Skip to content

Welcome to the Aladdin® site

Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction.

By entering this site you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, the Client and Vendor Privacy Notice, which explains how we collect, use, and disclose your personal information and how it is protected, and the Cookie Notice, which explains how we use cookies on our sites.

By confirming that you have read this important information, you also:

(i) agree that all access to this website by you will be subject to the disclaimer, risk warnings and other information set out herein; and

(ii) agree that you are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S., public distribution. In Canada, public distribution. In the UK, professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA").

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.. In Singapore,for Institutional Investor only as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore.. In Hong Kong, for professional Investor only (as defined in the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) and any rules made under that ordinance). . In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, for wholesale clients only as defined in the Australian Corporations Act 2001 (Cth). In Brunei, Indonesia, and Malaysia, Institutional Investors only. In Latin America, institutional investors and financial intermediaries only (not for public distribution). In Mexico, institutional and qualified investors only (not for public distribution).

This Contents are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and are subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any license or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

CLIENT STORY: MORGAN STANLEY

THE INVISIBILITY OF THE ENGINE

Morgan Stanley

NEVER DONE podcast

NEVER DONE podcast /

THE INVISIBILITY OF THE ENGINE

Episode description:

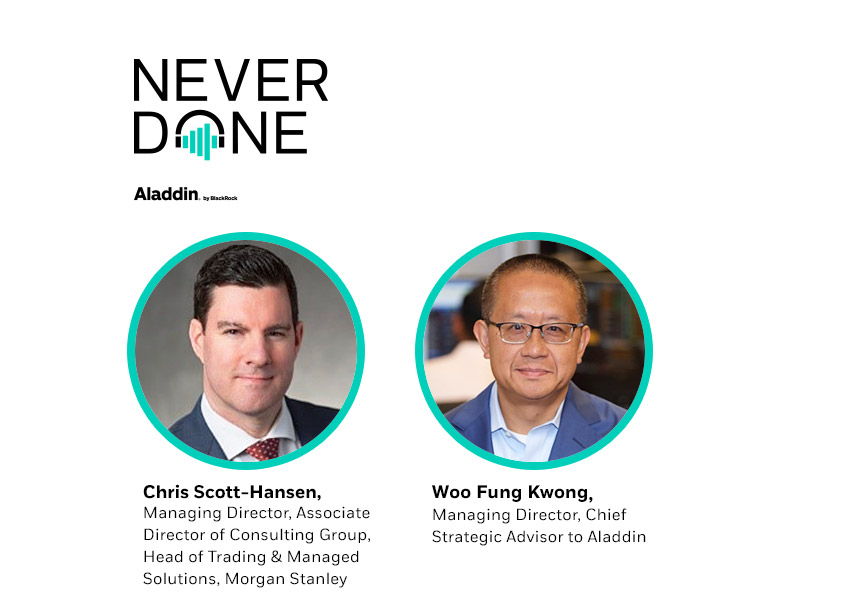

Chris Scott-Hansen, Managing Director, Associate Director of Consulting Group, Head of Trading & Managed Solutions, Morgan Stanley and Woo Fung Kwong, Managing Director, Chief Strategic Advisor to Aladdin, discuss the importance of risk management in the wealth space and how a risk-centric approach is changing the way advisor-client relationship.

Chris Scott-Hansen, Managing Director, Associate Director of Consulting Group, Head of Trading & Managed Solutions, Morgan Stanley, and Woo Fung Kwong, Managing Director, Chief Strategic Advisor to Aladdin, discuss the importance of risk management in the wealth space and how a risk-centric approach is changing the advisor-client relationship.

READ THE FULL TRANSCRIPT

This episode was recorded in Q3 2023.

CHRIS SCOTT-HANSEN: It's really about the topic of risk. And I remember vividly, I think our initial meeting, I don't know 2015, 2016.

WOO FUNG KWONG: I think it was around that, yes.

CHRIS SCOTT-HANSEN: It was a good time where the topic of risk, which is why we're here today really came into the limelight. And only propelled us further. I make a lot of decisions on my gut, right? Does it feel right? How is the advisor going to react to it? How is the client going to react to it, more importantly? And for me, every single day is a challenge. Right? Every single day there's something new that you weren't anticipating. And as a leader it's trying to capture that vision, capture that experience, and make something out of it, react to it.

