, yielding hypothetical scenario P&Ls based on a portfolio’s exposures. These impacts can be monitored on a regular basis for greater transparency into the portfolio’s most current risk exposures.

The goal of using MDS is to kickstart conversations about risk among wealth managers, advisors and their clients. It doesn’t provide the final portfolio decisions but can allow for greater transparency and insights along the way.

What we’ve learned from developing scenarios over the years

Hypothetical scenario analysis is an imprecise science, and industry best practices can be difficult to pin down given the qualitative nature of identifying and building scenarios. That’s why we continuously look for ways to improve our framework as we develop new MDS for the most challenging market conditions.

After developing MDS for many years and across many event types, we believe that it helps to home in on events with a clear market catalyst, and to consider a small subset of financial market variables whose significant moves could impact your client’s portfolio.

The future is anyone’s guess, but you don’t have to venture through widescale market events on your own.

BlackRock’s Market-Driven Scenarios in Aladdin Wealth™

Having our experts create the scenario analyses and push them through the Aladdin Wealth™ engine makes it easier for firms and advisors to evaluate portfolio risk with robust, forward-looking scenarios.

Our technology unifies the investment management process and provides a common data language. Advisors can personalize insights for each client’s long-term financial goals, while wealth managers can transform the business at scale.

Aladdin Wealth™ is built on the same portfolio and risk analysis technology used by BlackRock and sophisticated institutions around the world, so you can evaluate portfolios with greater transparency in any market environment.