And I think for many people in the industry, and I got lucky, I grew up as an intern at 16 years old, playing in the sandbox of at the time brokers, and watching them evolve from a green screen, to a Windows-based machine, to teaching them how to use a mouse and click on the mouse, and use the left mouse button, not the right mouse button. And that was an interesting challenge.

WOO FUNG KWONG: Aladdin obviously had been around for, I think over 20 years for external clients. Mainly institutional space in terms of other asset managers and asset owners. But it was relatively new in terms of wealth. Why did Morgan Stanley go with something that was relatively unproven in that part of the industry?

CHRIS SCOTT-HANSEN: Well, I think we had a mission which was to take our wealth management business to another level. And I think when we think about growth and managing assets and managing financial advisors and clients, you have to pair growth with risk management. And so for me, as someone who grew up on the asset management side of the business and then eventually got into the wealth management side of the business, I was very familiar with Aladdin. Obviously, knowing that from the asset management space, but I didn't know what the capabilities could be on the wealth management space.

And I think our management saw the opportunity as well to really change the game in terms of risk management around the space of wealth, which really hadn't been done before, or at least hadn't been done before in terms of sophistication, and complexity, and factoring for all the differentiation that comes with clients. And so I think that's what led us on that journey together.

And I remember, again, the time frame was we all came together thinking about what to do here. Right? I remember a time where you guys all marched into the room. And we were showcasing the Aladdin for wealth tools that you guys had kind of stood up initially. And I remember vividly sitting next to you. I had no idea who you were at the time, right? No idea.

And you were eating chocolate chip cookies and peanuts and M&Ms. I don't know what you're eating at the time, Woo. But you were sitting there and I remember turning to you and saying, I'm not sure if this is going to work, and started asking you a number of questions about how it would work for wealth management products and wealth management portfolios. And you were very honest saying, we'll figure this out together.

And I think that's what really led the charge of change of us building out something unique in wealth management, which I still think today is very unique in its kind.

WOO FUNG KWONG: I think that the main thing that we saw was that a lot of wealth management firms were trying to really move away from a more product-centric approach to really a portfolio and goals-based centric approach.

That didn't mean that products did not play a role in terms of their business. In fact, it was all really about products in the context of overall portfolios. The drivers were different. In Europe, a lot of it was driven by regulation. In the US, a lot of it was driven by some of the competition and the market forces post the financial crisis. But when you look at what the market was looking for, it was really all about portfolios, and that's exactly what Aladdin was built for.

CHRIS SCOTT-HANSEN: I remember when we first started talking and you were chomping away at those cookies, you had a really insightful piece of feedback for me, which I think was probably the differentiator. When I found out that the wealth management portfolio in reality was actually much more complex, right? We had annuities, structured products, alternative investments, SMAs, UMAs, and every acronym as you can imagine in a portfolio. It really became a challenge for both BlackRock and Morgan Stanley to solve for something unique at the time that would factor for all those different types of investments that could in theory be inside of a client's portfolio.

And for us, how we got our arms around it, not only to appease our regulators who are key partners of ours, but also to satisfy our clients and advisors who would take every shot at questioning the different risk analytics and methods that would be utilized to assess the risk of a client's portfolio. And that's continuously evolved today. And so when I think about the adoption of technology, we were faced with a really unique challenge which is to prove that what we built was differentiated, number one. And number two, that it was holistic and considerate of all the different investment products that a client and/or advisor could hold in their portfolio.

And that it didn't need to be perfect, but it had to be significant enough to make progress to attract and appeal to the financial advisor and the client that this was truly something different. And if we're about to purchase something today, whether it be any vehicle, any product, any CUSIP for that matter-- how could we legitimately show a client what their risk could be if they invested with us?

And I think that was the challenge that you and I admitted to each other. And you said very vividly, we're going to figure it out together. And I said, you know what? That means we've got a partner here. And we walked the line of risk together and took a risk in this partnership to build something that I still think is truly unique in the industry.

WOO FUNG KWONG: Risk exists in the financial markets, whether you choose to measure it or not. And risk exists independently of how you measure it. The models that we built are trying to capture exactly what is the risk, but it's not necessarily the truth. It is a representation of what we believe. And this is why the models constantly are being updated because we learn new things every day, and the market surprises us in things every single day.

At the same time, whether financial advisors appreciate it or know what their risk is on a daily basis, it still exists. So the goal is really to make sure that we are able to present this information to them in a way that doesn't compromise on that integrity, while at the same time to make sure that it is accessible to them. And I think the analogy I always try to use is that you think about people driving cars.

A lot of people in the world, almost everyone that's an adult, can drive a car or a vehicle of some sort. 99% of the people do not really understand Newtonian physics. But you know that the physics exists when you actually make these turns and accelerate and decelerate in terms of the laws of physics or laws of motion and so forth. And when you are driving that car, you definitely want people who understand how all of these mechanics work to design that engine that takes you from point A to point B in a safe way.

And I think that we are able to combine both the underlying rigor and also make sure that we have the quality of the data behind it, but make sure that we present it in a way that is easily digestible and consumable by a wide variety of different users with different skill sets and experiences. That is really our secret. And I think that working together, we're able to fine tune a lot of that. And I think that this is still an ongoing process. But we focus a lot in terms of trying to figure out how to present information in a way that is easily digestible and more importantly usable by financial advisors in terms of helping them have better conversations with their clients about their investments and their risk, and also more importantly what they should and shouldn't do about that going forward as the market are volatile or something happens in the market and clients want to know exactly what they should do.

CHRIS SCOTT-HANSEN: Newtonian physics, I think I skipped that class in college. I think we had to have strong sophistication behind the analytics behind the data, behind the information that was being presented. Because we do have some really sophisticated financial advisors who would challenge us on the quality of the data, the quality of the information that they were presenting. And we actually had a lot of clients who would question that as well.

Many of our clients are hedge fund managers who have their own personal wealth with us, or institutional asset managers who have their personal wealth with us. And for me, it was really about making sure we satisfy them with sophistication. But when we brought it to the financial advisor level, they needed sophistication but simplicity. And simplicity was the key in terms of adoption and engagement of the new platforms, and to keep them hooked.

And I think for our advisors and our clients understanding every day, every trade, every decision to guide a client's wealth, one needs to make sure the decision is most current and most accurate, as best as physically possible. Markets change. Stock market, bond market, war in Ukraine, you've got bond market crash last year, equity market volatility.

WOO FUNG KWONG: The SVB situation in March.

CHRIS SCOTT-HANSEN: SVB, or everything that we've been faced with, COVID, right? We've got faced with COVID. Who thought? And we had this tremendous risk environment that actually played really well for us together. But us evolving that platform together was the key differentiator, right? And we've actually seen our best financial advisors capitalize on this in terms of client appeal, client acquisition. But also using the platform more and more, we had to integrate risk into what they used every day.

And I think that became a really key differentiator for us because whether the advisor go deep and wide in terms of the spectrum of risk, in terms of conversation with the client, or if they just wanted to understand their volatility pre- and post-trade, we needed to make sure that we had a thin approach to engaging them where it was built into their advisor desktops. And so when they were making a trade, or looking at an account, or producing a client output-- they saw the risk right in front of them before they made a decision.

But if they needed to go deeper, they were supported by the Aladdin analytics, deep and wide, in so many different spectrums, stress test scenarios, risk factors galore. But for them, risk factors was the Newtonian physics in a sense. And we really had to break it down to a point of keeping it simple. Where is your risk? Where is it coming from? And what happens to you if markets go up or down from here?

And I think those became some of the most relatable factors in the mindset of a client and advisor when they were sitting across from each other at the table. That ultimately brought them together on the same side of the table and built trust in the risk-based relationship. So I always like to say inside of Morgan Stanley, not only are we doing financial planning, we're doing protection solutions, we're doing investment management solutions, we're doing banking and lending solutions, and mortgages these days. But risk advice was probably one of the key factors of differentiation that we brought to the table.

WOO FUNG KWONG: Let me just switch gears a little bit. Chris, when you look at Morgan Stanley today, it is really an amazing asset gathering machine and a growth machine. In the second quarter, you had 90 billion in terms of net new assets and your CEO, James Gorman, talks about additional trillion dollars of net new assets every three years. What is the secret in terms of Morgan Stanley?

Because $1 trillion is basically more than a handful of wealth firms in the world. And you're talking about that in terms of growth every three years. Can you tell us a little bit about what's really driving this amazing growth that you've seen?

CHRIS SCOTT-HANSEN: Well, I think it all comes down to a couple of things. I think first is one of the key core principles of Morgan Stanley which is all premised around putting our clients first, right? And I think by having Aladdin and risk analytics, and building better trust, and aligning with client goals really sets the stage for clients understanding that we're not here to sell them a product. We're not here to give them something that they don't need. We really want to make sure that we're putting their interests first in terms of everything that we do.

And I think Aladdin only helps us enhance that relationship from that perspective. But we've also accumulated over the past few years a significant number of clients. We've gone very deep into the workplace. I think James, and Andy Saperstein, and Jed Finn, if you think of them as leaders-- they've purchased Solium. They've purchased AFS. They've purchased E*TRADE which are huge growers of clients and assets in the workplace, but also in the digital direct space.

And when I think about those clients are now needing sophistication beyond maybe just doing the day-to-day trading of their own portfolios, they need planning advice. They need risk advice. They need solutions beyond investments that are ultimately going to help them achieve their goals for both them and their families more importantly, both. And I think for us it's messaging, it's marketing, but it's also standing up the full power of advice that we can bring to them through the broad-based solution set that Morgan Stanley has.

WOO FUNG KWONG: What do you see in terms of the future of wealth management in terms of some of the trends that's going to be driving what clients are looking for, and how firms like Morgan Stanley will be trying to solve some of those challenges?

CHRIS SCOTT-HANSEN: Number one is scale, right? How do you deliver high quality financial advice with scale? And I think you hear Andy Saperstein talk about this a lot, right? If you don't have the scale, you don't have the platform to deliver in scale, you're at risk. And I think you're going to see some consolidation. I think you're already seeing consolidation in the wealth management space. A lot of firms merging together trying to come together, and you're going to see a lot of me-too solutions out there. Everyone's trying to follow each other in many different directions.

But I think without scale and without high quality advisors and people behind those advisors to drive the growth, I think it's going to be tricky. I think you're going to see a lot of automation of mundane processes that, one doesn't need to do over and over and over again every single day. You're actually seeing that in the investment management space where BlackRock as an asset manager has been benefiting from the concept of indexing and now direct indexing in a lot of places. We're in that space too with our Eaton Vance and Parametric acquisition. But I think what you'll see is that financial advisors who are really incredible advisors and relationship managers and friends to their clients, they're going to be giving more of themselves to their clients but be able to do it in faster and more sophisticated ways with a lot of the tool sets we've built around them.

WOO FUNG KWONG: So I think the thing with any new technology is you need to try to have as many people innovate on it. And I think that that is important for firms to be able to balance out both the controls and the ability to let innovation flourish. Because that's how you basically create new kinds of things. That may be completely different than what you originally had envisioned or had planned out to do. And I think Aladdin Wealth is an example of that, right? Because in the beginning, it was serving as risk management system for wealth management firms. It was to provide supervision over [INAUDIBLE] PM programs to make sure that financial advisors were being consistent in terms of how they implement clients. That was supposed to be similar in terms of the mandates that they had given to financial advisors. But we quickly saw that it can turn into much, much more than that.

It gave advisors time back. It changes how they engage with their clients in terms of the content. It actually led to more account aggregation because clients actually want to see the total risk picture, because they normally don't have all of their assets with a single advisor or a single firm. This is something that when we try to figure out where Aladdin Wealth as a platform will evolve, we'll look to many of our partners including you and Morgan Stanley, especially you and Morgan Stanley in a lot of cases to try to work on some of these hard problems together.

And I think that obviously technology plays a huge role in everything that you've talked about. And the future of financial advice and really the future I think of any industry is that technology is going to do what technology does best. And human beings and people are going to have to do what they do best. And what you talk about in terms of financial advisors really getting to understand the clients, being empathetic to the client's needs, to really know clients as an individual, to be able to offer that personalization, and to be able to do all of that at scale-- that's really going to be the secret.